The COVID-19 pandemic has spurred the need to embrace new digital tools and technologies within the healthcare sector. There has been a significant increase in the use of technology to provide care, resulting in improved health outcomes. In Europe, Denmark has made significant progress and is at the forefront of the digital health transformation with a 99% digitalization rate. Over the last few years, Denmark has strived to digitalize further its healthcare infrastructure, testing and leveraging technologies such as AI and robotics to implement them at full scale across the country. In this transformation, the Danish digital health system can be a source of valuable lessons, uncovering various opportunities it presents for health tech companies.

Demark’s digital health: Harnessing power from a robust public infrastructure

Denmark’s healthcare system is among the most expensive worldwide, with 10% of GDP allotted for healthcare expenditures and 90% publicly funded through taxes. The health infrastructure is highly digitalized, with almost 99% of healthcare communication done electronically.

The national e-health portal, Sundhed.dk, launched in 2003, plays a key role in Denmark’s digitalization, offering a comprehensive platform catering to both healthcare professionals and citizens alike. Sundhed.dk provides safe and secure access to an individual’s personal health records (from hospitals), medication information, vaccinations, laboratory results, appointments, and referrals. The portal is user-friendly and is regarded as one of the superior models for public healthcare information exchange worldwide.

Over the last 20 years, the Danish government has supported and invested in various digital health initiatives, rolled out several IT services, and strengthened its digital healthcare infrastructure. In 2007, the country introduced E-record, through which individuals can access their medical information from EHR systems using the Sundhed.dk portal. The government also launched Shared Medication Record, which has records of patients’ prescriptions, details of the doctor who prescribed the medicines, and information pertaining to where the medications were picked from. During the COVID-19 pandemic, the “My Doctor” app was introduced to facilitate video consultations between GPs and patients. These digital initiatives contribute to improved care coordination and increase the patient’s trust in the system.

Unraveling the blueprint: Denmark’s digital health success story

Well-formulated digital health strategies address the needs of patients and healthcare workers

Many countries develop digital health strategies, which are frequently focused solely on technical aspects, steering away from addressing the actual needs of patients and healthcare professionals. Moreover, these policies often function as plain vision documents with no clear description of action plans or the roles and responsibilities of various stakeholders.

In contrast, Denmark’s digital health strategy is well-formulated and primarily focused on addressing the needs of patients and healthcare workers. It provides a clear vision of how digital technology can help meet their needs. In addition, the strategies highlight the importance of cross-sectoral collaboration, detailing focus areas and specific initiatives that must be jointly executed. For instance, it clearly mentions how the health and education sectors should work together to promote digital health literacy.

Denmark’s well-crafted digital health policies are a cornerstone of its successful digital health transformation. Since 1999, the country has been updating these strategies every four years, ensuring ongoing review and modernization of its digital health infrastructure.

Governance models aid in the speedy integration and implementation of digital healthcare tools

Denmark follows a regional governance model instead of the top-down approach, controlled by the state (national) government. The states and municipalities are responsible for developing and implementing their own health IT solutions in alignment with the national strategy.

Further, the government has established several steering groups to aid in implementing and disseminating digital health initiatives for rapid digital uptake. For instance, Connected Digital Health in Denmark, a cross-governmental organization, manages, coordinates, and ensures the implementation of various action plans mentioned in the national digital health strategies.

In addition, the government also regularly engages in public-private partnerships to boost its digital capabilities. The country’s strong governance is considered one of the critical success factors for the digital health transition.

Common IT standards help in effective healthcare data exchange

Many countries have deployed digital health technologies; however, integration remains sparse, resulting in a fragmented digital landscape. Integrating patient information siloed across multiple healthcare segments is crucial for establishing a high-quality digital health infrastructure. The adoption of common IT standards helps facilitate this data exchange and integration.

Denmark has been using these standards since 1990 for electronic health data communication as well as improving workflows between public hospitals, general practitioners, private healthcare entities, specialists, laboratories, and home care services. The early development of these standards significantly increased electronic communication within the healthcare sector, contributing to the high level of digitalization of the Danish healthcare sector.

Strict testing protocols ensure digital health tools are user-friendly

The user-friendliness of digital technologies is considered one of the major factors for early e-health adoption. Denmark undertakes several initiatives to ensure that digital health tools and technologies are user-friendly and easy to use. For instance, the country collects feedback from healthcare stakeholders about their experience with various digital health solutions, checks if they are user-friendly, and uses the input received to develop new solutions.

The country has also implemented strict testing protocols for telehealth solutions by evaluating their performance on mobile devices and testing the products with a range of end users, including the elderly and people with disabilities.

Government’s focus on educating and training healthcare stakeholders helps them to use digital tools effectively

Denmark educates and trains healthcare workers to use digital tools appropriately. According to a 2020 Deloitte report, nearly 76.8 % of Danish clinicians mentioned that they are well-trained and supported in using digital health tools and solutions.

Local governments and hospitals in Denmark collaborate with tech professionals to provide support, education, and training on using digital solutions such as EMRs, telemedicine platforms, and shared IT standards for healthcare data exchange. Digital health literacy of front-line healthcare workers is one of the core objectives of the country’s digital health strategy.

Unlocking opportunities: Denmark’s digital health sector for health tech companies

According to Statistics Denmark, the percentage of the Danish population aged 75 or above is expected to double from 7.8% in 2017 to 14.4% in 2047. In addition, the country faces a severe labor shortage, with projections suggesting that by 2035, Denmark might have a shortage of 14,500 healthcare workers. These factors are expected to put increased pressure on the Danish healthcare system.

In order to tackle these challenges, Denmark’s government continues to invest in advanced innovative technologies and digitalization strategies. In 2018, the country launched a digital health strategy titled “A Coherent and Trustworthy Health Network for All: 2018-2024”, aiming to modernize the healthcare infrastructure further. Under this initiative, the country aims to expand telemedicine solutions, increase virtual care visits, and automate the administrative and clinical workflows within the Danish healthcare system. This initiative is creating opportunities for startups and companies offering health tech solutions in the areas of telemedicine, video consultations, remote patient monitoring, hospital automation, and diagnostics.

Danish government seeks to expand telemedicine solutions for various segments of the patient population

Denmark has been using telemedicine services since 2012, beginning with home monitoring solutions for Chronic Obstructive Pulmonary Disease (COPD) patients. The country seeks to further expand the rollout of telemedicine solutions for patients with COPD, chronic diseases, heart failure, comorbid conditions, and pregnant women facing complications. In December 2023, the government of Denmark invested about US$72 million to expand telemedicine solutions for these patients, offer digital rehabilitation courses, and increase the number of virtual consultations through GPs.

Various governmental organizations in Denmark have been looking to partner with companies providing innovative remote monitoring and virtual care solutions to facilitate home treatment.

For instance, in 2021, in collaboration with the local government, Trifork, a Denmark-based digital health company, developed a telemedicine solution called Telma for severe COPD patients. The solution provides COPD patients with medication, measuring tools, and devices to track pulse and oxygen levels at home. The Telma app transmits this data in real time and facilitates communication between healthcare professionals and patients through video consultations, thus lessening the need for frequent hospital visits.

Similarly, in 2022, two Denmark-based health tech companies, Copenhagen Center for Health Technology (CACHET) and Cortrium, forged a research collaboration to develop a novel technology to monitor a patient’s heart rhythm remotely. This allows heart failure patients to receive prompt medical care without visiting a hospital.

The Danish government is also looking to provide telerehabilitation services amidst the rising mental health issues across the country. In 2021, the government established the Centre for Digital Psychiatry to develop, test, and implement several nationwide digital services. In March 2023, the Center initiated a research project with Monsenso, a Danish mobile health company, to provide personalized digital treatment for patients with depression.

A rise in telemedicine programs catering to various segments of the patient population is expected in the forthcoming years. This surge in demand fuels the growth of companies offering telehealth solutions nationwide.

AI presents several opportunities for innovation and collaboration within the healthcare segment

Denmark actively seeks to integrate AI into its healthcare system, especially in diagnostics, presenting numerous opportunities for AI-based health companies to thrive. The country has established research and innovation centers across the country focusing on AI for uses such as identifying at-risk stroke patients, helping radiologists interpret scans, and assisting in other diagnostics.

In 2021, Denmark established the Radiology AI Test Center (RAIT) to accelerate the development and implementation of medical AI applications in the country. Through RAIT, private companies can test and validate their AI-based technologies in Denmark. For example, in 2021, through the RAIT program, several Danish hospitals in Copenhagen partnered with US-based imaging AI startup Enlitic to evaluate an AI-based algorithm to read chest X-rays. Similarly, in 2023, RAIT partnered with Cerebriu, a Denmark-based health tech company, to use AI to improve MRI imaging of the brain.

Investments in advanced digital technologies modernize healthcare infrastructure

As Denmark endeavors to digitalize its hospitals, ample opportunities arise for companies specializing in robotics and mobile health to improve hospital and clinical workflows, among other areas.

Some steps have been taken to digitalize hospitals. For instance, the Centre for Clinical Robotics (CCR), a research and innovation center for healthcare robotic technology in Denmark, aims to leverage robotic technology for various hospital processes, such as food service, cleaning, medication dispensing, clinical sample collection, etc.

Another interesting instance is the pilot project between Systematic, a Denmark-based software company, and physicians at the Aalborg University Hospital. Systematic has developed a communication platform called Columna Flow Clinical Tasking, which facilitates direct communication among the physicians at the Aalborg Hospital. The solution offers a real-time overview of the patients, including their medical conditions and the workload of hospital clinicians on duty. This empowers physicians to prioritize patients and efficiently allocate tasks during peak hospital hours.

EOS Perspective

The Danish health system is poised for an even more profound digital transformation in the coming years, aiming to improve patient accessibility and convenience. Denmark’s healthcare market is already highly digitalized, which provides a robust foundation for further digital transformation and innovation.

Home care and telemedicine, health data interoperability, AI-based diagnosis, healthcare automation, personalized medicine, and preventative health are likely the key focus areas for the next phase of digital health transformation.

Further, the country is looking to elevate patient care through its super hospital program, which involves consolidating smaller hospitals into larger, higher-capacity units. The aim is to provide superior medical care at lower costs. Technology will play a key role in improving healthcare delivery and patient outcomes in these hospitals, with applications across logistics, clinical decision support tools, diagnostic tools management, and patient engagement, among other areas.

These initiatives can be expected to make the Danish health system even more robust. The system is expected to move from a doctor-centric to a patient-centric care model, where patients would be actively involved in taking care of their own health. The country’s meticulously crafted digital health strategies, well-established digital infrastructure, and technology-proficient population lay a solid foundation to usher in the next wave of innovation.

As Denmark persists in its commitment to build a healthcare system fit for the future, there are abundant opportunities for health tech companies to thrive and drive innovation within the Danish healthcare industry.

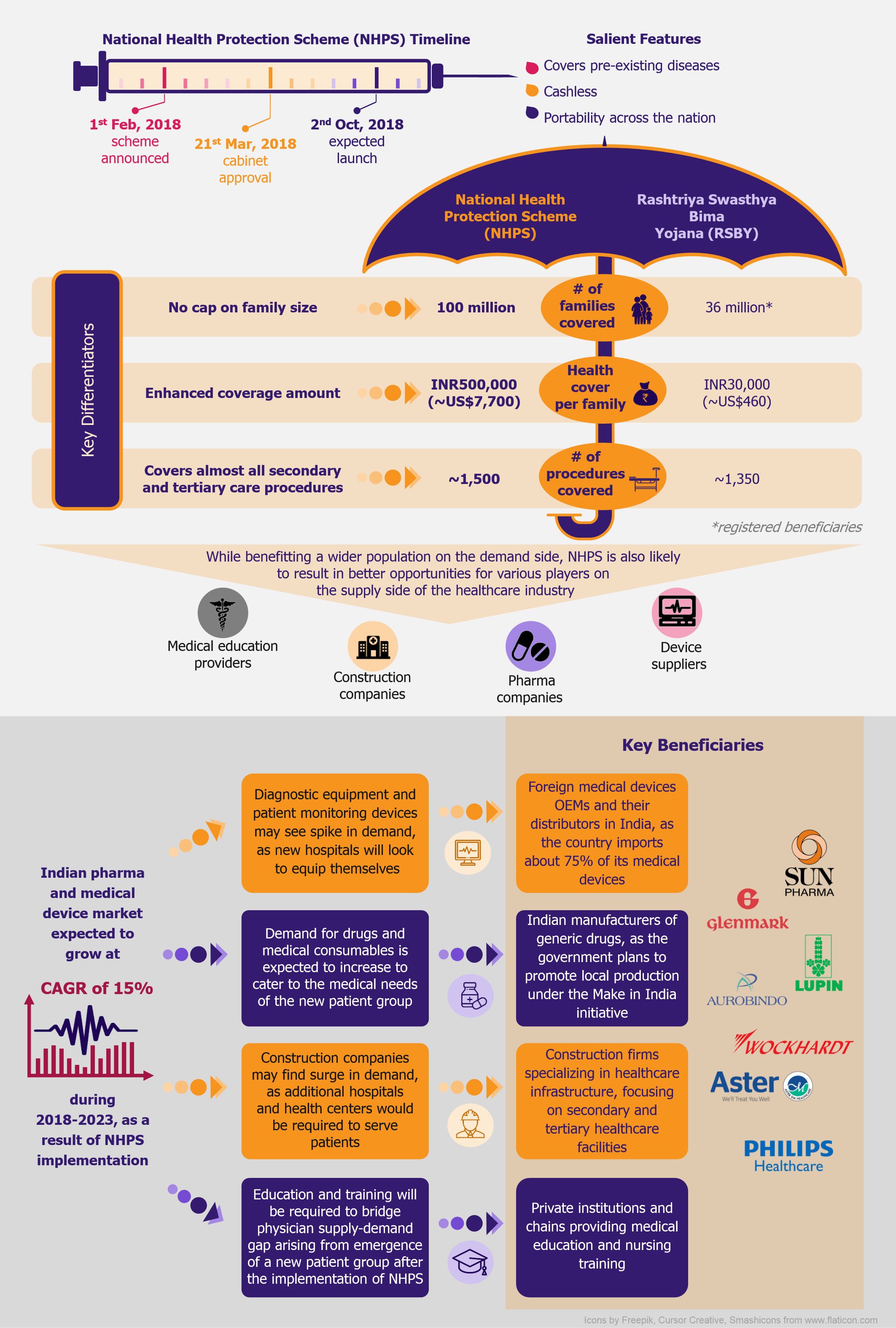

NHPS is expected to provide secondary and tertiary healthcare access to more than 40% of the Indian population, which was earlier deprived of it due to financial constraints. This will create a new healthcare market, giving boost to the entire healthcare ecosystem in India. Companies across the entire healthcare value chain, including medical education providers, healthcare service providers, construction firms, pharmaceutical and medical devices companies, etc., are expected to witness ample growth opportunities. One can expect increased investments in the Indian healthcare sector by private companies as well as foreign investors.

NHPS is expected to provide secondary and tertiary healthcare access to more than 40% of the Indian population, which was earlier deprived of it due to financial constraints. This will create a new healthcare market, giving boost to the entire healthcare ecosystem in India. Companies across the entire healthcare value chain, including medical education providers, healthcare service providers, construction firms, pharmaceutical and medical devices companies, etc., are expected to witness ample growth opportunities. One can expect increased investments in the Indian healthcare sector by private companies as well as foreign investors.

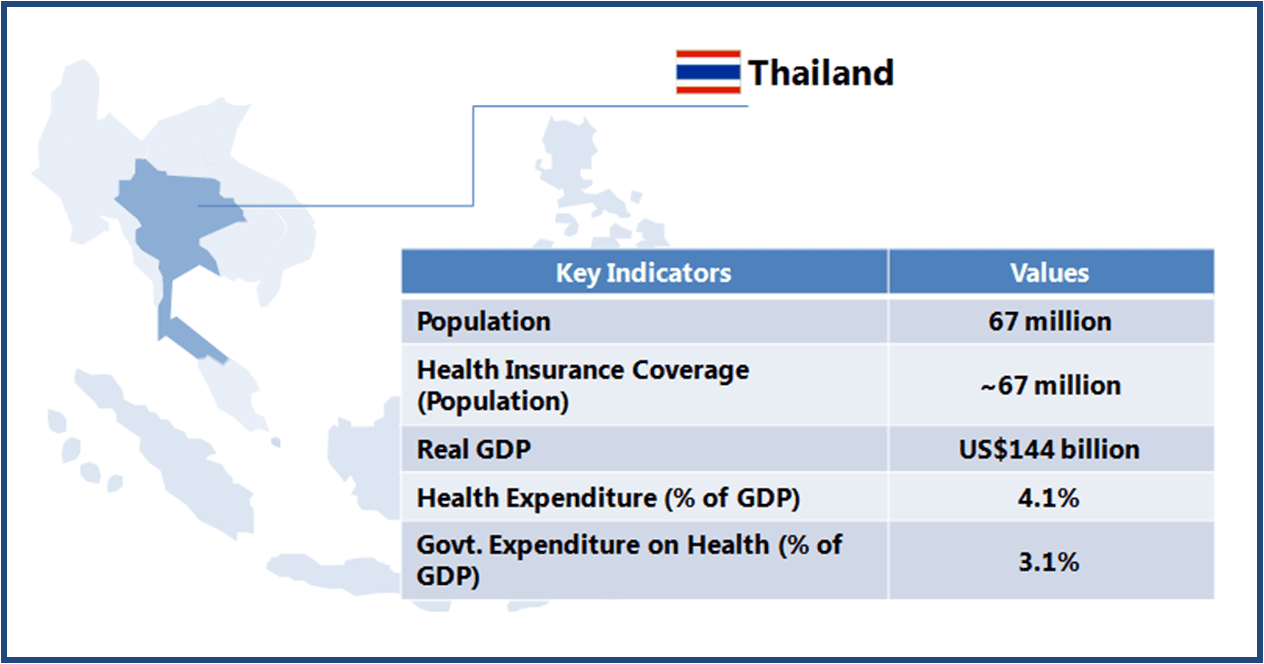

Thailand boasts of world class medical facilities (especially in the private healthcare sector), and is among the world’s largest medical tourism markets. The government is looking to further develop Thailand into an “International Health Center for Excellence” under its second strategic five-year plan (2012-2016).

Thailand boasts of world class medical facilities (especially in the private healthcare sector), and is among the world’s largest medical tourism markets. The government is looking to further develop Thailand into an “International Health Center for Excellence” under its second strategic five-year plan (2012-2016).