With the subsidence of COVID-19 and the announcement of the ending of the Global Health Emergency by WHO in May 2023, the world has started to move on and embark on its path back to pre-COVID normalcy. However, some of the lessons the pandemic has brought are hard to forget. One such lesson, and more importantly, an issue that demands attention and action, is the prevalent price disparity of COVID-19 tests in low-income regions of the world, such as Africa, compared to some more affluent countries, such as the USA.

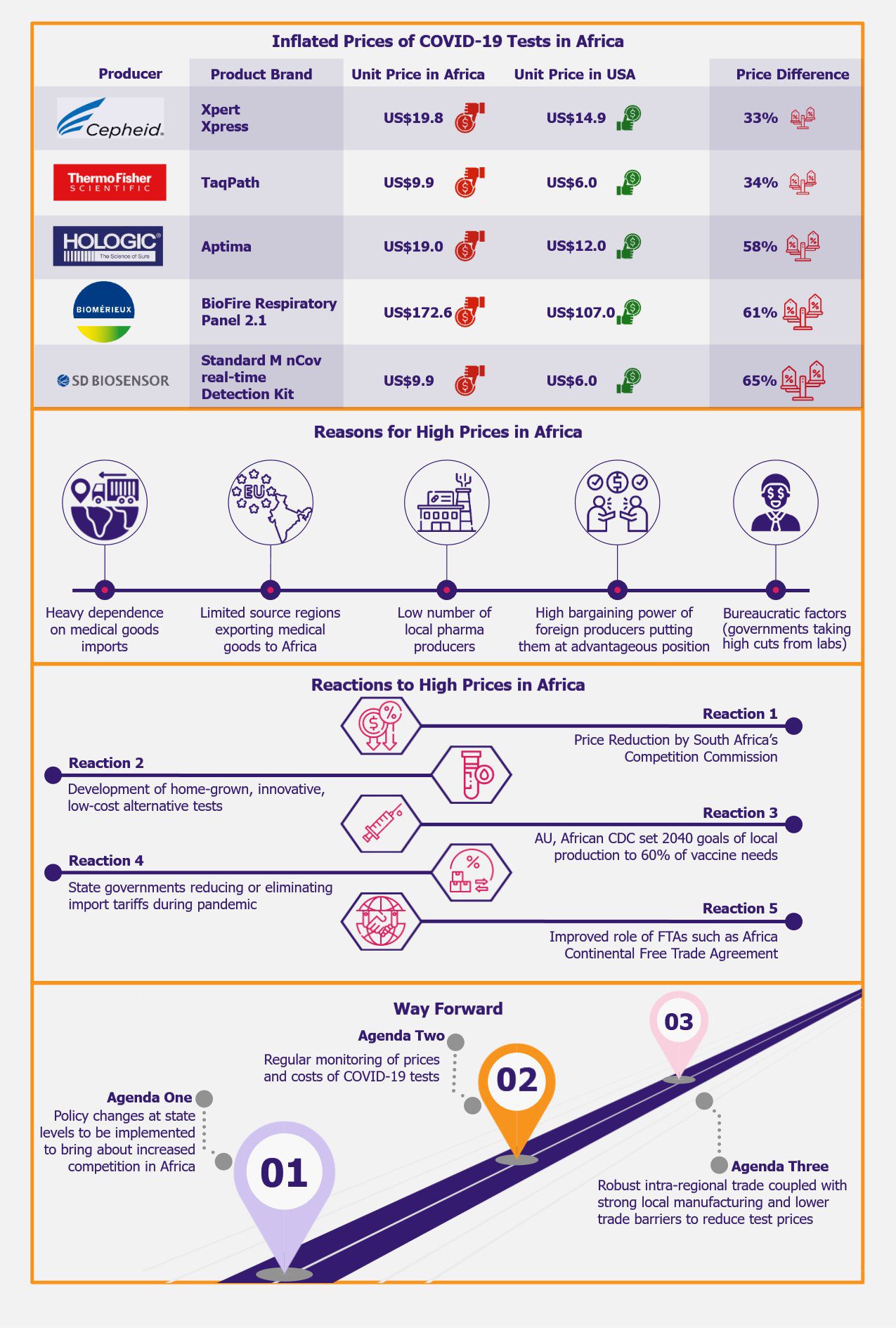

High test prices across Africa, in comparison with prices in more developed parts of the world, such as the USA, have become evident after the onslaught of COVID-19 on the African continent. To illustrate this with an example, the average selling price of SD Biosensor’s STANDARD M nCoV Real-Time Detection kit comprising 96 tests per kit in the USA is US$576 compared to US$950 in African countries. This translates to a unit price of US$6 in the USA compared to US$9.9 in African countries, amounting to a 65% difference between the price points in the two regions. The price disparity in Africa vis-à-vis the USA ranges from +30% to over +60% in the case of PCR-based COVID-19 tests in our sample when compared to the prices of the same products that are being sold in the USA. This leads to the crucial question of why these tests are so costly in a place where they should be sold at a lower price, if not donated, owing to the continent’s less fortunate economic standing.

The Why: Reasons for inflated price in Africa

Several factors, such as Africa’s heavy dependence on medical goods imports, a limited number of source countries exporting medical goods to the continent, paucity of local pharma producers, higher bargaining power of foreign producers enabling them to set extortionate prices, shipping and storage costs, and bureaucratic factors drive the inflated prices of COVID-19 test kits in African countries.

Africa is heavily dependent on imports for its diagnostic, medicinal, and pharma products. To elucidate this, all African countries are net importers of pharma products. Additionally, the imports of medicines and medical goods, such as medical equipment, increased by around 19% average annual growth rate during the span of 20 years, from US$4.2 billion in 1998 to US$20 billion in 2018.

In 2019, medical goods accounted for 6.8% of total imports in Sub-Saharan Africa (SSA), whereas they accounted for only 1.1% of exports. The SSA region experiences a varied dependence on the imports of medical goods. This is evident from the fact that Togo and Liberia’s share of imports of medical goods was around 2%, while that of Burundi was about 18% in 2019.

The 2020 UNECA (United Nations Economic Commission of Africa) estimates suggest that around 94% of the continent’s pharma supplies are imported from outside of Africa, and the annual cost is around US$16 billion, with EU-27 accounting for around 51% of the imports, followed by India (19%), and Switzerland (8%). This means that only 6% of the medicinal and pharma products are produced locally in the African continent, creating a situation where foreign producers and suppliers have drastically higher bargaining power.

This became particularly evident during the 2020-2022 COVID-19 pandemic, when the demand for COVID-19 tests was extremely high compared to the supply of these tests, making it easier for foreign suppliers to set an exploitative price for their products in the African continent.

The lack of competition and differentiation in the region aggravated the situation further. There are only a handful of suppliers and producers in the continent that provide COVID-19 tests. To elucidate this further, there were only 375 pharmaceutical producers in the continent as of 2019 for a population of over 1.4 billion people. When compared with countries with similar populations, such as India and China, which have around 10,500 and 5,000 pharmaceutical companies, respectively, the scarcity in the African continent starts to manifest itself more conspicuously. To illustrate this further, only 37 countries in Africa were capable of producing medicines as of 2017, with only South Africa among these 37 nations able to produce active pharmaceutical ingredients (APIs) to some extent, whereas the rest of the countries had to depend on API imports.

Furthermore, the SSA region gets medical goods supplies from a small number of regions, such as the EU, China, India, the USA, and the UK. As of 2019, over 85% of the medical goods that were exported to SSA were sourced from these five regions. It is interesting to note that the source countries slightly differ for the SSA region and the African continent as a whole, with the EU and India being the common source regions for both. With a 36% share in all medical goods imports to the African continent in 2019, the EU is the top exporting region of medical goods to SSA, albeit with a declining share over the last few years. India and China share the second spot with a 17-18% share each in all medical goods imports supplied to SSA in 2019. Considerable concentration is observed in the import of COVID-19 test kits to SSA, with a 55% share in all medical goods imports supplied by the EU and a 10% share by the USA in 2019.

To provide a gist of how the above-mentioned factors attributed to the inflated prices of COVID-19 tests in the region, Africa’s medical goods industry, being import-driven, is heavily dependent on five regions that supply the majority of the medical goods needs of SSA. In addition to this, the scarcity of local pharma producers across the continent aggravated the situation further. This, in turn, gave an opportunity for foreign producers to charge a higher price for these COVID-19 tests in Africa.

Additionally, storage and shipping costs of COVID-19 tests also play a significant role in the pricing of these tests. The actual share of shipping and storage costs is difficult to gauge owing to the fact that there is not enough transparency in disclosing such pieces of information by test producers and suppliers.

Another aspect contributing to the inflated prices of these tests in African countries is bureaucratic factors. According to Folakunmi Pinheiro, a competition law writer based in Cambridge, UK, some African state governments (such as in Lagos) take exorbitantly high cuts on the sale of COVID-19 tests, allowing labs to keep no more than 19-20% of the profits per test after covering their overhead costs such as electricity, IT, logistics, internet, salary, and consumables costs including PPE, gloves, face masks, etc.

Since labs in Africa must purchase these tests from foreign producers, they have limited room for maneuvering with their profit margin, given the high test price and the cuts imposed by the local governments. Pinheiro further simplifies the profits in absolute terms. The cost of a PCR-based COVID-19 test, analyzed in laboratories (not at-home tests), in Lagos in February 2022 was around NGN45,250 (~US$57.38), and the labs selling and performing these tests on patients would make a profit of around NGN9000 (~US$11.41) per test which translates to 19.89% of the total cost of the single test. It is believed that this profit is after the overhead costs are covered, implying that the majority of the profits go to the state government of Lagos.

The What Now: Reactions

To combat the inflated prices of COVID-19 tests developed by foreign producers, many African price and competition regulatory organizations undertook efforts to reduce the prices of these tests to a significantly lower level in their respective countries. While R&D was ongoing for the making of groundbreaking low-priced alternative testing technologies that were ideal for African climate and economic conditions, many academic institutes tied up with foreign companies to launch these tests in the African markets. Additionally, the African Union (AU) and Africa CDC had set new goals to meet 60% of the vaccine needs of the continent domestically by fostering local production by 2040. Lastly, many African countries were able to eliminate or reduce import tariffs on medical goods during the pandemic for a considerable amount of time.

- From price or competition regulatory bodies

As a response to the high PCR-based COVID-19 test prices in South Africa, the country’s Competition Commission (CCSA) was successful in reducing the prices for COVID-19 testing in three private laboratories, namely Pathcare, Ampath, and Lancet by around 41%, from R850 (~US$54.43) to R500 (~US$31.97) in January 2022. The CCSA asked these private clinical laboratory companies for financial statements and costs of COVID-19 testing as part of the investigation that started in October 2021. CCSA further insisted on removing the potential cost padding (an additional cost included in an estimated cost due to lack of sufficient information) and unrelated costs and thus arrived at the R500 (~US$31.97) price. Furthermore, the CCSA could significantly reduce the price of rapid antigen tests by around 57% from R350 (~US$18.96) to R150 (~US$8.12). However, it is believed that there was still room for further reduction in rapid antigen test price because the cost of rapid antigen tests in South Africa was around R50 (US$2.71). Although the magnitude to which this price reduction was possible is hard to analyze owing to the fact that there was not enough transparency in revealing the cost elements by these test producers.

- From local producers, labs, and academia-corporate consortia

The fact that Africa is a low-income region with lower disposable income compared with affluent countries, in addition to its unfavorable climate, has driven local scientists to develop alternative, low-cost testing solutions with faster TAT and minimal storage needs.

African scientists were believed to have the potential to develop such cheaper COVID-19 tests, having had the necessary know-how gained through the development of tests for diseases such as Ebola and Marburg before. The high prices of COVID-19 tests in the African markets have compelled local universities to tie up with some foreign in-vitro diagnostic (IVD) producers to develop new, innovative, low-cost, alternative technologies.

To cite an example, the Senegal-based Pasteur Institute developed a US$1 finger-prick at-home antigen test for COVID-19 in partnership with Mologic, a UK-based biotech company. This test does not require laboratory analysis or electricity and produces results in around 10 minutes. This test was launched in Senegal as per a December 2022 publication in the Journal of Global Health. Although this test’s accuracy cannot match the high-throughput tests developed by foreign producers, the low-cost COVID-19 tests proved to be useful in African conditions where large-scale testing was the need of the hour and high-temperature climate was not conducive to cold storage of other types of tests.

Countries such as Nigeria, Senegal, and Uganda tried to increase their testing capacity with their homegrown low-cost alternatives as the prices of the tests developed by foreign manufacturers were exorbitantly high. Senegal and Uganda stepped up to produce their own rapid tests, while in remote areas of Nigeria, field labs with home-grown tests were set up to address the need for COVID testing that remained unaddressed because of the high prices of the foreign tests.

Dr. Misaki Wayengera, the pioneer behind the revolutionary, low-cost paper strip test for rapid detection of filoviruses including Ebola and Marburg with a TAT of five minutes, believes that a low-cost, easy-to-use, point-of-care (POC) diagnostic test for detecting COVID-19 is ideal for equatorial settings in Africa providing test results within a shorter time span while the patient waits. He spearheaded the development of a low-cost COVID-19 testing kit with a TAT of one to two minutes, along with other Ugandan researchers and scientists.

- From the African Union and CDC Africa

As an aftermath of the adversities caused by the COVID-19 pandemic, the African Union (AU) and African Centers for Disease Control and Prevention (CDC Africa) put forth a goal of producing 60% of Africa’s vaccine needs locally by 2040. A US$ 45 million worth of investment was approved in June 2023 for the development of vaccines in Africa under the partnership of Dakar, Senegal-based Pasteur Institute (IPD), and Mastercard Foundation. The goal of MADIBA (Manufacturing in Africa for Disease Immunization and Building Autonomy) includes improving biomanufacturing in the continent by training a dedicated staff for MADIBA and other vaccine producers from Africa, partnering with African universities, and fostering science education amongst students in Africa.

Additionally, the US International Development Finance Corporation (DFC), in partnership with the World Bank Group, Germany, and France, announced in June 2021 a joint investment to scale up vaccine production capacity in Africa. The investment was expected to empower an undisclosed South African vaccine producer to ramp up production of the Johnson & Johnson vaccine to over 500 million doses (planned by the end of 2022).

- From FTAs such as the Africa Continental Free Trade Agreement

Intra-regional trade within Africa (as opposed to overseas trade) from 2015 to 2017 was only 15.2% of total trade, compared to 67% within Europe, 61% within Asia, and 47% within the Americas. While supply chain disruptions hampered the availability of COVID-19 testing kits, many African nations could develop home-grown solutions locally to address the issue. Africa Continental Free Trade Agreement (AfCFTA) was set up on January 1, 2021, with the intention of improving intra-regional trade of goods, including medical supplies. AfCFTA, the largest FTA after WTO, impacts 55 countries constituting a 1.3 billion population in an economy of US$3.4 trillion. Inadequate intercontinental collaboration is one of the primary restraints for medical supply chains. In order for health systems to fully capitalize on AfCFTA, partnerships with the African Union’s (AU) five Regional Collaborating Centers and current global healthcare organizations need to be increased.

- From state governments

Sub-Saharan African countries have the highest MFN (most favored nation) tariff rate (9.2%) on medical goods, compared to developed nations’ tariffs (1.9%) as well as emerging economies’ tariffs (6.6%). However, out of 45 countries in Sub-Saharan Africa, only eight countries could remove or decrease import tariffs and value-added taxes on medical goods on a temporary basis to aid the public health situation during the pandemic in 2020, as per Global Trade Alert. These eight countries include Angola, Chad, Malawi, Mauritius, Niger, Nigeria, South Africa, and Zambia. In three of these eight countries, these measures had already expired as of April 2021. Furthermore, to promote intra-regional trade, 33 Sub-Saharan African countries provide preferential tariff rates of around 0.2% on average on some medical products. At the same time, the average MFN tariff rate for the same medical goods is around 15% for these Sub-Saharan African countries.

EOS Perspective

Since the demand for COVID-19 test kits was significantly higher compared to their supply, producers and suppliers had a higher bargaining power, because of which they set an extortionate price. However, that being said, African competition authorities did their best to curb the prices, although there was still room for more.

Secondly, policy changes need to be brought about at the state level to allow increased competition in the African markets, which in turn would lower the price of the tests. African governments need to consider a more patient-centric and consumer-protective approach wherein competition is likely to facilitate the launch and consequent market uptake of better-quality products available at lower prices.

Additionally, prices and costs of COVID-19 tests should be monitored on a regular basis. The underlying problem of inflated COVID-19 test prices is likely to cease only when competition in the PCR testing sector is encouraged, and government policies of pricing the tests are more patient-oriented.

Moreover, robust intra-regional trade coupled with strong local manufacturing and lower trade barriers is expected to help build Africa’s more sustainable health system.