Under its National Health Strategic Plan (NHSP), Indonesia is continuously focusing on improving the quality and accessibility of its public healthcare system. NHSP (2010-2014) aims to enhance health status through involvement of private sector and civil society. It also focuses on the prevention and cure of health problems faced by the community through availability of comprehensive and equitable health services and health resources, supported by good governance.

This article is part of a series focusing on universal healthcare plans across selected Southeast Asian countries. The series also includes a look into the plans in The Philippines, Cambodia, Vietnam, Indonesia, and Thailand.

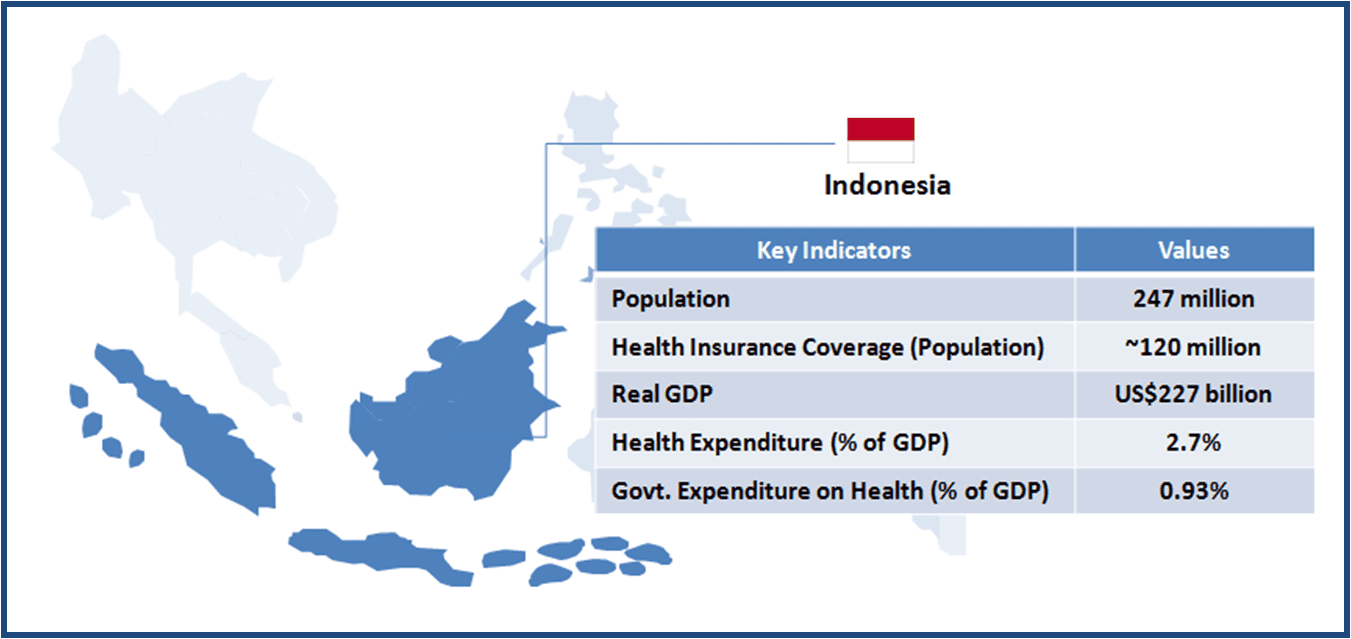

The Indonesian government is planning to cover every Indonesian under Universal Health Insurance (UHI) by 2019 under a new scheme called Jaminan Kesehatan Nasional (JKN). As of January 2014, about 120 million Indonesians (government servants, police and army personnel, and poor) were automatically included under this scheme. The government has already allocated about 20 trillion rupiah (US$1.6 billion) to cover health insurance premiums for the poor in 2014.

One of the features of the Indonesian UHI is the participation of the private sector wherein a number of hospitals and clinics have signed-up under the JKN.

When implemented fully, UHI is expected to create significant demand for companies operating in the industry, as the scope of the services is bound to increase. However, uncertainties exist regarding the smooth transition of the social health insurance mechanism from the current (prior to 2014) multiple-scheme-based system to a single system. The foundation design and the support infrastructure would determine the long term success of UHI.

| INFRASTRUCTURE |

| Key Stakeholders |

|

| Healthcare Service Delivery |

|

| KEY CHALLENGES |

Capacity Constraints

Uneven Concentration of Healthcare Personnel

|

| DESIGN |

| Beneficiary Classification |

|

Prior to the implementation of UHI in January 2014, certain sections of the population were already covered under different schemes, such as:

|

| Healthcare Insurance Financing |

|

| Payment System |

|

| Benefits |

|

| Co-payment (Reimbursement) System |

|

| Reimbursement System for Drugs |

|

| KEY CHALLENGES |

Concern about Quality

Ensuring Comprehensive Coverage

Addressing the Grey Areas

|

Opportunities for Healthcare Companies

Healthcare Service Providers

-

The current set-up does not provide enough incentives for the private sector healthcare providers; however, the UHI policy envisages a space for private players. Also, the government has indicated about increasing the premium paid for the poor gradually, therefore private clinics and hospitals have significant opportunities to increase their business as well as to fill the resource gap in the Indonesian healthcare system

Medical Device Manufacturers

-

Irrespective of the implementation of the UHI, there was significant growth potential for the medical device companies due to years of under investment in the hospital equipment and devices such as MRI, Tomography scanners, mammography etc. A wider UHI coverage would require purchase of such equipment, to cater to the increasing demand

-

It is expected that new health facilities would come up in the regions where the newly insured population resides i.e. outside Java and other large cities. This would boost the demand for equipment and devices

Pharmaceuticals Companies

-

UHI is expected to create additional demand for medicines, as the population that was previously unable to purchase medicines comes under the coverage. Demand for generic medicines is expected to increase, as the government focuses on procuring low-cost medicines to keep the cost of UHI down

A Final Word

Considerable ground needs to be covered before Indonesia realizes the goal of 100% healthcare access coverage. The current state of the healthcare infrastructure as well as the healthcare benefits that have been designed (for the population under coverage as of January 2014) pose challenge in creating a working (and efficient) UHI system.

Success of UHI primarily hinges on the inclusion of informal sector population. Introducing an informal sector-specific mechanism for the premium contribution, attractive enough to ensure participation, would be the key in this direction. More clarity about the role of private insurance will help towards creating a system capable enough to cater to 250 million plus population.

Size of the Indonesian healthcare market already presents ample opportunities for pharmaceutical as well medical device manufacturers. 100% coverage under UHI will further boost the prospects of these firms. The expected expansion of healthcare infrastructure beyond the developed regions (cities) is likely to create demand for equipment as well as medicines.

Existing capacity constraints in the public healthcare system may augur well for the private health care service providers. As of now, given the geographical challenges and regional disparity in healthcare services, the goal of 100% coverage under UHI looks a distant dream without the participation of private sector. Therefore a workable payment system needs to be devised to ensure greater participation of the private sector players.