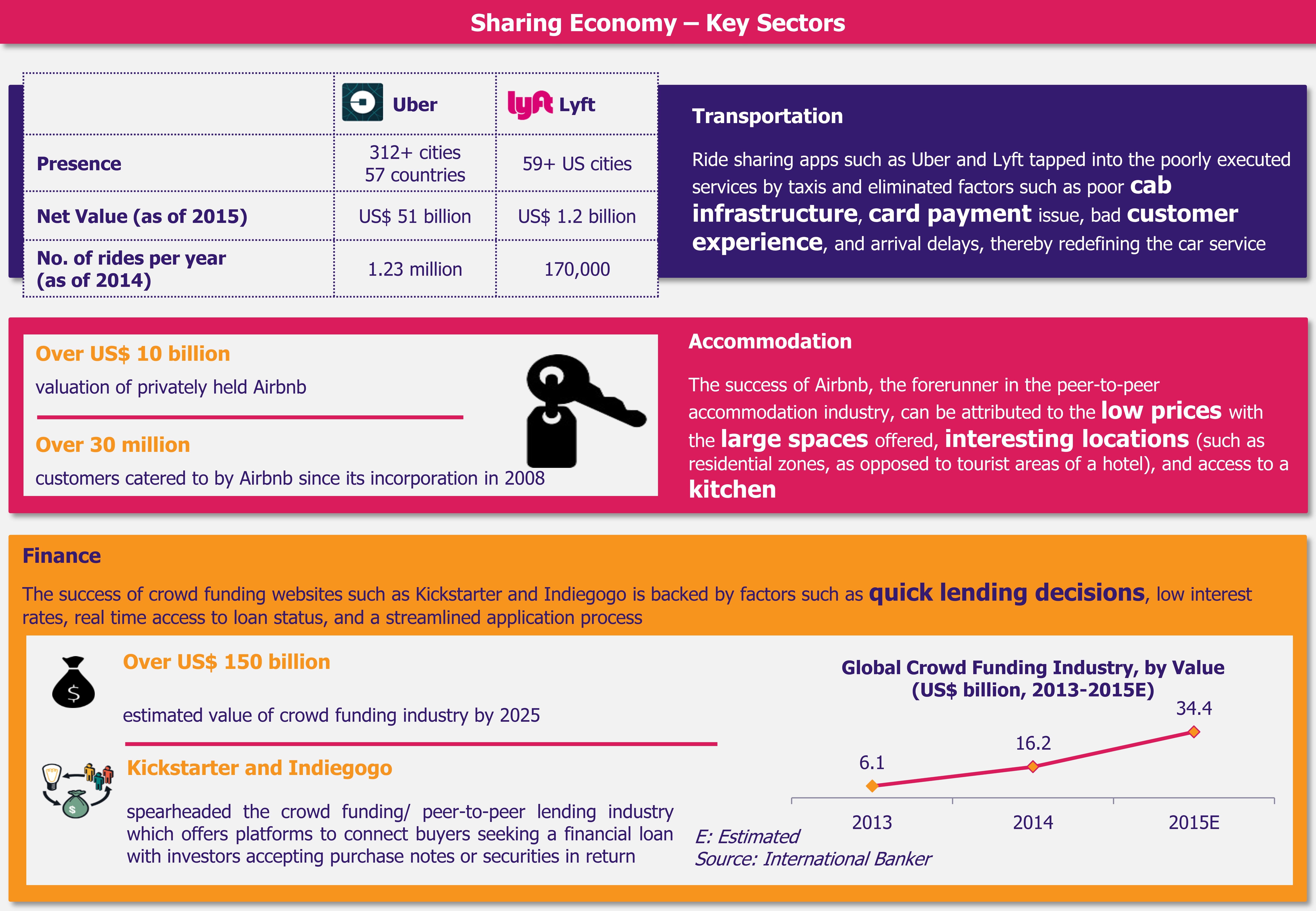

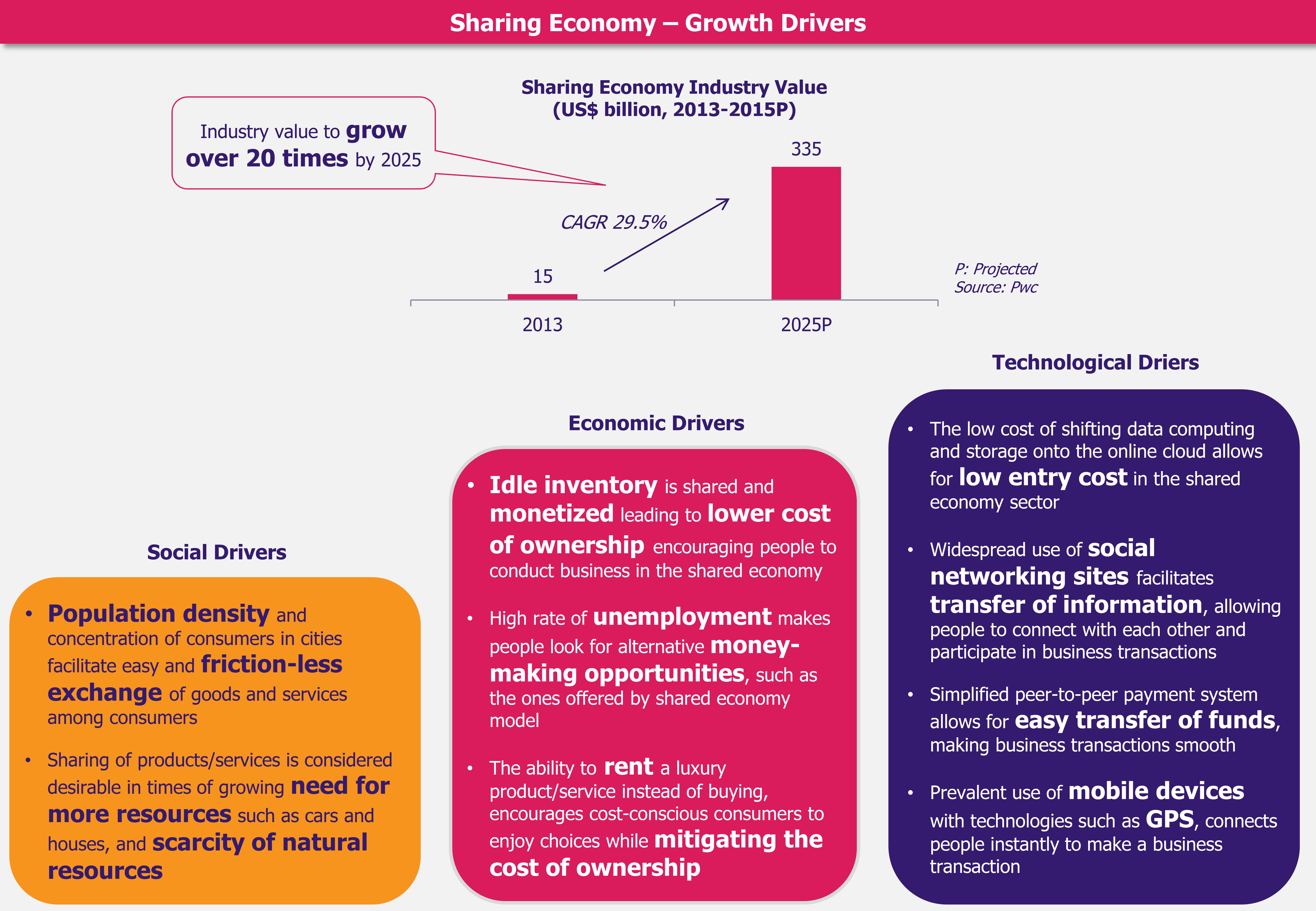

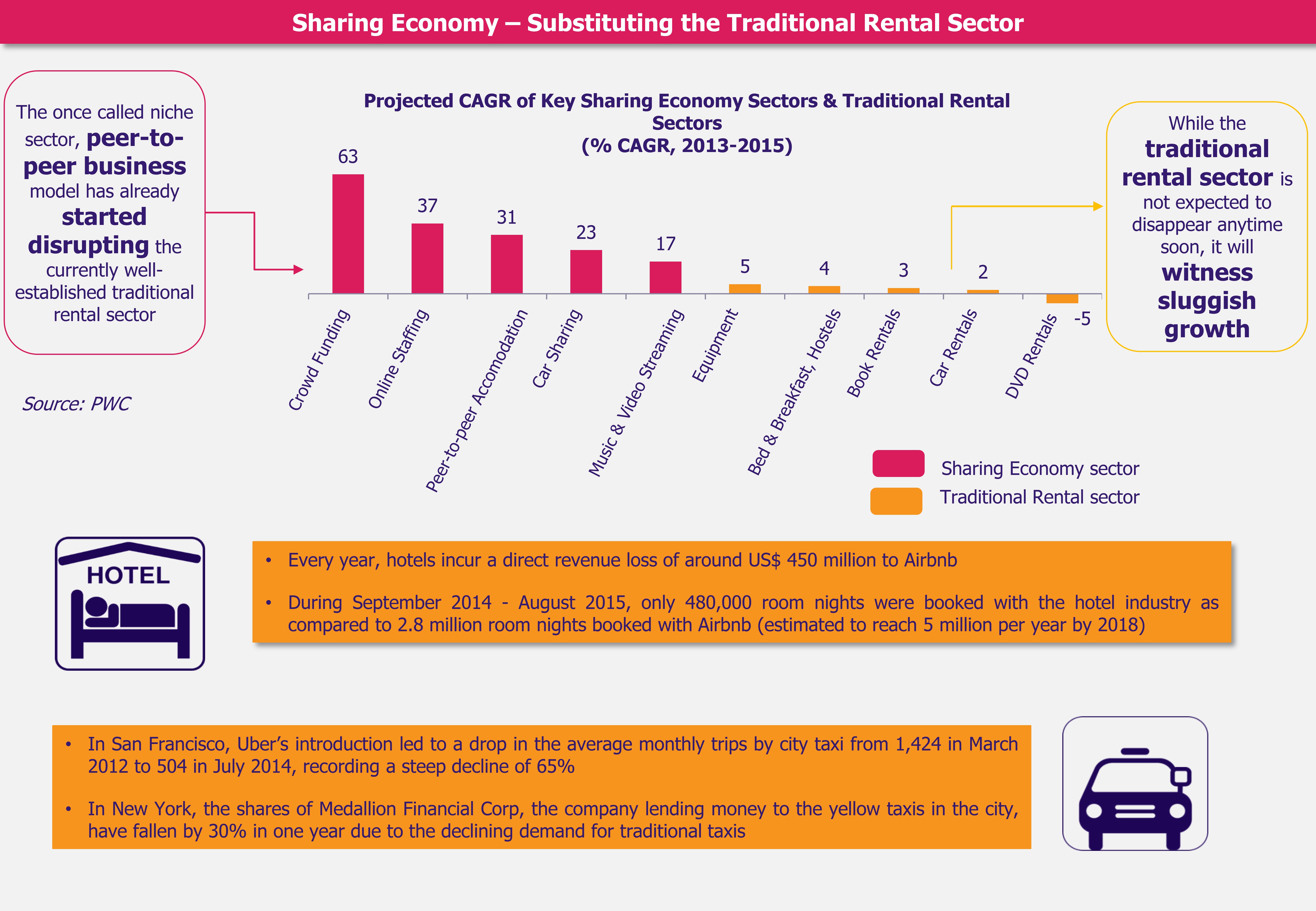

Sharing economy works on a business model where individuals have the ability to borrow or rent goods or services owned by someone else. The concept has been widely accepted in a short span of time and companies such as Uber and Airbnb have become well known among consumers. The sharing economy sector has witnessed tremendous growth with aggregate valuation of the companies operating in this market reaching US$ 140 billion in 2015. The industry has already started causing a shift in the employment sector and is said to have far-reaching implications which are likely to disrupt the traditional rental business model, particularly for companies in hotel and transportation sectors. The growth potential of sharing economy has become of considerable interest to policy makers around the globe as well, and the industry has recently come under scrutiny of various governments and regulators, and is likely to face regulatory barriers affecting its potential to scale up.

The concept of sharing economy, also known as peer-to-peer economy, facilitates a direct contact between consumers and service providers and is centered around the use of privately owned, unused inventory. Technology is key to the growth of this type of economy, which has already witnessed the emergence of several sharing platforms enabling consumers to share products and services such as cars and houses.

EOS Perspective

EOS Perspective

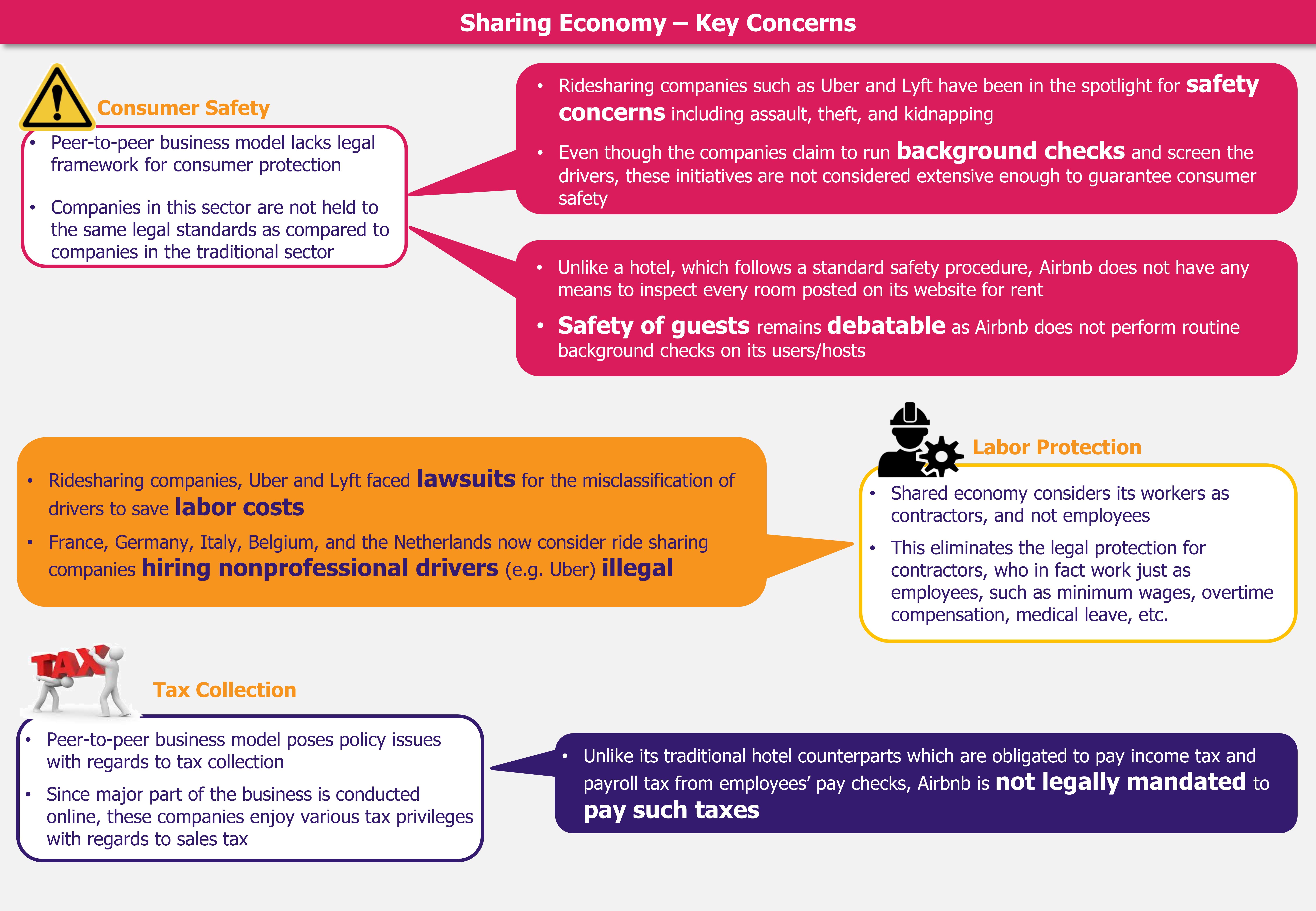

Companies such as Uber and Airbnb have become the talk of the town, due to their tremendous growth achieved thanks to a simple business model: providing consumers the ability to monetize idle inventory and rent an asset, instead of purchasing it. Sharing economy also meets consumers’ desire for social interaction, lower costs, and technology-based access to goods and services. However, the sudden and overwhelming rise in its popularity has shaken the governments’ ability to appropriately and sufficiently regulate this economy. Weak legal frameworks hampering consumer’s safety and tax collection have led to debates around the benefits of sharing economy.

Implementation of the traditional regulatory frameworks in the sharing economy sector is likely to upend the peer-to-peer business model. Inclusion and implementation of monetary employee benefits, tax obligations, and safety regulations in the sharing economy can be expected to lead to an increase in the cost of services offered by these companies, thereby defeating the purpose of the existence of sharing economy. Thus, instead of imposing regulations originally developed and meant for traditional rental sector, there arises a vital need to develop a new policy framework best suited to the peer-to-peer business model.

Instead of completely imposing bans on these services and eliminating the opportunity to make use of idle inventory, governments should work alongside these companies and create regulations tailored to their regions to encourage safe business conduct. For instance, Airbnb signed an agreement with the City of Amsterdam to promote responsible home sharing in 2015. The agreement includes a set of rules for the hosts to be followed before activating their listing, and also stipulates the collection and remittance of tourist tax by Airbnb on behalf of the hosts. In addition, the agreement also includes a partnership with Airbnb to collect content from the company’s database to shutdown illegal hotels. These efforts are expected to ensure the hosts receive clear information on renting their homes and promote consumer safety.

Sharing economy has the potential to make a tremendous impact on the traditional rental sector and is likely to create opportunities across various different economic activities. However, from a legal perspective, it cannot be ignored that the model lacks a strong regulatory support, which over time will continue to put pressure on this newly emerged sector. The peer-to-peer model will be required to address these imperatives in the near future in order to scale to new heights.