Innovative marketing strategies have become highly important for businesses in today’s crowded markets, where there is abundant competition and consumers have a vast array of options. This is why neuromarketing, a concept where brain science meets marketing, has started gaining popularity. Christened “astonishing hypothesis” by Nobel Laureate Francis Crick, it holds great promise for current and future marketers.

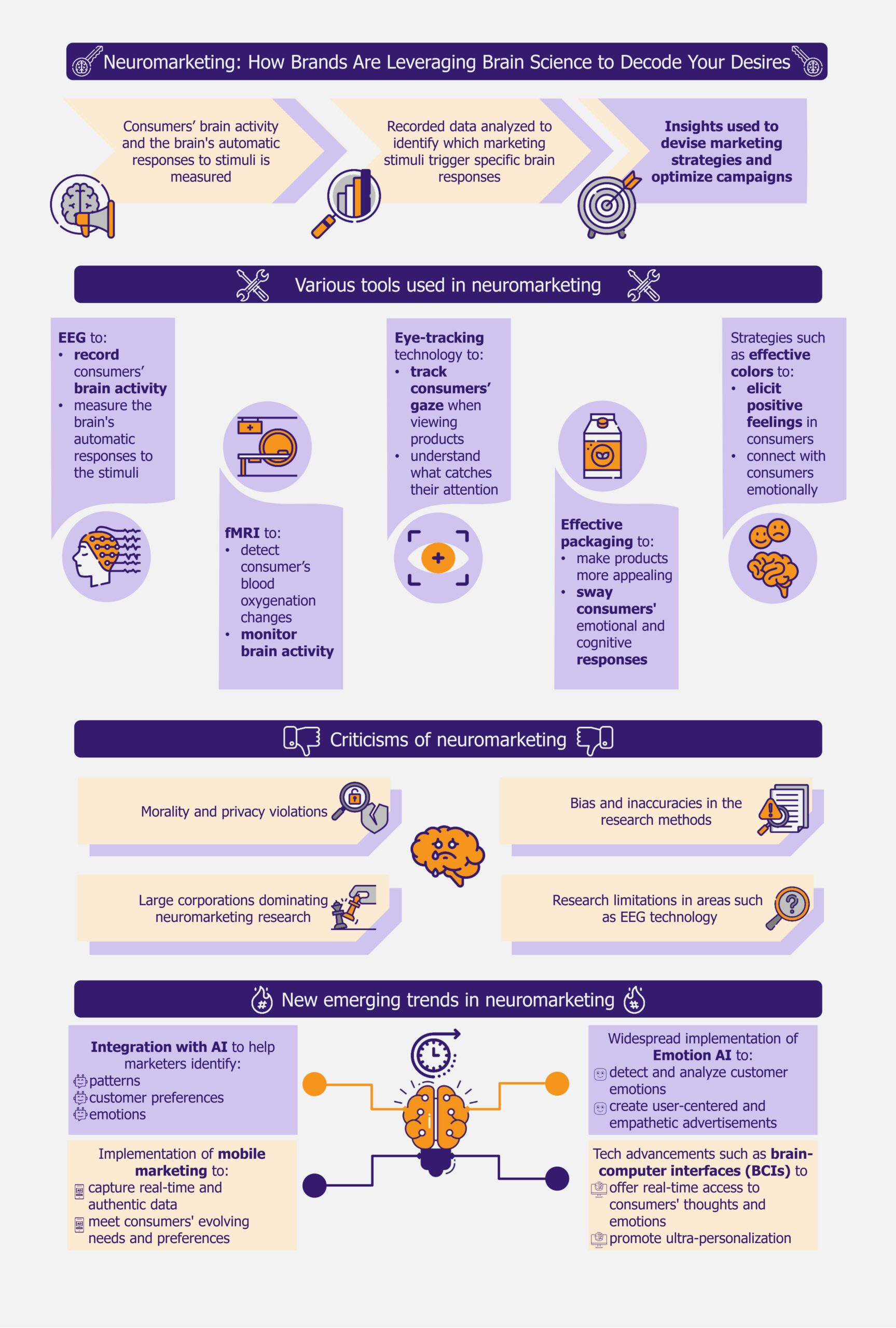

Neuromarketing is a marketing strategy that uses scientific methods to understand how consumers’ brains respond to products and advertisements. It measures brain activity and how people subconsciously react to ads, packaging, and products using methods such as electroencephalography (EEG), functional magnetic resonance imaging (fMRI), and eye tracking.

The goal is to uncover the underlying motivations, preferences, and decision-making processes that drive customer behavior. This approach can help marketers and businesses create more effective advertisements, develop products that meet customer needs and wants, and set appealing prices.

The concept of neuromarketing has been around since the 1990s and it gained popularity with the development techniques such as the Zaltman metaphor elicitation technique. This method allows researchers to tap into a person’s conscious and unconscious thoughts by analyzing their metaphoric or non-literal expressions.

Companies are using various approaches to adopt neuromarketing

Neuromarketing campaigns can use numerous approaches to attract customers.

EEGs and fMRIs are becoming increasingly popular

One approach is to use brain scanning techniques such as fMRI or EEG to monitor brain activity and understand how people process information.

An example is the 2011 neuromarketing study by the South Korean automotive manufacturer Hyundai. The company measured brain activity using EEG and identified the design features most likely stimulating a desire to buy. Based on the study, Hyundai also modified the exterior design of its cars.

Another one is the 2011 commercial Yahoo rolled out to attract more users to its search engine. Before launching the US$100 million rebranding campaign, the company tested the 60-second commercial featuring happy people dancing worldwide. The company had people wear EEG caps to monitor their brain activity while watching the ad to gauge its impact. The results showed that the ad stimulated activity in areas of the brain associated with memory and emotional response, suggesting it could effectively grab viewers’ attention.

Similarly, Microsoft partnered with California-based market research company EmSense in 2009 to study the brain activity of Xbox gamers to understand how engaged they are when exposed to 30- and 60-second TV ads versus in-game ads on the Xbox. The study, using EEG technology, showed that the highest level of brain activity occurred during the first half of TV ads promoting an automotive brand. Also, brain activity decreased when the same ad was repeated during Xbox Live in-game advertising. Microsoft incorporated this format to improve the ad’s memorability.

Businesses such as Frito-Lay, a US-based snack manufacturer, use EEG and focus groups to assess consumers’ genuine reactions to new advertisements. In a 2008 ad, they showed a woman pranking her friend by filling her laundry with orange Cheetos. Despite the focus group participants expressing a dislike for the ad, an EEG study revealed that they actually found it enjoyable.

The EEG-based neuromarketing trend will likely gain even more traction, especially with wearable EEG devices becoming increasingly common. In 2011, Tokyo-based multinational conglomerate Hitachi developed a portable, wearable brain scanner that neuromarketing can employ. Users can wear it while performing everyday activities, such as shopping, allowing marketers to study consumer behavior and preferences in real-life settings. This will also help them to develop marketing campaigns aligned with consumer preferences.

Marketers track eyes to identify customer preferences

Eye-tracking technology is another important technique used in neuromarketing. This technology records the movement of a person’s eyes as they view a screen, generating a heat map to show where they focused their attention. This method can be used to compare the effectiveness of different ads.

A 2009 study conducted by Objective Experience, a Singapore-based research firm, found that when people are shown a diaper ad with a baby looking directly at them, they pay less attention to the message. However, when the baby looks at the ad content, people engage more with the message.

Companies such as UK-based Unilever frequently use this method to test how their products perform in-store. In 2016, it partnered with Swedish technology company Tobii to record shoppers’ attention data while browsing products on the shelf using wearable eye trackers. The data was then analyzed to identify the features that drew shoppers’ attention, how they interacted with branding and marketing elements, and their impact on customer behavior. The insights from this study helped Unilever determine the design features that resonate most with shoppers, allowing the company to optimize brand awareness and perception.

Many other companies have also experimented with eye-tracking techniques. In 2017, the Japanese automotive manufacturer Toyota collaborated with Tobii to improve its in-store experience. The study revealed that younger shoppers spent more time on interactive digital elements, while older shoppers focused on textual information. However, it also showed that interactive digital screens generated the most engagement. This study became very beneficial for Toyota. Since consumers, such as automobile buyers, visit showrooms to make a specific purchase, eye-tracking technology can directly impact the sales of such companies.

While Unilever and Toyota collaborated with Tobii on neuromarketing strategies, UK-based pharmaceutical giant GlaxoSmithKline (GSK) has developed an in-house technique. In 2017, it launched a “Consumer Sensory Lab” to test its products using eye-tracking technology. The lab is designed to mimic a real store, allowing consumers to browse and shop while being monitored by eye-tracking devices. This allows GSK to analyze how consumers interact with products on the shelf and what packaging elements catch their attention. GSK’s investment in this technology shows that big players are now considering leveraging neuromarketing for market research and product development.

Packaging, colors, and emotions are essential in neuromarketing

Many companies are using effective packaging and experimenting with color psychology in neuromarketing. In 2009, Frito-Lay partnered with Ontario-based Juniper Park to understand why women were not choosing their products. The company identified that its shiny packaging was generating feelings of guilt in women while snacking. They redesigned their packaging using softer colors and avoided language that might trigger guilt.

Several companies use certain colors as neuromarketing tools to evoke specific emotions. US-based Coca-Cola’s use of the color red is an example. Similarly, brands such as Target and Netflix use red to convey feelings of power, excitement, and passion. Red has also been linked to increased hunger. Many fast-food chains, such as Wendy’s and KFC, use red to increase client engagement.

Many businesses also try to increase engagement by bringing out specific emotions. An example is German auto manufacturer Volkswagen’s 2011 Super Bowl ad, featuring a young boy dressed as Darth Vader trying to use “the force” on a VW Passat. Experts attributed the ad’s success to its combination of nostalgia (Star Wars), empathy (parental love), and humor (Darth Vader’s reaction).

Another example is Frito Lay’s 2018 “Operation Smile” campaign, which featured a series of smiles on the packaging of its potato chips. The campaign was designed to bring joy and happiness to customers and successfully connect with them.

Many brands are redesigning their packages and presentations using neuromarketing feedback, and the trend is expected to continue in the future.

AI integration and emotion AI are the emerging trends in the market

Integration with AI is one emerging trend that is greatly benefiting neuromarketing. As consumers engage in various online platforms, including social media, they leave a digital trail of personal information. This can be accessed by AI programs stored in the cloud.

AI analyzes this data and identifies patterns and customer preferences. This information can then be used to create effective marketing strategies. Netflix, for example, uses AI to power its recommendation engine and suggest shows based on users’ viewing history, completion rates, popularity rankings, etc.

AI also plays a crucial role in facial recognition and emotion detection. AI-driven facial tracking technologies are expected to help marketers understand how people respond emotionally to ad content more efficiently and accurately, helping them to design more engaging and impactful experiences.

Emotion AI, a type of artificial intelligence that analyzes, responds to, and simulates human emotions by detecting and interpreting emotional signals from various sources such as text, audio, and video, is another technological trend expected to benefit neuromarketing. Since this technology can capture and analyze human emotions and body language, marketers can use it to create user-centered and empathetic advertisements.

Sentiment analysis is an example, a tool used by Emotion AI that analyzes human emotions in text. This is often employed in marketing functions such as product review analysis.

An example is a 2018 campaign by the American sportswear giant Nike. The company used sentiment analysis to navigate the controversy surrounding NFL player Colin Kaepernick’s “take a knee” protest. As public opinion was divided, with both critics and supporters voicing their views, Nike partnered with California-based software development company Sentieo to monitor customer sentiments to protect its reputation. They tracked tweets and news related to the campaign before and after incorporating the “#justdoit” hashtag in Kaepernick’s tweets. The analysis also showed that consumer purchase intent improved due to the campaign, which benefited Nike.

Using tools such as Emotion AI is expected to directly affect companies’ profits since it helps them easily identify the customer’s opinion about the brand. It can also be used to detect early warning signs of customer dissatisfaction or frustration. This is expected to enable businesses to address issues promptly and reduce the risk of negative word-of-mouth or online reviews.

There are challenges and concerns about adoption

Though neuromarketing is expected to shape the future of marketing, interested players must address some concerns before taking the plunge. Critics have raised ethical concerns about its morality and the potential for privacy violations. There is also a potential for bias and inaccuracies in the research methods, leading to unreliable conclusions and flawed marketing strategies.

Larger companies with greater budgets are more likely to use neuromarketing leaving smaller players, who cannot afford the cost, at a significant disadvantage. This will widen the gap between these companies, as smaller ones will struggle to compete with larger companies’ marketing and advertising capabilities. Also, consumers may unknowingly choose products influenced by neuromarketing tactics, making it even harder for smaller companies to compete.

Moreover, larger corporations will have the means to invest in research and development of own neuromarketing techniques, further solidifying their advantage. These companies are also likely to keep the research findings proprietary, thereby limiting opportunities for smaller companies to compete.

More research is also needed to bring neuromarketing to the mainstream, especially in areas where real-time responses and feedback are required, such as in-store shopping. Since EEG technology, widely used in neuromarketing, can be compromised by interference from other electrical devices and requires subjects to remain still, it can become difficult to replicate lab-based research conditions in a real-world setting.

EOS Perspective

The marketing landscape has significantly transformed in the past few years. Consumers are now more tech-savvy and take to social media platforms when faced with an unpleasant event. Companies are also aware that negative reviews on online platforms can significantly impact a brand’s reputation within a short time. This can be increasingly managed by employing neuromarketing. Though it is still considered to be in its embryonic stage, experts believe this innovative marketing technique will reshape advertising and consumer-business relationships.

As the number of global mobile users is expected to cross 7.5 billion in 2025, according to a 2021 report by the US-based market research firm, The Radicati Group, neuromarketers are expected to collect real-time data by leveraging mobile devices. This will enable players to capture a more authentic and nuanced understanding of consumer behavior in real-world settings rather than relying solely on laboratory-based or controlled environments.

This real-time data collected using mobile devices can be used to design marketing strategies, product development, and customer experiences that are more tailored to meet consumers’ evolving needs and preferences.

Experts also believe that technological advancements such as brain-computer interfaces (BCIs) can revolutionize the marketing landscape in the near future. BCIs enable seamless communication between the human brain and machines, giving marketers access to consumers’ real-time thoughts and emotions. This is expected to pave the way for ultra-personalization, as companies can tailor their products and advertisements to individuals’ unique preferences and emotional responses.

While there are ethical concerns surrounding its use, the fact that neuromarketing is still in its early stages of development means it has the potential to evolve in tandem with addressing the ethical doubts. As technology becomes more accessible, the key challenge will be ensuring that neuromarketing is used responsibly and ethically.