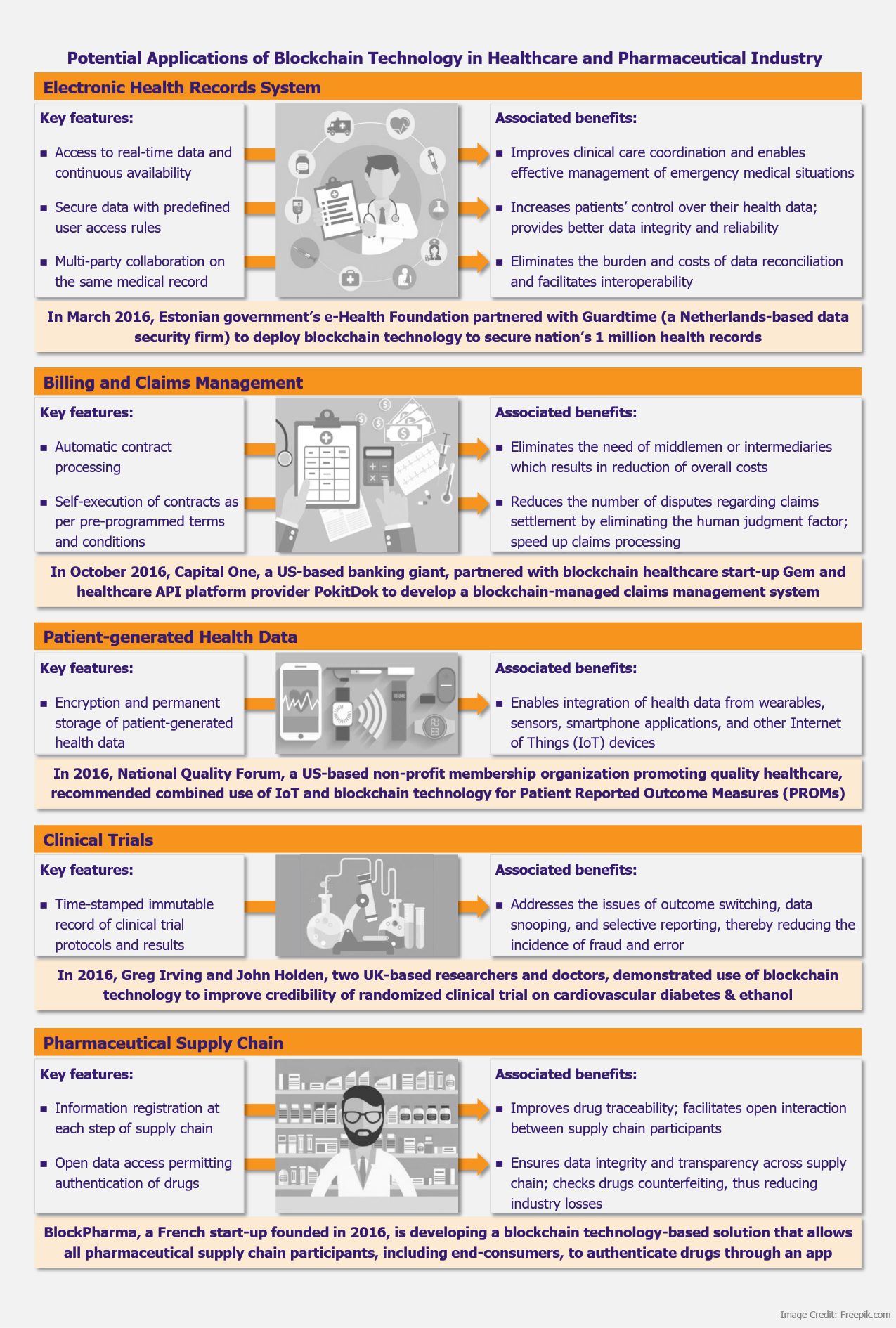

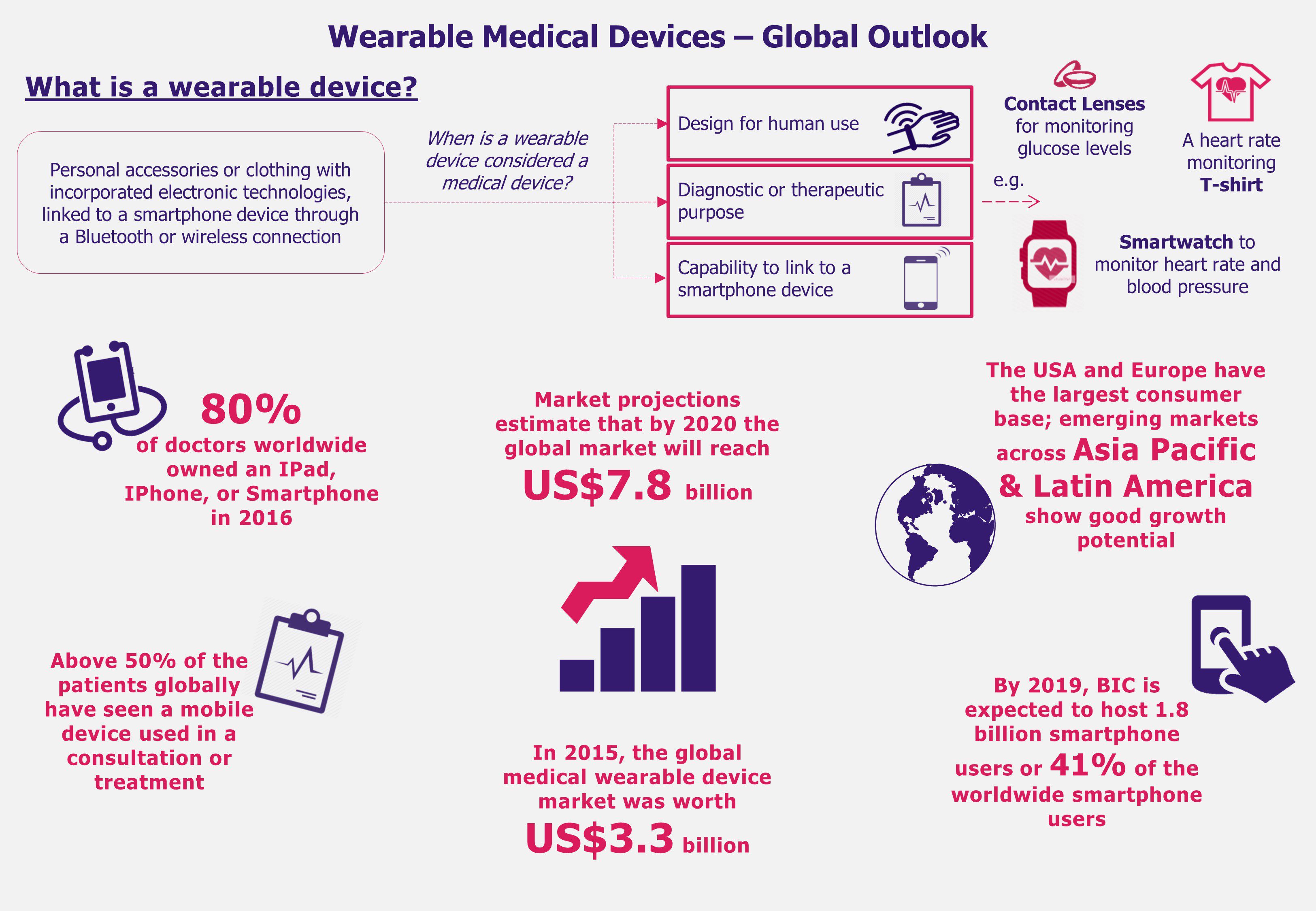

Blockchain, an innovation underlying the Bitcoin cryptocurrency, is a distributed ledger technology enabling transparent and secure data sharing in real time. The buzz around blockchain technology has spread far beyond finance sector, the technology’s original application area. In fact, think tanks globally are exploring and testing the potential use of blockchain technology to ease current pain points in healthcare and pharmaceutical industries.

EOS Perspective

EOS Perspective

Blockchain-managed information exchange ensures data security, transparency, integrity, and reliability. These attributes have the potential to address several healthcare industry challenges associated with interoperability, data security and privacy, insurance claims processing, clinical trials credibility, and drugs counterfeiting, among others. As a result, blockchain technology is quickly gaining ground among industry stakeholders.

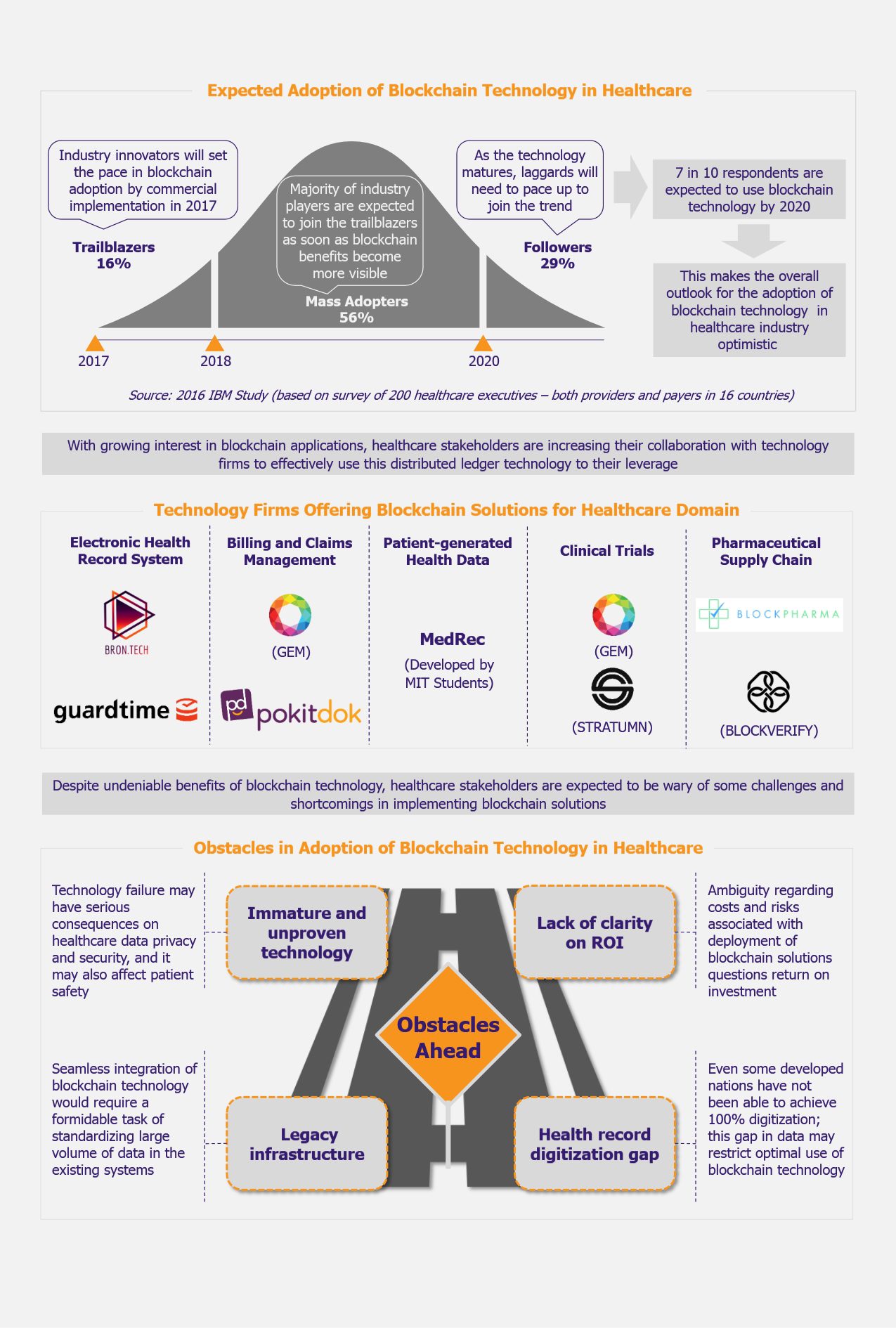

An IBM study (released in 2016) based on survey of 200 healthcare executives – both providers and payers in 16 countries – indicated that 72% of the respondents were planning to deploy blockchain technology-based solutions by 2020. The survey emphasized that the industry pioneers have great confidence in application of blockchain technology with about 16% of the respondents planning to have commercial blockchain solution operational in 2017. Another survey commissioned by Deloitte in 2016 involving 308 executives at the US companies (from various industry segments) with US$500 million or more in annual revenue indicated that 35% of the respondents from healthcare and life sciences industry plan to deploy blockchain solutions in 2017. These surveys suggest that healthcare industry have set high expectations from and is ready to embrace blockchain technology.

Though blockchain promises to offer several unique solutions, industry players need to be cautious about some obstacles associated with adoption of this technology.

Blockchain technology is a relatively new concept for healthcare domain. There are high risks of dealing with immature and untested technology. A report released by Tierion (a US-based blockchain start-up) in 2016 indicated that healthcare data is prime target of cybercriminals as patient health records sell at US$20 compared with US$1 per credit card number.

Moreover, healthcare organizations need to comply with stringent rules and regulations pertaining to patient data privacy and security to avoid steep penalties. Even though the blockchain technology is expected to provide better security against data breach, the adopters need to be cautious until the capabilities of blockchain technology are proven in real-time environment.

Even though the blockchain technology is expected to provide better security against data breach, the adopters need to be cautious until the capabilities of blockchain technology are proven in real-time environment.

Since blockchain technology is still in the stage of development, the costs and risks associated with its implementation in practicality are largely unknown. Moreover, in absence of real-world business cases, it is difficult to forecast the operating costs as well as potential technology post-implementation roadblocks. This might create some hesitation among the industry players to adopt this new technology as there is little clarity on return on investments.

Full digitization of healthcare data is imperative for successful deployment of blockchain technology. However, it is observed that even some of the developed nations have not been able to achieve 100% digitization till date. For instance, 2015 Commonwealth Fund’s International Survey of Primary Care Physicians indicated that about 84% of physicians in the USA use some form of electronic health record system, while in other countries, such as Germany, France, Canada, and Switzerland, these figures are even lower – 84%, 75%, 73%, and 54%, respectively. These shares can surely be expected to be incomparably lower in less developed and developing countries.

Explore our other Perspectives on blockchain

Furthermore, the implementation of blockchain solutions would require significant changes to, or complete transformation of, existing systems. In order to integrate blockchain software in legacy systems, all forms of data would need to be standardized to ensure compatibility. Considering large volumes of healthcare data, which is now being produced in the range of petabytes, the transition would be a major challenge.

Implementation of blockchain solutions would require significant changes to, or complete transformation of, existing systems. In order to integrate blockchain software in legacy systems, all forms of data would need to be standardized to ensure compatibility

In view of these risks and challenges, we believe that the time is not ripe for the healthcare industry to readily adopt blockchain solutions at a large scale. Rather than rushing to adopt blockchain solutions, the technology should be thoroughly tested before deployment. There is no doubt that the application of blockchain technology has the potential to impact healthcare industry in several positive ways, however, in absence of real-world business cases, it seems too early to estimate the scale of impact and risk.