Agriculture technologies in Africa have been undergoing significant development over the years, with many tech start-ups innovating information and communications technologies to support agriculture at all levels. While some technologies have been successfully launched, some are in initial stages of becoming a success. Private sector investments have been the key driving factor supporting the development of agriculture technologies in Africa. In the first part of our series on agritech in Africa, we are examine what impact and opportunities arise from the use of these technologies in Africa.

Agriculture plays a significant role in Africa’s economy, contributing 32% to the continent’s GDP and employing 65% of the total work force (as per the World Bank estimates). Nearly 70% of the continent’s population directly depends on agribusiness. Vast majority of farmers work on small scale farms that produce nearly 90% of all agricultural output.

This article is the first part of a two-piece coverage focusing on technological advancements in agriculture across the African continent.

Read part two here: Agritech in Africa: How Blockchain Can Help Revolutionize Agriculture

Agriculture in Africa has been under the pressure of many challenges such as low productivity, lack of knowledge and exposure to new farming techniques, and lack of access to financial support, especially for the small-scale farmers. These challenges are prompting investments in newer technologies to enhance the productivity through smart agriculture techniques.

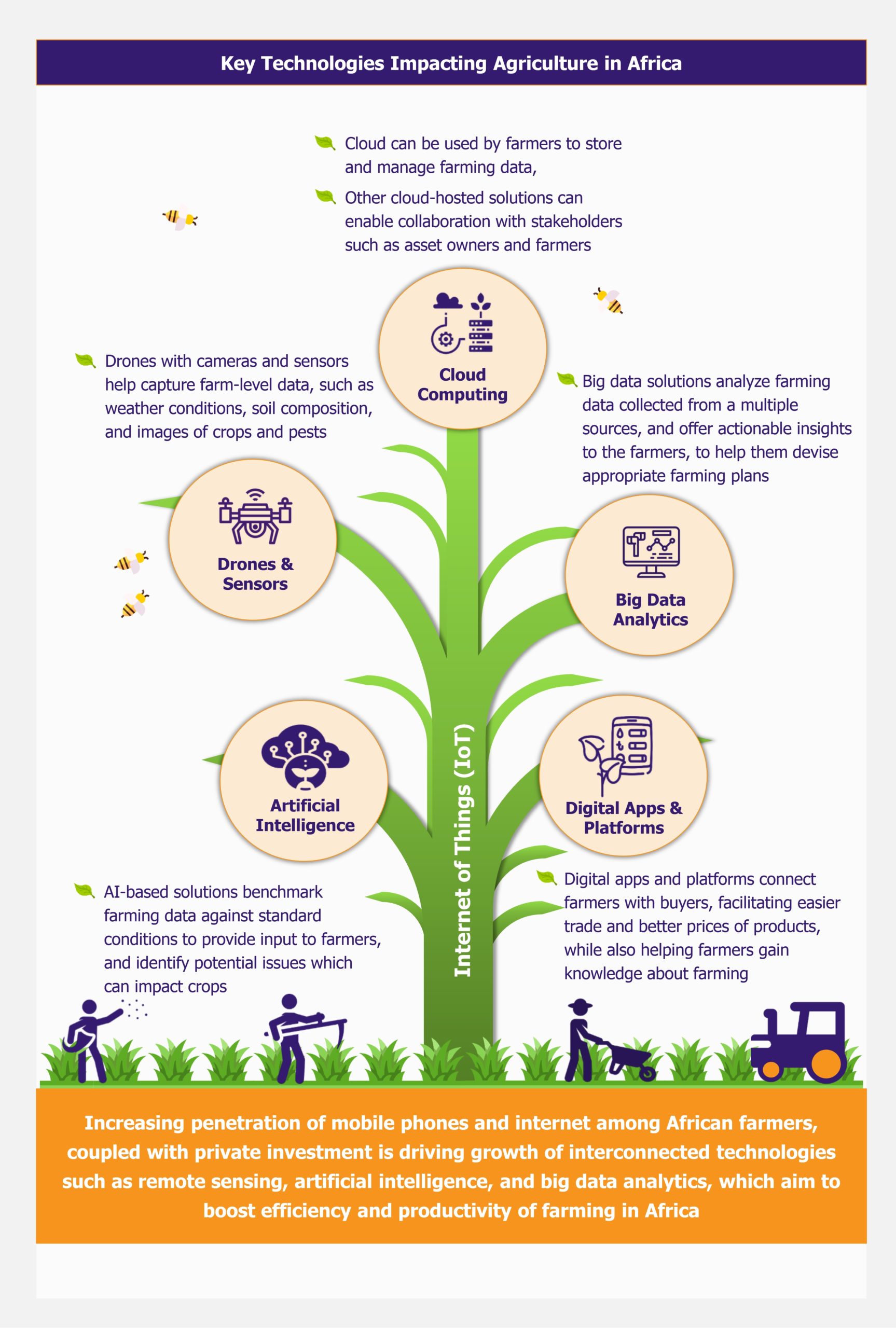

Lately, there have been an increased use of various technologies in agriculture in Africa, such as Internet of Things (IoT), Open Source Software, Cloud Computing, Artificial Intelligence, Drones/Unmanned Aerial Vehicles (UAVs), and Big Data Analytics. Many tech start-ups have developed solutions targeting various aspects of agriculture, including finance, supply chain, retailing, and even delivering information related to crops and weeds. These solutions are accessible to farmers through front-end devices such as smart phones and tablets, or even SMS.

Start-ups lead agritech development in Africa

Many agritech start-ups in Africa have come up with solutions that have led to a rise in productivity of the farms. Drones have been a breakthrough technology, helping farmers oversee their crops, and manage their farms effectively. Drones use highly focused cameras to capture picture of crops, soil or weeds. This, coupled with big data analytics and Artificial Intelligence (AI), provides insights to farmers, saving their time and effort, while also helping them find potential issues which could impact the productivity of their farms.

There are various agritech start-ups that are developing such drones, and providing them to farmers for rent or lease to analyse their crops and farms. A South African agritech start-up, Aerobotics, offers an end-to-end solution to help farmers manage their farms using drones, through early detection of any crop-related problems, and offering curative measures for the problems using an AI-based analytics platform. The company partners with drone manufacturing companies such as DJI and Micasense to deliver these solutions.

Acquahmeyer, another start-up based in Ghana, also provides drones to its farming customers to help them use a comprehensive approach to apply crop pest control and plant nutrition management for their farms.

Advent of advanced technologies such as IoT is also helping farmers to adopt smart farm management through the use of smart sensors connected in a network. This helps every farmer to get granular details of the crops, soil, farming equipment, or livestock, enabling the farmers to devise appropriate farming approaches.

Kenya-based UjuziKilimo provides solution for analyzing soil characteristics using electronic sensor placed in the ground. This helps farmers with useful real-time insights into soil conditions. The solution further utilizes big data analytics to guide the farmers, by offering insights through SMS on their connected mobile phones or tablets.

Hello Tractor, a Kenyan start-up, provides an IoT solution, through which farmers can have access to affordable tractors which are monitored virtually through a remote asset tracking device on the tractor, sharing data over the Hello Tractor Cloud. Farmers, booking agents, dealers, and tractor owners are connected via IoT. The company is also collaborating with IBM to incorporate artificial intelligence and blockchain to their solutions.

AI has also witnessed a rapid growth in adoption across agriculture sector in Africa. Agrix Tech, based in Cameroon, has developed a mobile application that requires the farmers to capture the picture of diseased crop, which is then analyzed via AI to detect crop diseases, and helps the farmers with treatment solution to save their crops.

AI is also helping Kenyan farmers with the knowledge on planting the right crops at the right time. Tech giant, Capgemini, has teamed up with a Kenyan social enterprise in Kakamega region in Western Kenya to use artificial intelligence to analyze farming data, and then send insights about right time and technique of planting crops to the farmers’ cell phones.

There are other agritech solutions that include mobile applications which use digital platforms such as cloud computing to reach out to farmers, and provide them with apt agriculture solutions. Ghana-based CowTribe offers a mobile USSD-based subscription service which enables livestock farmers to connect with veterinarians for animal vaccines and other livestock healthcare services using cloud-based logistics management system. The company focuses on managing the schedules, and delivering the right service to the livestock farmers, to help them safeguard their animals from any health-related problems.

Several agritech investments are also impacting the financial side of agriculture. Kenya-based Apollo Agriculture provides solutions related to financing, farm inputs, advice insurance and market access through the use of agronomic machine learning, remote sensing, and mobile technology using satellite data and cloud computing.

Another Nigerian start-up Farmcrowdy has developed Nigeria’s first digital agriculture platform that provides financial support to the farmers by allowing those outside the agriculture industry to sponsor individual farms.

Several other agritech start-ups across the continent, such as Ghana-based Farmerline and AgroCenta, and Nigeria-based Kitovu have also launched data-driven mobile application for farmers. These technology solutions are proving to be a boon for agriculture sector in Africa, helping improve the overall efficiency and productivity.

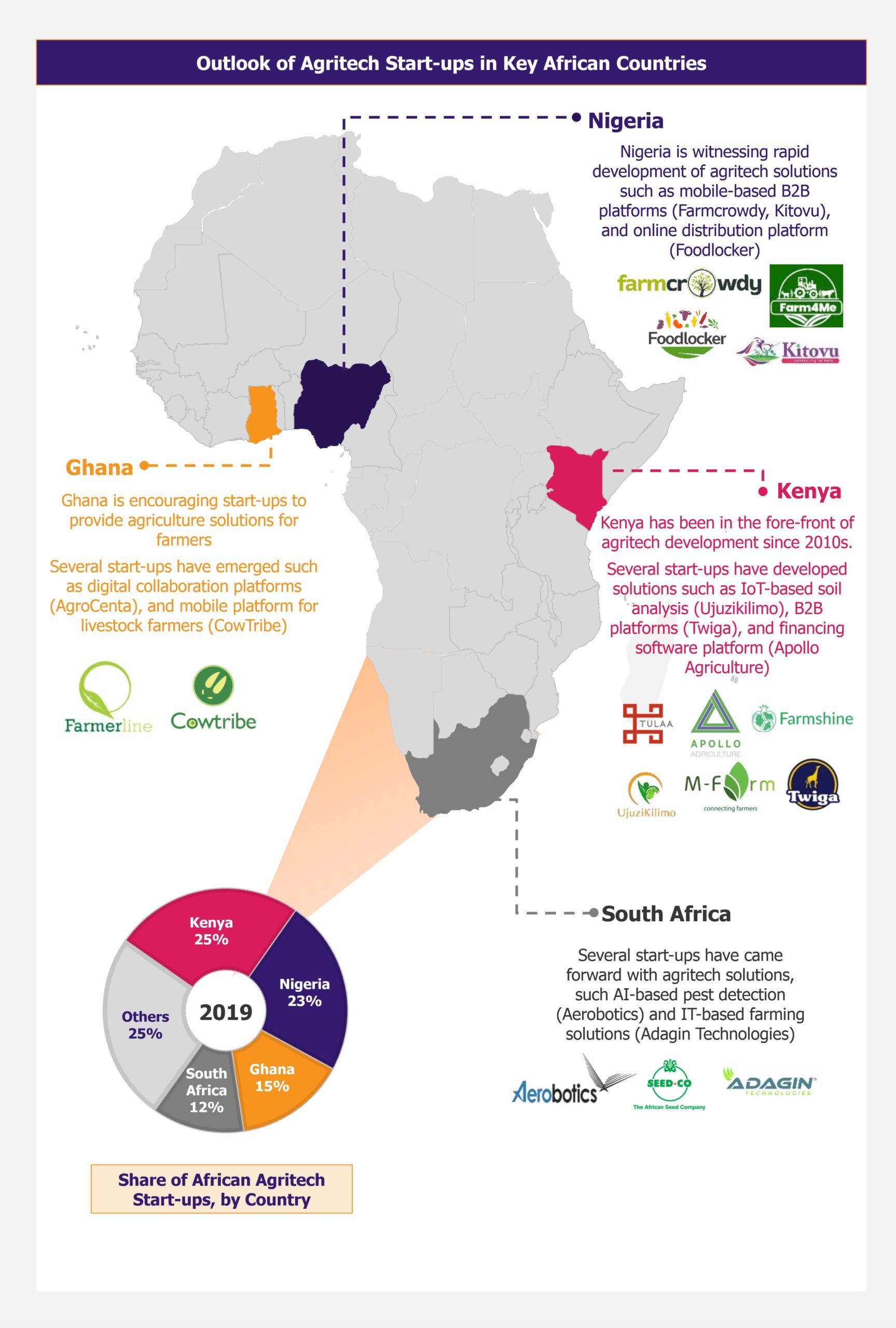

Agritech development is concentrated in Kenya and Nigeria

But, when it comes to first adopting the newest technologies and starting an agritech business in agriculture, Kenya and Nigeria have been leading in the adoption of new agritech solutions, accounting for a significant share of agritech start-up across Africa. Kenya has played a pioneering role in bringing agritech in Africa since 2010-2011, when the first wave of agritech start-ups began to bring new niche innovations. Currently, Kenya accounts for 25% of all the agritech start-ups in Africa, and the development is progressing rapidly, thanks to the country’s advancement in technology, high smartphone penetration, and relatively widespread internet access.

Similarly, Nigeria too has sailed the boat of success in agritech start-ups since 2015, and now it accounts for 23.2% of total agritech start-ups in Africa, with include major players such as Twiga Foods, Apollo Agriculture, Agrikore, and Tulaa. The growing inclination amongst Nigerian farmers towards using digital tools in agriculture sector has further pushed the rapid development in agritech sector in the country.

Other countries have also shown potential for agritech development, though it is still in the initial stages of becoming mainstream in their agriculture sectors. Ghana has encouraged several start-ups to launch different technology innovations for making agriculture more sustainable, while South Africa, Uganda, and Zimbabwe have also witnessed the rise in agritech start-ups over the years with newer technologies for agriculture sector.

Recent investments highlight the agritech potential

The agriculture technologies in Africa got the boost from the increased private funding. According to a report by Disrupt-Africa released in 2018, there has been a total investment of US$19 million in agritech sector since 2016. These investments have largely focused on funding agritech start-ups working on bringing innovative agriculture technologies. Also, according to the same report, the number of agritech start-ups rose by 110% from 2016 to 2018.

Some of the recent investments in the agritech sector include Kenya’s Twiga Foods, a B2B food distribution company, which raised US$30 million from investors led by Goldman Sachs in October 2019. The company aims to set-up a distribution centre in Nairobi to offer better supply chain services, while also expanding to more cities in Kenya, including Mombasa.

In December 2019, Kenya-based agritech start-up Farmshine, also raised US$25 million in funding from US-based Gray Matter’s Capital coLabs (GMC coLabs), to expand its operations in Malawi. GMC coLabs also invested US$1 million in another Kenyan B2B agritech start-up Taimba in July 2019. Taimba provides a mobile-based cashless platform connecting smallholder farmers to urban retailers. The investment was focused on strengthening Taimba’s infrastructure and increase the delivery logistics to cater to new markets.

Cellulant, a leading pan-African digital payments service provider that offers a real-time payment platform to farmers, also raised US$47.5 million from a consortium of investors in May 2018, which is the largest investment in the African tech industry till date. Cellulant also plans to channel a significant portion of funds into its Agrikore subsidiary, an agritech start-up dealing with blockchain based smart-contracting, payments, and marketplace system.

EOS Perspective

African agritech is expected to witness high growth in future. According to a CTA report on Digitalization for Agriculture (D4Ag) published in 2018, digital agriculture solutions are likely to reach 60-100 million smallholder famers, while generating annual revenues of nearly US$320- US$470 million by the end of 2020.

Adoption and use of innovative technologies such as remote sensing, diagnostics, IoT sensors for digitalization of agriculture is steadily moving from experimental stage to full-scale deployment, contributing to the data revolution in agriculture, while also unlocking new business models and opportunities.

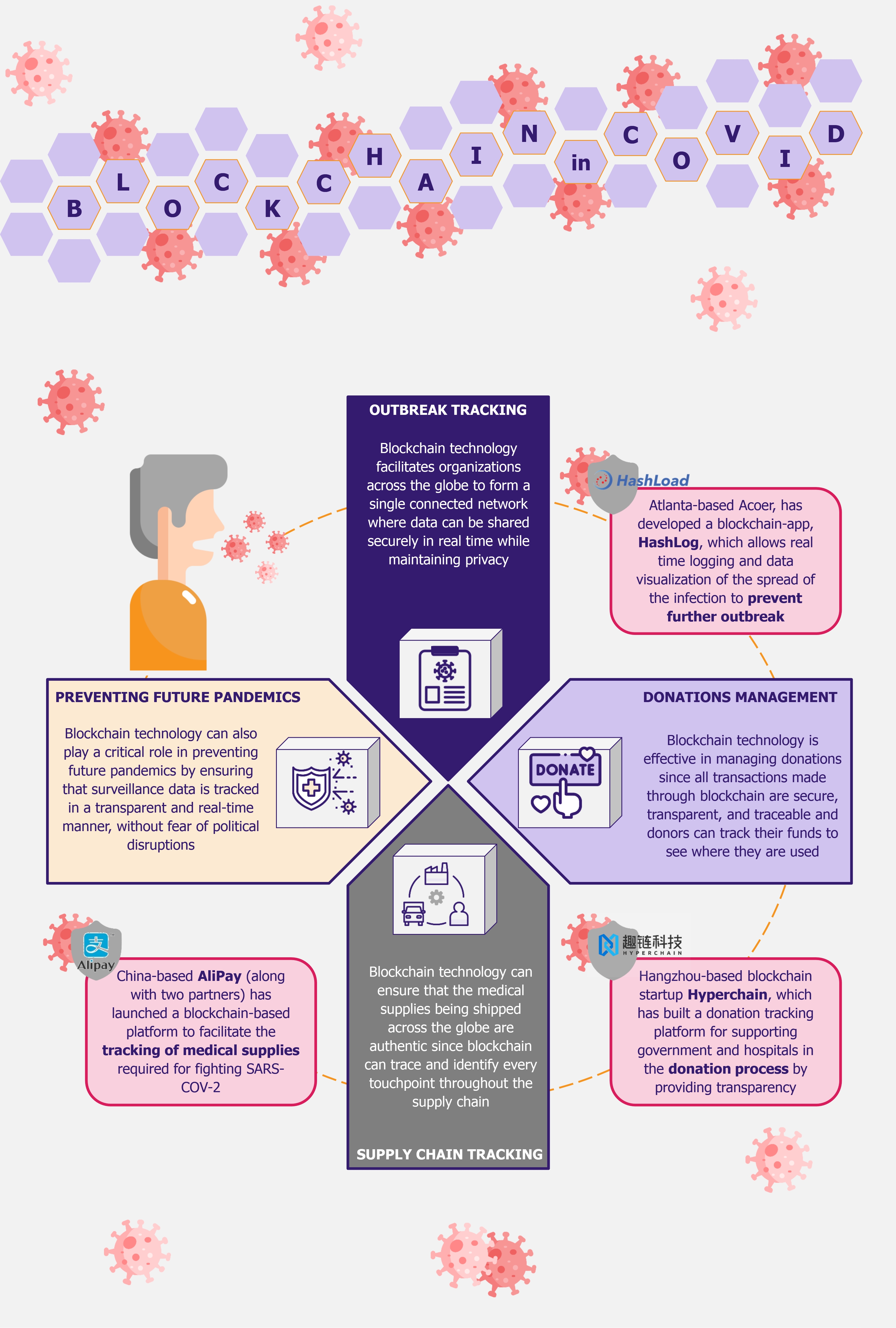

Apart from these, blockchain is gaining prominence, and finding applications in the agriculture sector in Africa. This technology has the potential to significantly impact the agriculture sector, which we will discuss in the second part of our series on Agritech in Africa.

However, lack of affordability and knowledge to access such technologies, especially by small-scale farmers, has restricted the growth and reachability of these solutions. With the need to educate farmers and make such technology affordable and viable, it is likely that it may take at least 5-7 years before these technologies become truly mainstream in the continent.

A disparity of investments has been observed among the countries in the region. Over the years, countries such as Kenya, Nigeria, and Ghana have experienced a strong growth in terms of private investments, while other countries are left wanting. Investors have prioritized easy-to-reach markets in Africa, leaving behind the lower-income markets, resulting in agritech becoming less sustainable and scalable in these markets. However, several other African countries have shown the appetite to adopt agritech solutions, and offer significant potential.

This requires an intervention and participation from both governments and private investors, which can help improve scalability of agriculture technologies in the region. Implementation of farming digital literacy, public-private partnerships, and increased private sector investments in agritech enterprises can help the agritech industry experience a consistent and higher success rate, thus bringing the agriculture technology to a mainstream at faster pace.