629views

As various countries across the globe are aiming to reduce their dependency on petroleum and tap into comparatively cheaper sources of energy, policy makers are looking at electro-mobility as a way to address energy supply issue in the future. Electro-mobility or e-mobility refers to the concept of using electricity-driven vehicles (also known as electric vehicles) and hybrid vehicles, in order to reduce the dependency on fuel-driven automobiles, while also reducing carbon emissions. Policy makers are focusing on de-carbonization of public transport which is expected to tackle environmental issues such as air pollution, particularly in densely populated regions. Even though consumers remain skeptical about passenger electric vehicles, electrification of public transport adoption rate is stirring at a much faster pace. Being on the fringe for so long, emission-free electric buses and taxis are finally gaining popularity and are being considered the epitome of sustainable transportation. In addition, the infrastructure to support e-mobility, such as battery-operated vehicles and charging stations, is becoming affordable and easier to adopt across the globe.

The electrification and hybridization of transit buses is anticipated to become a global phenomenon by 2020, backed by lower operation costs, tax subsidiaries, strict emission laws, and cash incentives. Hybrid buses are expected to attain a global penetration rate of 9.7% by 2020, while electric buses are likely to reach 5.7% penetration. Leading global manufacturers of hybrid and electric buses (such as Zhengzhou Yutong Group, BYD, Volvo, Zhongtong Bus, Proterra, etc.) have been working on making these buses more attractive with regards to both capital and operational costs. Constant efforts are being made to lower battery cost and increasing battery life.

Various developed as well as developing countries across the globe have already initiated the adoption of hybrid and electric buses and other public transportation, in order to cut down on fuel consumption and carbon emissions.

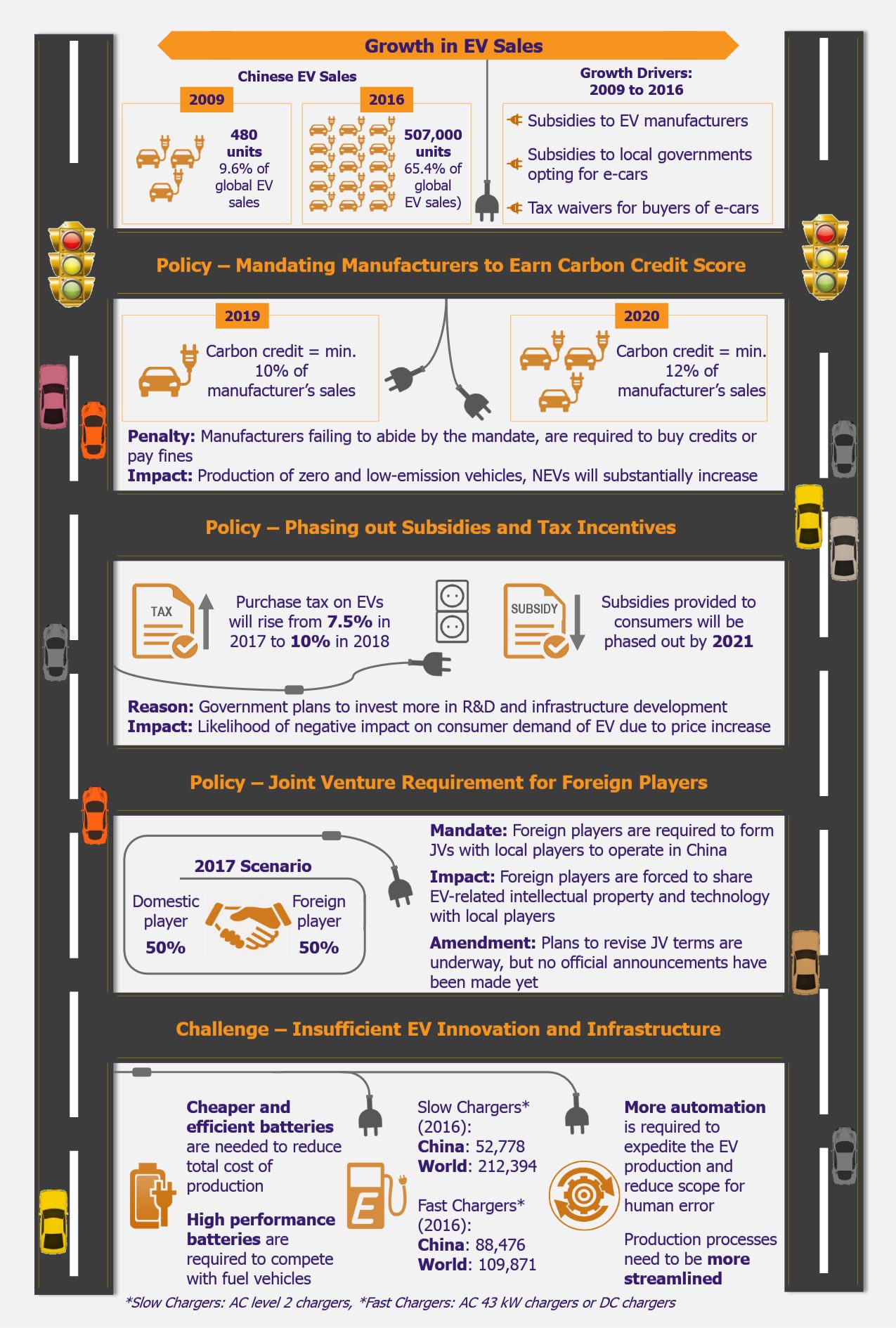

CHINA

The electrification of public transport has been gaining popularity in China. The Chinese government has initiated several programs, pilot projects, and R&D activities to replace conventional public transportation vehicles with electric vehicles. In 2015, cars, which had been registered before 2005 and were considered to emit excessive pollutants, were removed from the Chinese roads. The owners of such vehicles received subsidies for the purchase of more environmentally friendly cars. The government has allocated approximately USD 1 trillion for electric buses during 2015-2030, in hopes that this will help in lessening the monetary impact from air pollution by more than USD 22.5 trillion in the same period. Such an investment is likely to make electric buses account for 70% of total buses in China by 2020, marking a huge step forward in government-led electric vehicles market.

With a view to encourage the development of electric taxis, the government announced its Electric Taxi Project in 2010 which aimed at introducing 500,000 electric taxis in Shenzhen by 2015. Despite being a promising initiative, the project showed little success due to the lack of charging stations and vehicles’ long charging time. On the other hand, a similar model introduced in Beijing in 2014 was more successful and fueled the addition of a host of electric taxis in the city, along with the development of EV parking lots and fast charging points. With the effective implementation of this venture, the government decided to kick start the Electric Taxi Project in Shenzhen again in 2015, under which taxi operators were offered cash subsidies, along with a 10-year operating license to replace petrol-driven taxis with electric vehicles.

Despite these initiatives, weak electric vehicle infrastructure is one of the key hurdles the country needs to overcome. The government has noticed this issue and steps are being taken to create a sound charging network across the country. The number of public charging piles in the country grew from around 1,100 units in 2010 to 49,000 units in 2015, representing a CAGR of 113.68%. To meet the charging demand of 5 million electric vehicles by 2020, the government has introduced incentive policies with an aim to build 4.8 million charging piles across China.

UK

UK has shown a fair share of commitment to freeing its cities from the harmful effects of fuel-driven vehicles. Efforts are being made by the island nation to promote sustainable public transportation. Transport for London (TfL) has announced its Ultra Low Emission Zone program to introduce 300 single electric/hydrogen deck buses and 3,000 double deck hybrid buses by 2020. The pilot phase of this project will be initiated in 2016 with the introduction of 51 electric buses across two routes in the city. China-based company Build Your Dreams (BYD), the largest manufacturer of pure electric buses, and UK-based Alexander Dennis Limited (ADL), the fastest growing bus builder, together, will be supplying these 51 buses for GBP19 million (USD 26.86 million).

Further, under the new plans by the London government, all hybrid taxis and buses will be able to switch to electric mode when entering certain polluted zones in the city. A ‘geo-fencing’ technology will be used for this purpose, which will allow vehicles to recognize a highly polluted area and switch to a ‘zero emission’ mode. By 2018, it will be mandatory for all new cabs to be electric/hybrid. Additionally, feasibility studies are being carried out as part of another GBP20 million (USD 28.28 million) government scheme for the introduction of plug-in taxis in various cities. The study focuses on finding solutions to reduce the upfront vehicle cost and develop charging infrastructure for taxis.

The UK’s innovative approach with emphasis on R&D for the promotion of sustainable transportation could potentially be a game-changing movement in its fight for an emission-free country.

INDIA

India is one of the few developing countries that has been paying attention to reducing carbon emission and tackling air pollution caused majorly by transportation. In 2013, the Indian government introduced The National Electric Mobility Plan 2020. The ambitious plan aims to create a paradigm shift in the country’s transportation industry, through a combination of policies intended at introducing 6-7 million electric/hybrid vehicles in the country by 2020. With a total outlay of INR 140 billion (USD 2.1 billion), the plan includes the acquisition of vehicles, development of infrastructure, R&D, etc. Under Phase I of the scheme, pilot projects have been initiated in metro cities, state capitals, and cities of the north eastern states. For instance, in Delhi, the plan intends to convert 150,000 diesel buses into electric buses in the first phase. In 2016, BMC (the Municipal Corporation of Greater Mumbai) announced its plans to convert 25-30 existing diesel buses into electric buses having received a grant of INR 1 billion (USD 1.5 million) for the project. In another project, the central government has sanctioned INR 5 billion (USD 7.5 million) to purchase 25 electric buses to operate in Himachal Pradesh state, especially to be operated between Manali and Rohtang Pass.

The plan also encouraged the promotion of electric three wheelers (e-auto rickshaw or e-tuktuk). Despite having proved to be a successful model in countries such as the UK, the Netherlands, and Italy, this type of vehicle was initially met with skepticism in India. However, over the past six years, it gained popularity and soon the roads in the capital witnessed a surge in the number of e-rickshaws (about 100,000 e-rickshaws by 2014). Various companies such as Bosch India, OK Play, and Kinetic Group have developed indigenous e-rickshaw prototypes with a view to tap into this INR 500 billion (USD 7.49 billion) industry. The Indian government has also shown support and is considering offering motor-vehicle tax exemption and credit on the purchase of e-rickshaws.

Despite the high initial cost of procuring these vehicles and implementing the plan, the absence of carbon emissions, reduction in idle motor energy loss at bus stops, and silent running of the vehicles are some of the strong arguments that could help pave the way in creating a sustainable public transportation system based on e-mobility in urban India.

E-Mobility in Public Transportation Faces a Set of Own Issues

Despite its numerous benefits, e-mobility in the public transportation sector comes with its own share of challenges. While lack of charging infrastructure and high cost of electric buses are the two key roadblocks to the smooth adoption of EVs, the industry faces several other challenges, such as limited funding availability (from states), service levels of EVs not matching up to those of conventional buses, demand charges levied by electricity providers resulting in higher operation cost, and significant impact on electricity grids.

Inadequate charging stations infrastructure is the key problem faced by various countries which are in the process of rolling out electric buses and taxis system that needs to rely on a solid charging infrastructure network to support public electric vehicles. A weak charging infrastructure not only limits the vehicle to short range commutes, but might also postpone the transformational shift to electric vehicles. For instance, Car2Go, Daimler’s electric car sharing rental launched in San Diego, USA in 2011, might switch its fleet from electric to gas due to a weak charging infrastructure available in the region. On an average, about 20% of the fleet remains unavailable due to the lack of electricity required for the car to be driven.

Another aspect that impacts the availability of a robust charging infrastructure especially for e-buses is the unavailability of adequate power source close to existing bus yards. Bringing power to the current yards/parking stations may require additional efforts and costs with regards to excavation, cabling, etc.

In addition, the cost of electric vehicles in the public transportation segment, particularly of electric buses, is considered very high. These buses cost almost 2-3 times more than conventional buses. The initial investment in electric buses seems massive vis-à-vis their diesel counterparts. This could prove to be a major hindrance as countries aiming for a sustainable public transportation system could easily switch from diesel buses to low emission gas buses, which are comparatively cheaper when compared with electric buses. For instance, Australian Tasmania’s public bus company considers the technology behind electric buses ‘too expensive and experimental’. An electric bus costs around USD 1 million, almost twice as much as the diesel-fueled bus. Thus, in order to reduce the environmental impact of diesel-fueled buses, the state is focusing on introducing gas-fueled buses whose prices range between USD 500,000 and USD 670,000 making them much less expensive than electric buses.

The problem of high purchase cost is paired by the issue of financing of electric vehicles, which is another hurdle to the widespread adoption of such buses. While the reduction of transportation CO2 emissions features as an important target for most governments and municipalities, stringent budgets and lack of funding often make these plans harder to achieve. For instance, in January 2016, Ireland-based Dublin Bus was refused funding for the lease of three trial hybrid buses costing EUR 900,000 by the National Transport Authority (NTA), due to lack of availability of funds. The rationale stated by the NTA for the refusal was that adding fewer hybrid buses in place of diesel buses (which are relatively cheaper) will result in lower number of public buses on the street, which in turn will translate into a significant rise in the number of car journeys, consequently leading to greater environmental damage. This Irish example might indicate that the adoptability of electric vehicles can only be successful in countries where the government is willing to make vast long-term commitment towards the purchase of electric vehicles for public use.

The challenges do not end there. While electric buses are considered to be more cost efficient with regards to operations, pure electric buses, in most cases as of now, are not capable of delivering a non-stop 18-hour service cycle that is achievable by most conventional buses, without stepping out of service for recharging their batteries. Moreover, most electric buses are currently not suitable for challenging environments (such as rural or hilly regions), which in turn limits their adoptability, while traditional buses have long been used in a great variety of terrains.

The operating cost advantage of electric buses is further impacted by the frequent application of ‘demand charges’ by electric utilities, especially in case of pilot/trial projects. For instance, in California, the application of demand charges increases the operation cost (which stands at about USD 0.25/mile without any demand charges for electric buses) by about USD 0.24/mile for one electric bus charging overnight and by USD 0.90/mile for one electric bus charging on-route. This significantly impacts the operating cost benefits that make electric buses attractive (the fuel cost per mile for diesel bus is approximately USD 1/mile). However, with the rise in number of electric buses, the demand charges can be spread over a larger number of buses making on-route charging more economically viable. For instance, if the number of electric buses rises to four or eight, the operation cost increase is reduced from USD 0.90 to a mere USD 0.42 per bus or USD 0.29 per bus (respectively) for an on-route recharge. Thus the greater number of buses, the lower the demand charges per bus. To support the deployment of electric buses, it is essential that electric utilities pardon demand charges for plying electric buses till the time the bus operators manage to increase the electric bus numbers to make them economically feasible.

EOS Perspective

While electrification of public transportation is not easy to achieve considering the vast set of challenges faced by the industry, the global market for electric and hybrid buses offers huge growth potential as several leading economies such as the USA, Canada, UK, Germany, France, China, and India are making a conscious effort to switch to electric and hybrid fuel systems for public transportation. Electric buses not only help address rising pollution and environmental concerns but also offer lower operational costs, which is a key driving factor for their growing acceptability. According to experts, all of these advantages of electric buses are likely to spur the industry to grow at a forecast CAGR of 20-27% during the next five years (2016-2020). This is also supported by an ongoing effort by the leading hybrid and electric bus manufacturers, who are working to expand their product portfolio with innovative and cost-effective solutions that suit different countries’ requirements and road conditions. While currently, in real terms, the number of electric buses across the globe seems very limited, the industry is sure to have a bright future.