It is not often that one can hear that a US$100 billion industry is in tatters, however, this is currently the reality in case of the US recycling industry. For years, the USA has been dependent on waste exports, to countries such as China, India, and Korea. However, that dependence has now placed the USA in a very difficult position, as the implementation of National Sword policy by China, the largest export destination for US waste, amidst the China-USA trade disputes, resulted in waste exports coming to a virtual halt since the start of 2018.

With waste generation growing, the USA has been left scrambling to look for alternative destinations for its waste, the largest being India, Malaysia, Thailand, and Vietnam, albeit none of them capable of completely compensating for waste exports to China. Recently, in March 2019, India also banned imports of plastic waste, eliminating another major avenue through which the USA could get rid of its trash.

US dependence on exports for waste recycling meant that the development of domestic recycling facilities has been neglected. The country’s domestic waste recycling sector is now incapable of handling the ever-increasing waste, a major chunk of which ends up in landfills, creating other environment and health-related problems.

However, where there are challenges, there are opportunities as well. We look at what challenges the USA currently faces, and how the recycling industry is trying to adapt and come up with potential solutions to the country’s waste problem.

USA’s linear model left recycling industry unprepared

Traditionally, US municipals have depended on external companies to dispose their waste. Most disposal companies follow a linear model, under which they collect the municipal waste and then segregate it for further processing (with majority of it previously being exported to China). This dependence on waste exports led to limited investments in developing or expanding the domestic recycling infrastructure, which the country has been left to rue in the wake of the waste import ban imposed by China and India.

Limited capacities have put extra burden on the system. Moreover, elimination of revenue from scrap sales to China puts additional economic pressure on waste processors. As a result, many waste collection agencies have either suspended waste pickup or raised prices to dispose of waste. Municipals too have to bear greater economic burden. Cities, which were earlier paid for their waste, are now being charged significant amounts for hauling waste.

Current waste disposal process is not up to the mark

Another key challenge is the lack of sorting at source, i.e. at the household level. Due to consumer’s preference, the USA follows a single-stream recycling system, where all recyclables are collected in the same receptacle. With no segregation happening at this stage of waste collection, the processor is responsible for sorting different type of materials for recycling.

However, the lack of capacity and established infrastructure makes it difficult and expensive to sort these waste materials, resulting in most of the waste being discarded, either ending up at an incineration facility or a landfill, which are much more cost-effective compared with recycling. Currently, only 10% of plastic waste generated in the USA is recycled, while 75% of it is discarded in landfills (remaining 15% being incinerated to form electricity – but that too has its critics due to the pollution caused).

Recycling companies invest to boost processing capabilities

Impacted by the loss of the key buyer and facing own limited capacities, several smaller recycling companies reliant on exports to China have shut down their operations, while several other recyclers have been forced to reassess market strategy from exports to processing.

Several recycling companies have already started investing to develop their domestic waste processing and collection infrastructure. As an example, Waste Management, a US-based waste disposal and recycling services provider, invested more than US$110 million in 2018 alone in developing additional processing capacity, acquiring new technologies, and boosting waste collection infrastructure.

Robotic technology is likely to witness more investment

With limited capacities and waste production growing, there is a need to improve the overall efficiency of waste sorting and recycling process. Companies across Europe and Asia Pacific have been researching and developing trash robots (also called “trashbots”) capable of collecting, sorting, and recycling waste and other scrap materials.

The trend is now catching up in the USA as well. Waste Management has already installed a waste sorting robot at one of its material recycling facilities, and plans to install three more robots in 2019. The company is also planning to install additional screeners and optical sorters at its facilities.

New opportunities are emerging in plastic waste recycling

With a significant focus on promoting sustainability, several other companies also see recycling as a promising business opportunity, thereby driving investment in recycling infrastructure. GDB International, a US-based company selling plastic scrap to international markets, was impacted by the Chinese import ban, and decided to invest in developing its own recycling capabilities. The company plans to recycle plastic scrap domestically, and sell recycled plastic pellets to plastic product manufacturers within the USA and abroad.

EOS Perspective

Chinese and Indian waste import bans have jolted the US recycling industry as a whole, pressing it to search for a solution to its swelling problem. The industry is witnessing problems which question the entire structure of the industry and challenge companies to reconsider their commonly utilized business model – shifting from a linear model to a circular economy.

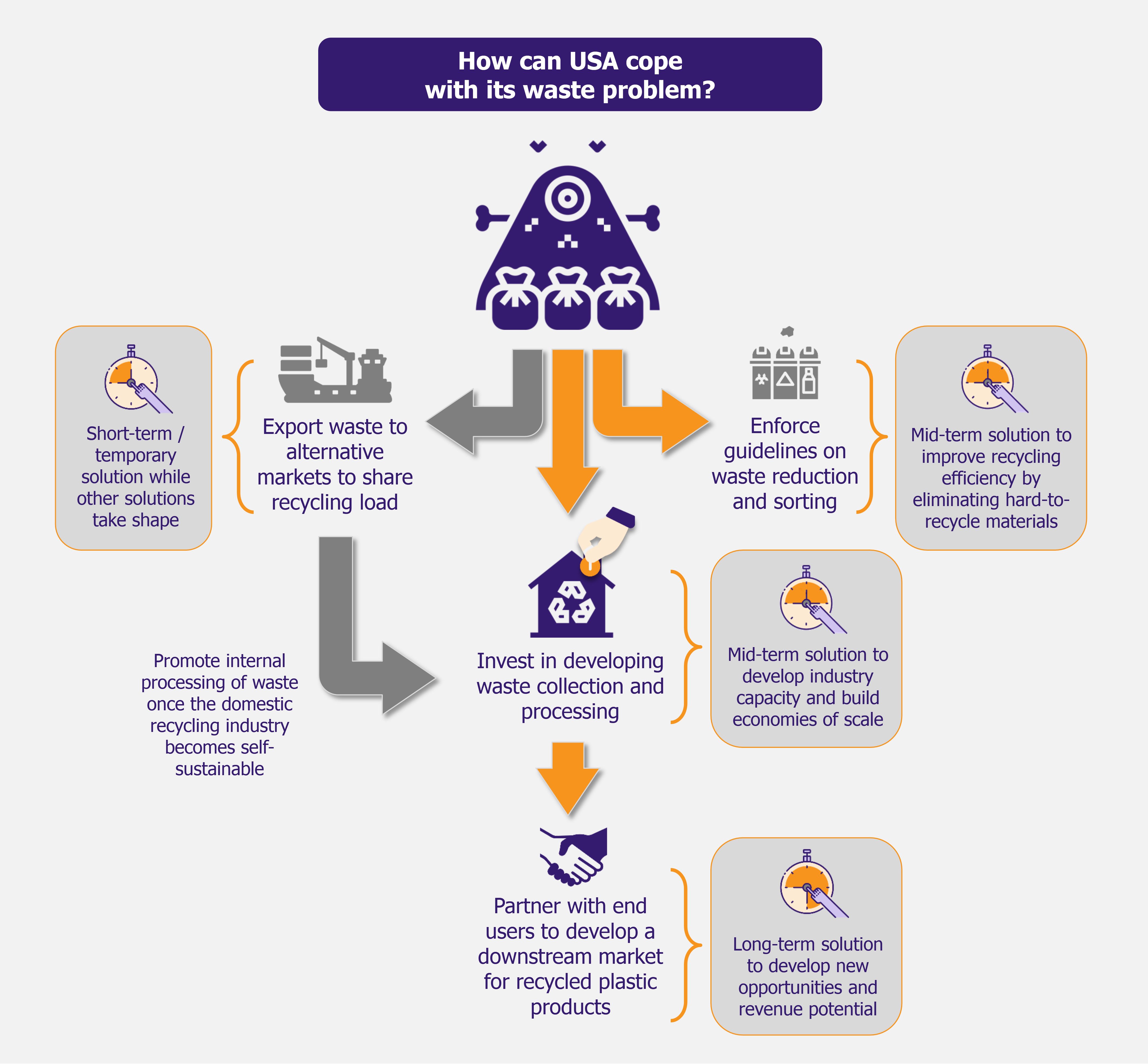

The most obvious solution for the US recycling industry, in the short term, is to consider alternative waste destinations, such as Vietnam, Malaysia, and Thailand, to share the waste burden. However, since none of these markets are developed enough to sustain over a long term, this solution, at best, can be considered a temporary fix.

The government needs to take several initiatives to lay a strong foundation for a revamped recycling industry, such as banning or restricting the use of hard-to-recycle plastics (including single-use plastics such as straws and disposable spoons), and laying down strict guidelines for sorting of waste already at the household level, which will improve the efficiency and costs associated with the recycling process.

A coalition of plastics players and other industry groups is lobbying for provision of funds by the US government, an investment of US$500 million, to help develop local waste management systems. If disbursed, these investments will enable development of the recycling industry until it becomes self-sufficient in handling domestic waste. Once this happens, the costs of disposing and processing waste are also likely to reduce.

In the long run, significant private investments in building domestic recycling capacities will be required to effectively address the ever-increasing waste. Excess waste, which was earlier exported to China and India, offers a sustainable source of raw materials to justify these investments in developing the recycling infrastructure. Furthermore, increasing focus on sustainability is driving a demand for recycled raw materials. Development of downstream recycling and processing capabilities can also enable recycling companies to tap this lucrative business opportunity. Partnerships with end users are likely to open further revenue stream.

While private investments in recycling infrastructure have started flowing in and the rate is expected to pick up, these investments will take time before the added capacities actually become operational. The success of these investments, however, will depend on how effectively the US government is able to execute initiatives to aid growth of domestic recycling industry.