Precision and personalized care are becoming the keys to unlocking better patient care in modern medicine. With personalized medicine image-guided therapy (IGT) systems offering physicians better control over therapy decisions, the healthcare industry hopes discomfort and uncertainty will give way to reliability and healing.

IGT enhances surgical precision and treatment management

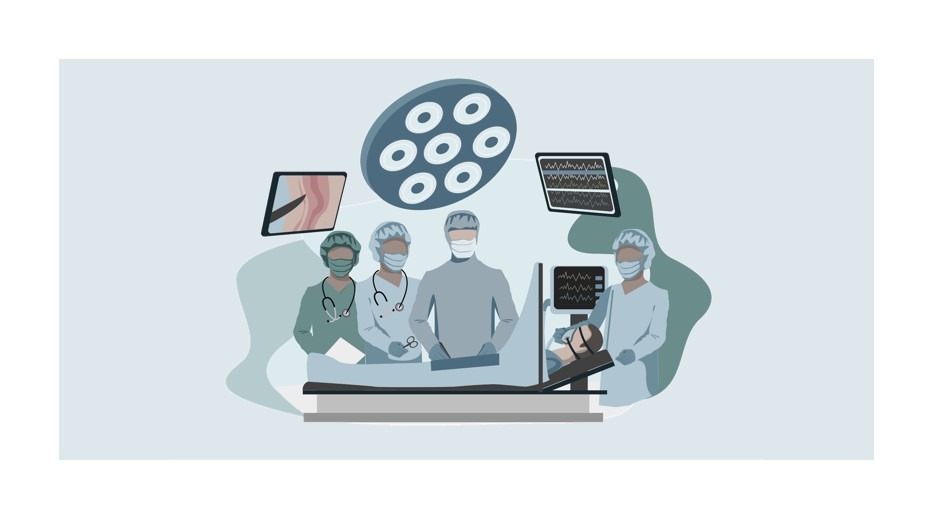

IGT is an approach that uses various imaging technologies to plan, perform, and evaluate surgical procedures and treatments. There are two main groups: traditional surgeries enhanced by imaging technology and newer procedures that use imaging and specialized instruments to treat internal organs and tissues without surgery.

The IGT systems, such as Dutch Philips’ Azurion and American Varian’s Halcyon, help improve minimally invasive procedures by offering real-time imaging support during interventional techniques, especially in cardiology and oncology. They also aid in precise navigation and treatment delivery.

Azurion’s IGT system offers various clinical suites, including Coronary, Onco, and Neuro suites, tailored to a particular surgery. This customization can make a surgeon’s work easier. Many IGT systems also integrate with hemodynamic systems and similar interventional tools that give surgeons more information.

On the other hand, advanced imaging platforms such as the 1788 visualization platform by US-based Stryker, TIVATO 700 by Germany-based Zeiss, and VISERA ELITE II by US-based Olympus specifically work in open surgical settings, providing high-definition imaging that enhances visibility during more invasive procedures.

IGT employs imaging modalities and technological innovations for disease management

The most commonly used imaging modalities in IGT are X-rays, ultrasound, MRI, and CT scans, which provide detailed cross-sectional images of the body. Other supporting technologies include angiography, ultrasound, tracking tools, surgical navigation systems, and integration software.

IGT also offers invaluable insights into disease diagnosis and management of minimally invasive procedures. Significant advancements have been made in this field in recent years owing to developments and integration of innovations such as artificial intelligence (AI), big data, deep learning, sensor fusion, and advanced signal processing.

Personalized Image-Guided Therapy Medicine’s New Crystal Ball by EOS Intelligence

IGT and advanced visualization systems complement each other in cancer surgeries

Applying advanced visualization systems for open cancer surgeries adds a competitive aspect to the image-guided therapy landscape. Systems such as Stryker’s 1788 have the potential to be a viable option in low-resource environments or hybrid surgical settings. Such facilities may view it as a cost-effective and simpler substitute for comprehensive IGT systems for certain cancer surgeries.

The competition could also intensify in niche applications where minimally invasive tumor resection overlaps with interventional oncology. This is especially true for hospitals that aim for a one-stop surgical solution without high investment in IGT infrastructure.

However, the IGT systems have a different clinical role, being particularly effective in procedures such as catheter-based interventions or radiotherapy, where accurate imaging is extremely critical. Therefore, the competition may be nuanced, depending on the specific surgical approach, as the two technologies could also complement each other by providing tailored solutions for distinct surgical techniques and scenarios.

IGT sector is rapidly growing in minimally invasive and specialized procedures

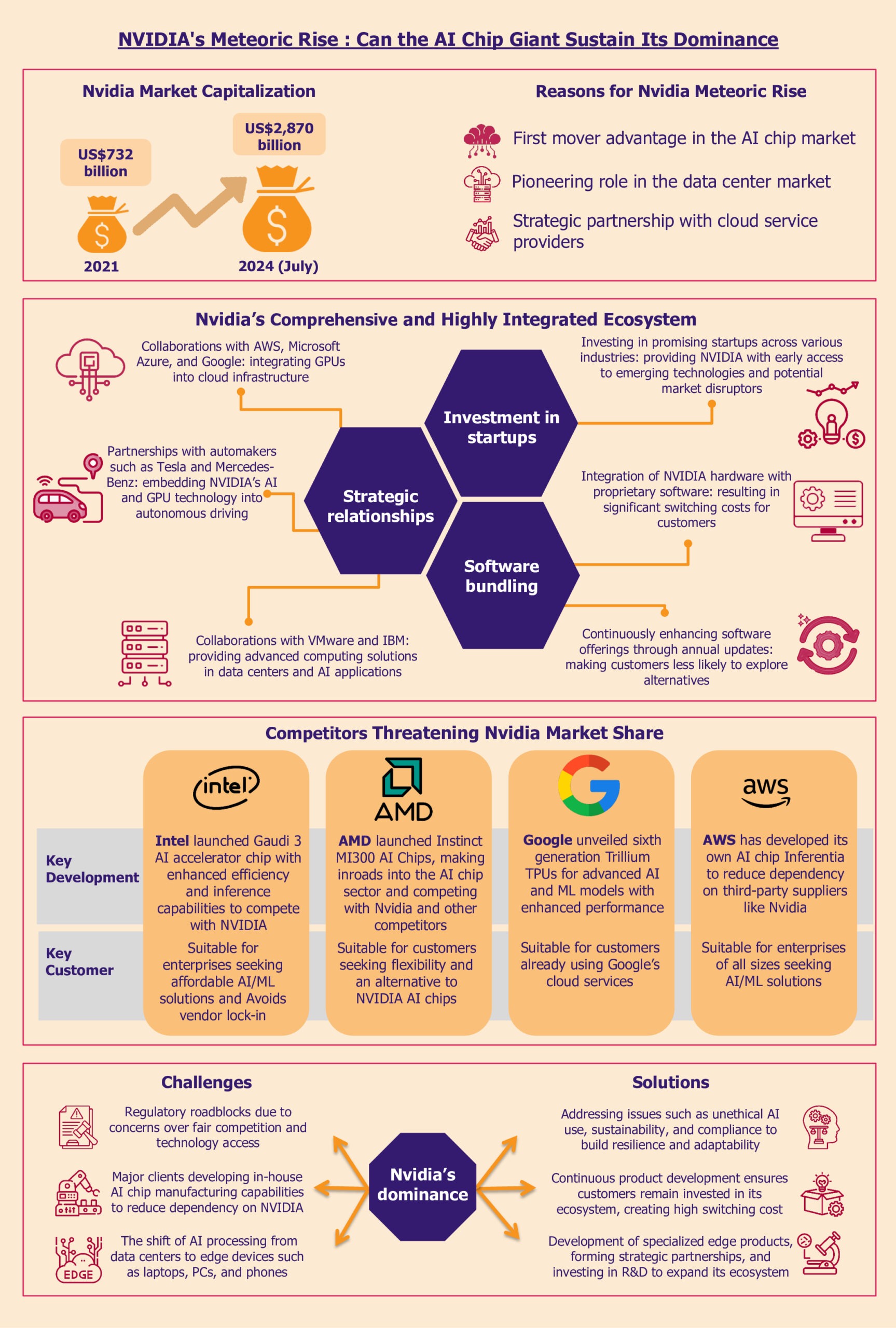

The IGT market has seen rapid development, especially in the post-pandemic era. The global IGT systems market was US$5.5 billion in 2023 and is estimated to reach US$8.9 billion by 2032, according to an India-based market research firm, IMARC. The company also forecasts the market to grow at a CAGR of 5.4% from 2024 to 2032.

Several factors drive this growth, including IGT’s ability to offer better health outcomes in treating severe conditions such as cancer, its application in treating old age-related conditions, such as stroke and vessel blockage, and the surge in demand for minimally invasive procedures.

Rising cancer cases are boosting sector growth

The American Cancer Society estimates that approximately 20 million new cancer cases were diagnosed, and 9.7 million people died from cancer worldwide. The number of cancer cases is expected to reach 35 million by 2050. The high prevalence of cancer has increased the need for innovative treatment options with limited damage to healthy cells. Oncologists and patients are now opting for IGT, such as image-guided surgeries and radiotherapy, to treat cancers, including severe and complex ones.

For example, hepatocellular carcinoma, the most common liver cancer, is a challenging disease to treat. A 2010 study published in Insights into Imaging, a peer-reviewed open-access journal, indicated that due to the advanced stage of the disease at diagnosis and limited donor availability, only 10–15% of HCC patients are eligible for surgical resection or liver transplantation. Surgical options are primarily reserved for patients with solitary, asymptomatic HCC and well-preserved liver function without significant portal hypertension or elevated bilirubin levels. Also, systemic chemotherapy has largely been ineffective for HCC.

Image-guided procedures can offer doctors detailed imaging data to aid diagnosis, patient risk assessment, and treatment planning during the early detection stages. Image-guided catheter-based techniques are used for treating larger lesions or more extensive liver involvement seen in intermediate-stage HCC, and ablative procedures are employed for early-stage HCC.

Minimally invasive image-guided therapies can also extend survival, preserve more healthy liver tissue (crucial for cirrhotic patients), allow for potential retreatment, and serve as a bridge to transplantation.

Growing geriatric population is also contributing to sector expansion

The rising geriatric population is also driving the need for image-guided therapies. UN estimates there were 761 million people aged 65 or older globally in 2021. This number is expected to rise to 1.6 billion in 2050. Age is a significant factor in determining the likelihood of developing serious conditions such as cancer. According to the National Cancer Institute (NCI), the average age of individuals diagnosed with cancer is 66, indicating approximately half of all cancer cases are diagnosed in people aged 66 and older.

Older people are also at a higher risk of suffering from severe post-procedural complications, especially in the case of invasive surgeries. IGT-supported therapies, especially minimally invasive surgeries, can help doctors treat geriatric patients with limited adverse effects.

Advancements in minimally invasive procedures and cancer radiotherapy are on the rise

The rising demand for minimally invasive procedures is another factor driving the increasing adoption of IGT systems. A 2015 study published in JAMA Network, an open-access medical journal, indicated that minimally invasive surgeries have fewer postoperative complications, provide better outcomes, and reduce healthcare costs. This has prompted many physicians and patients to choose IGT system-based minimally invasive therapies in treating complicated conditions that may otherwise require longer hospital stays and repeat visits.

The growing number of developments in cancer radiotherapy is also an important factor propelling the IGT market forward. AI in radiation therapy enhances the accuracy and precision of treatment. In image-guided radiotherapy (IGRT), AI-based algorithms are used to analyze images taken during treatment and make adjustments to the treatment plan in real time. This enables clinicians to target tumors with greater precision, reduce the amount of irradiated healthy tissue, and improve treatment outcomes.

Several premier institutions, such as Cancer Research UK, London-based Medical Research Council (MRC), and US-based Stanford Medicine, are involved in cancer radiotherapy research to develop cancer imaging, diagnostics, and minimally invasive treatment platforms. With the radiotherapy market will likely reach US$12.51 billion by 2029, according to a 2024 report by India-based market research firm Mordor Intelligence, these efforts can contribute to the growth of the IGT sector.

IGT therapies allow for prompt and low-risk interventions

The introduction of IGT into personalized medicine has had a crucial impact on patient outcomes. IGT enables healthcare professionals to diagnose and treat serious conditions more rapidly. This prompt initiation of treatment reduces the risks associated with delayed interventions.

An example of an IGT system offering better treatment management is Philip’s Azurion Lung Edition, a 3D imaging and navigation platform that streamlines the diagnosis and treatment of lung cancer. The system combines tableside CT-like images with real-time X-ray guidance and advanced tools to support guided procedures. It is specifically designed for bronchoscopy procedures and enables clinicians to perform minimally invasive biopsy and lesion ablation in a single procedure. This reduces the need for additional procedures and speeds up diagnosis.

IGT systems also offer a precise, real-time visualization of the therapy site, enabling highly targeted interventions. This level of accuracy can minimize complications and failures during procedures. For example, IGRT used in cancer treatment enables oncologists to target tumors while sparing healthy tissues precisely, reducing side effects and boosting treatment success rates. Surgeons also better comprehend spatial relationships between the tumor and vital organs or blood vessels when they can access high-resolution images highlighting the essential structures during the procedure.

Minimally invasive nature of IGT therapies minimizes complication and disability risks

IGT procedures are minimally invasive in nature. This reduces the trauma caused by the procedure, reducing the risk of complications. Patients can recover faster from IGT procedures, reducing hospital stays and lowering the likelihood of hospital-acquired infections and other potential complications. A 2022 study published in the National Library of Medicine’s (NLM) online portal indicated that image‐guided procedural techniques reduce risks, prompt faster recovery, and shorten hospital stays.

IGT’s minimally invasive nature also reduces the risk of disability post-treatment. In the case of complicated surgeries such as brain tumor removal, surgeons use techniques such as intraoperative MRI (iMRI) to get a detailed map of the tumor and surrounding brain structures before and during surgery. This allows for more precise resection of the tumor and reduces the risk of injury to critical brain areas, thereby lowering the possibility of neurological damage and associated disabilities. A 2014 article published in NLM’s online portal indicated that using iMRI improved surgical outcomes, including increased tumor resection and survival rates and decreased risk of neurological deficits.

IGT systems offer interventional tools supporting surgeons in complex procedures

Advanced IGT systems now come with integrated interventional tools, which can be especially beneficial during complex or delicate procedures. For example, Azurion, an IGT platform developed by Philips, has interventional tools integrated into the imaging system. It offers procedure cards that allow clinicians to pre-program routine tasks and preferences, as well as an interface for performing various procedures in interventional labs.

Integrations such as these can help surgeons make informed and data-driven decisions during procedures, allowing them to make mid-procedure adjustments. Such flexibility is crucial, particularly in complex surgeries or when treating conditions such as cardiovascular diseases.

Development high costs and cybersecurity issues hinder adoption

Despite offering numerous benefits to patients, the developers of IGT systems face several challenges.

Huge R&D costs and market competition are impacting new players

The significant financial burden of research and development in this field is one major obstacle for companies, especially newer ones entering the market with limited budgets. Developing advanced imaging technology that seamlessly integrates with therapeutic tools requires substantial investments in software and hardware.

Also, these systems require continuous refinement to ensure optimal accuracy and adaptability, as they must be able to accommodate diverse patient anatomies and conditions. This is a time-consuming and costly process. Consequently, only established companies with significant R&D budgets may be able to compete in the market.

Not just the R&D budget but also leading players’ brand equity is a significant challenge for new players trying to enter the IGT systems market. The newer entrants face intense competition from established players such as Philips, GE Healthcare, and Siemens. These companies have been in the market for years and have a strong foothold in terms of market share and brand recognition. This can make it challenging for new players to establish themselves in the sector, limiting innovation and market growth.

New companies can attempt to tackle this and make inroads into the market by forming partnerships with hospitals and public health initiatives to drive the adoption of their IGT systems.

High upfront costs are affecting the widespread adoption of IGT devices

The IGT devices’ market prices reflect the high R&D costs. Almost all IGT systems have high upfront costs. For example, an interventional radiology suite can cost anywhere between US$1 million to over US$3 million, depending on its sophistication. This can make acquiring and implementing IGT systems prohibitively expensive for many healthcare providers, particularly smaller or publicly funded organizations.

While healthcare providers can pass on the cost to patients, it can also cause many other challenges. Even with insurance coverage, some patients may not be able to afford certain procedures or treatments when the out-of-pocket expenses are significant. Consequently, this can reduce the overall demand for IGT devices, negatively impacting sales for manufacturers.

Companies can try tackling this issue by offering price flexibility and discounts for large orders or entering into long-term contracts with healthcare providers to help maintain demand. They may also offer leasing or subscription-based payment models instead of selling devices outright. This could encourage purchases by healthcare providers, allowing them to spread out the costs over time and lighten the upfront financial burden on patients.

Cybersecurity challenges are threatening patient care and security

Another significant challenge in adoption is cybersecurity and data management issues. A 2024 fact sheet by the US Office of the Director of National Intelligence indicated that there has been a 128% increase in healthcare ransomware attacks in 2023 over 2022 in the USA. As a result of these attacks, American hospitals have faced disruptions to medical procedures, patient care, and operations, including delayed procedures, diverted patients, rescheduled appointments, and strained acute care provisioning.

IGT systems generate and store vast amounts of imaging and procedural data on the cloud. Any security breach can lead to privacy leaks and misuse of patient data. Attackers can also maliciously embed images or reports and manipulate medical images, thereby delaying procedures and patient care and causing loss of life. This complexity often leads to hesitation in adoption, particularly for institutions that lack the necessary IT infrastructure.

Many companies are addressing this issue by creating devices with secure design and in-depth defense approaches. An example is Philip’s Azurion, which offers a six-layer protection to combat cyberattacks.

EOS Perspective

IGT systems promise to improve patient outcomes and revolutionize healthcare in the long run, particularly in treating serious medical conditions such as cancer. While there are some challenges to address in order to strengthen widespread adoption, with rapid developments underway in technologies such as AI and augmented reality, IGT can play a greater role in disease treatment in the coming years.

Currently, studies are underway using AI and machine learning to predict the response to minimally invasive image-guided therapies. Similarly, AI-based algorithms are also being developed to monitor tumor motion, reduce treatment uncertainty, and improve treatment precision.

One promising direction new entrants can push for is more portable and cost-effective IGT solutions. Research to miniaturize imaging devices and develop affordable hardware could make IGT systems more accessible to a broader range of healthcare providers, even those in remote areas, thereby expanding the market. Also, as costs come down and standardization improves, hospitals and clinics of varying sizes will be more likely to invest in IGT technologies.

In the short term, larger, well-funded players are likely to continue to lead the way in adopting and refining IGT systems. These companies have the resources to invest in technology and training, enabling them to push the boundaries of personalized medicine. However, as the technology matures and becomes more affordable, smaller players will increasingly be able to capture a market share.