Thailand has a well-developed healthcare system, as compared with most of the Asian countries. Majority of the health-related Millennium Development Goals (MDG) have been achieved, though a rapidly ageing population and the burden of non-communicable diseases remains a challenge for the public healthcare system. A better disease prevention mechanism, health promotion, and adequate primary care are some of the priorities of the Thai government in the healthcare sector.

This article is part of a series focusing on universal healthcare plans across selected Southeast Asian countries. The series also includes a look into the plans in The Philippines, Cambodia, Vietnam, Indonesia, and Thailand.

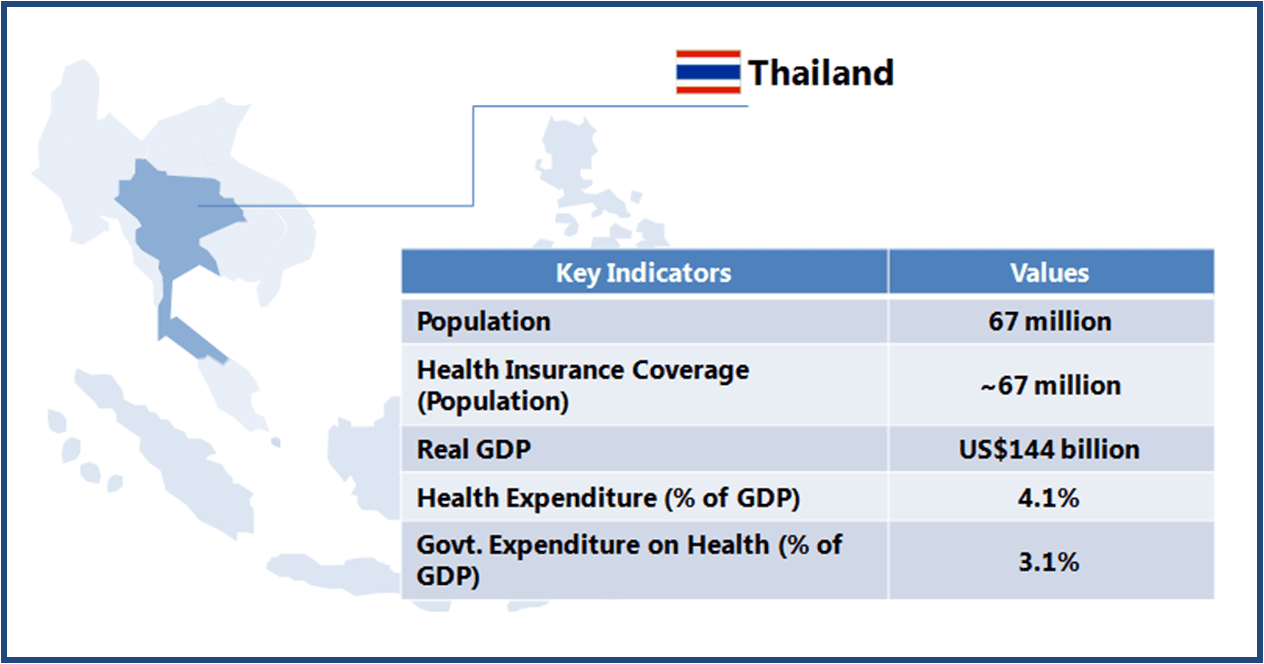

Thailand achieved Universal Healthcare Access (UHA) status in 2002 with the launch of health insurance benefits for 30% of the population that was outside the health insurance ambit till then.

Thailand boasts of world class medical facilities (especially in the private healthcare sector), and is among the world’s largest medical tourism markets. The government is looking to further develop Thailand into an “International Health Center for Excellence” under its second strategic five-year plan (2012-2016).

Thailand boasts of world class medical facilities (especially in the private healthcare sector), and is among the world’s largest medical tourism markets. The government is looking to further develop Thailand into an “International Health Center for Excellence” under its second strategic five-year plan (2012-2016).

The plan focuses on four major areas: medical services, integrative wellness centers, development of Thai herbs, and traditional and alternative Thai medicines.

With almost 100% population already covered by UHA, and a reasonably developed healthcare infrastructure in place, the government’s focus is likely to be on improving the quality of healthcare services. This will create opportunities for the companies operating in the healthcare industry.

| INFRASTRUCTURE |

| Key Stakeholders |

|

| Healthcare Service Delivery |

|

| KEY CHALLENGES |

Unequal Distribution of Services

Duplication of Efforts

|

| DESIGN |

| Beneficiary Classification |

|

| Healthcare Insurance Financing |

|

| Payment System |

|

| Benefits |

|

| Co-payment (Reimbursement) System |

|

| Reimbursement System for Drugs |

|

| KEY CHALLENGES |

Absence of Unified Scheme

Funding Constraints

|

Opportunities for Healthcare Companies

Healthcare Service Providers

-

Thailand has a better (as compared with most of the countries in Asia) developed healthcare system with a majority of the healthcare services being delivered by the public network. At present, it appears limited scope for the private providers, as they also are mostly concentrated in the urban centres while there is a greater need (at least at primary and secondary level) in non-urban areas

-

However, private providers can look for collaboration opportunities in areas/aspect that add value to pre-existing service set-up. For example in the field of mobile healthcare, telemedicine etc.

Medical Device Manufacturers

-

There is significant growth potential for the medical device companies, as the country’s universal healthcare system continues to support healthcare initiatives. Demand for medical devices is further anchored by the government’s efforts to develop the country into an Asian medical hub

-

Public hospitals continue to be the main user of medical equipment. Opening of new health facilities would also create demand for equipment and devices

Pharmaceuticals Companies

-

The government encourages the use of drugs listed in the National List of Essential Medicines, all of which are fully reimbursed by the three major public health insurance schemes

-

However, the government may review health expenditure pattern and reimbursement policies amid changing demographic profile (i.e. more senior citizens) leading to increased focus on cost-effective healthcare services. This may create better opportunities for generics and low-cost drugs

A Final Word

Thailand’s UHA scheme has largely been a success, and a model for other countries to follow. The scheme provides coverage to a large informal sector, which is a challenging task in itself. The benefit package, which includes curative as well as preventive services, is comprehensive.

The country has demonstrated efficiency in UHA implementation with satisfactory outcomes in terms of meeting healthcare needs of the society, and in attempts towards offering equitable health. A relatively better developed healthcare network and relevant administrative experience helped in achieving the desired results.

Leaving behind the past successes, UHA would be required to gear-up for the challenges ahead. For instance, the country needs to plan for changing disease profile i.e. an increased burden from Non-communicable Diseases (NCDs). This may have cost implications for UHA (and opportunities for the healthcare industry participants) in terms of accommodating suitable interventions and planning for adequate preventive measures at primary, secondary, and tertiary care level. It is expected that the country will witness more activity with respect to qualitative improvement in healthcare services, as compared with geographical expansion of services.

A comparative with other countries in the region should provide a better perspective on the actual potential of Thailand as a prospective destination for devices and drugs companies alike.