1.6kviews

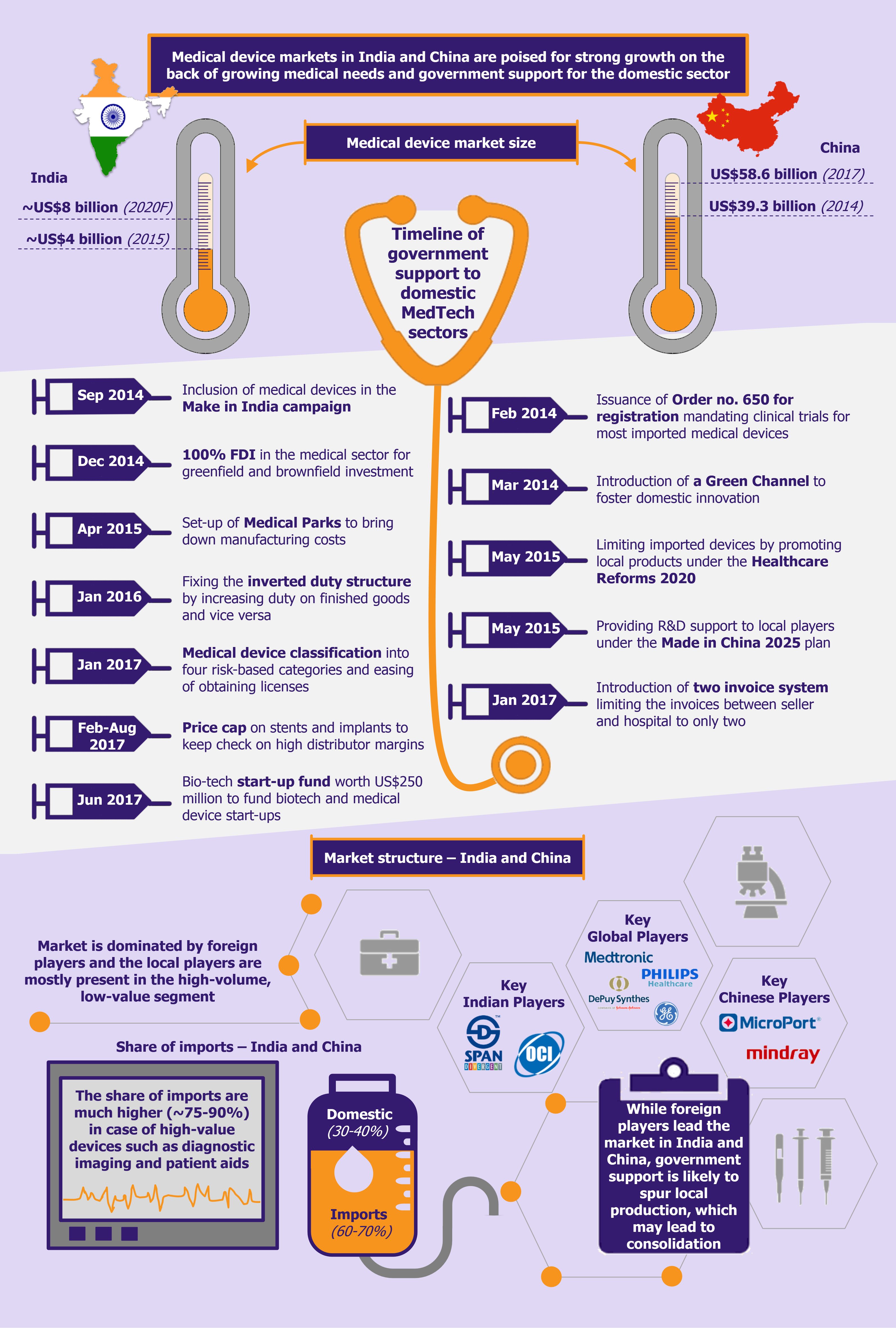

Medical device industries in India and China have long been dominated by international players, especially when it comes to high-end devices. High investment requirement, long gestation period on ROI, limited support from the government, and relatively low demand and awareness about medical procedures have resulted in limited domestic investments. However, the industry has been evolving as more and more local players are realizing the scope of this high-potential market that is still in its nascent growth stage in India and China. Moreover, increased government support is further expected to boost indigenous production in the industry.

Similar market structures, a whopping difference in size

While the medical device sector in China is far ahead of that of India (with respect to sales, number of players, and investment), they both have a similar market structure, i.e. being dominated by large multinational players, who have built strong relationships with large hospitals, healthcare organizations, and influencers.

Very few local players have had any significant presence in this industry, and those that did hold some share in the market, limited their focus to the low-investment, low-price product range. However, with healthcare spending in the two countries rising significantly, more and more domestic players are entering and expanding into this space.

India’s healthcare industry is poised to reach US$280 billion by 2020 registering a CAGR of 15% during 2016-2020, while China’s healthcare spending is projected to reach US$1 trillion by 2020, growing at a CAGR of about 12% during the decade.

The rise in healthcare spending in both countries is underpinned by rising disposable income, availability and growing awareness about medical care, expansion of health insurance coverage, rising burden of lifestyle diseases and increased stress levels, as well as ageing population (especially in China).

In addition to this, the governments in both countries are providing instrumental support to companies interested and engaged in medical device manufacturing on domestic soil.

Government takes initiative to promote Indian domestic manufacturing

India’s medtech market, which was valued at close to US$4 billion (INR 260.5 billion) in 2015 is expected to reach about US$8 billion (INR 550.4 billion) by 2020, registering a CAGR of 16.1% during 2015-2020, which is significantly higher than the global industry growth of about 4-6%.

Although about 65-70% of the market value is characterized by imports, the current government’s initiatives in the sector (including the Make in India initiative) are expected to reduce the country’s dependency on imports in the medium-to-long term. Some of the initiatives undertaken by the government include allowing 100% FDI in the sector, setting up medical technology and devices parks across selected states to bring down indigenous manufacturing costs by as much as 30%, developing two testing and quality certification labs aimed at monitoring and improving quality of manufactured devices, and issuing Medical Device Rules 2017, which promote domestic manufacturing.

Before the Medical Device Rules 2017, medical devices were regulated as drugs and this resulted in several regulatory bottlenecks with regards to medtech manufacturing. The new set of rules ease the process of obtaining licenses and undertaking clinical trials, encourage self-compliance, and promote a single-window digital platform for the processing and easy tracking of applications and licenses for import, manufacture, sale/distribution, and clinical investigation of medical devices. In addition, the new medical device rules classify medical devices into four categories based on the risks these devices may pose, in line with global standards for classifying and registering medical devices.

In addition to this, the government also corrected the inverted tax structure faced by the industry in the past (i.e. import of finished goods attracted lower duty compared with import of raw materials for domestic manufacturing). Under the 2016-2017 budget, the government relaxed import duty on components and raw materials required to manufacture medical devices to 2.5% and provided full exemption from additional customs duty (SAD). Further, it increased duty on import of finished medical devices from 5% to 7.5% (in addition to imposing an additional duty of 4% on medical devices by withdrawing exemptions.)

While the move of reducing duty on raw materials has been appreciated by the industry, the rise in duty of imported medical devices has met with mixed reviews. India is highly import-dependent with regards to medical devices and a rise in duty on most categories will make medical care more expensive for the consumer.

Further, in June 2017, the union cabinet announced a US$250 million initiative as a part of the National Biopharma Mission to fund bio-tech start-ups in the field of medical devices, bio-therapeutics, etc. The government is also looking to encourage innovation in this space by setting up R&D incubation centers in association with leading research institutions in this field.

Apart from easing the supply side, the government’s initiatives, such as Free Diagnostics Service Initiative also play a vital role in boosting the demand for medical devices (especially in-vitro devices) in the country. Through this initiative, the government, under the National Health Mission aims at providing a minimum set of diagnostics to the underprivileged population in the country.

In addition to this, the program has worked on devising an integrated approach to combat prevalent non-communicable diseases such as hypertension, diabetes, and cancer by undertaking year-round screening and testing. This will result in large government orders for IVDs and other medical devices.

Another initiative undertaken by the government to both support the domestic industry and ensure a more widespread reach of medical devices has been price capping of coronary stents and orthopedic implants. Observing the huge distributor margins on these medical devices, the government undertook a bold step to cap the prices at which stents and knee implants can be sold in India.

Prior to the price control, the average retail price for a bare metal stent was about US$700, while that for a drug-eluting stent was about US$1,800-2,000. In February 2017, the government fixed a ceiling price of ~US$106 (INR 7,260) for bare metal stents and ~US$431 (INR 29,600) for drug-eluting stents.

In a similar move, the government capped prices for knee implants in August 2017. Knee implants, which ranged from ~US$2,308-US$13,121 (INR 158,300 – 900,000) were limited to ~US$791-1,661 (INR 54,270-113,950). In mid-2017, the government published a list of 19 medical devices (including catheters, heart valves, other orthopedic implants, etc.) that will be monitored for pricing, thus similar price capping may be expected for other devices as well.

Large players may withdraw their latest generation products from India, while Indian players will focus only on cost-effective products instead of innovations.

While the intent for the price capping is noble and will provide a boost to the domestic manufacturers who are better equipped at producing low-priced products, several leading international companies, such as Abbott Vascular and Medtronic, have criticized the decision and submitted applications to increase the ceiling price for the premium quality products or allow them to withdraw the products from the Indian market (as per the government’s rules, no manufacturer can withdraw their products from the market for a period of 12 months from the date of the price ceiling without prior approval from the government). This may be detrimental to the overall industry as large players may withdraw their latest generation products from India in the long run, while Indian players will focus only on cost-effective products instead of innovations.

Indian domestic players might go beyond high-volume low-end products

The Indian medical device market is largely import driven with a very fragmented domestic players landscape. While there are around 800 local medical device manufacturers across the country, only 10% have a turnover of more than ~US$7.3 million (INR 500 million).

The small-scale domestic players focus primarily on the consumables and disposables segment of the medical device industry, which include high-volume low-end products such as syringes, needles, and catheters.

The patient aids segment, including mostly hearing aids and pacemakers, is largely import dependent.

While the equipment and instruments segment and the implants segment are largely dominated by foreign players, they have recently seen an influx of local players that have customized their offerings to the Indian market. Karnataka-based Remidio Innovative Solutions has come up with a retinal imaging system, wherein the fundus of the eye connects to a mobile phone camera to take pictures of the retina to detect diabetic neuropathy. The device can also be used in remote areas and the images and results can be shared in real time on the treating doctor’s phone. Similarly, Karnataka-based Tricog Health Services has developed a cloud-based ECG machine for faster diagnosis. Several other players include Sattva, Cardiotrack, Forus Health, etc.

Understanding the needs and price-sensitivity of the Indian market, several leading global players have also created customized offerings for Indian consumers. For instance, GE Healthcare has come up with a compact CT scanner, which consumes less power, while Skanray Technologies has developed affordable X-ray imaging systems to meet the Indian needs.

We can expect a transition in the domestic sector, which will not only focus on high-volume low-end products but also look at entering the high-end innovative segment offering more affordable and locally customized solutions.

Since the Indian government has fixed the inverted duty structure and provided other instrumental support to the domestic sector, we can expect a huge transition in the industry, which will not only focus on high-volume low-end products but also look at entering the high-end innovative segment offering more affordable and locally customized solutions. This may eventually result in a phase of consolidation, with foreign market leaders absorbing several innovative Indian start-ups and established players.

Chinese government also focuses on aiding local producers

China’s medical device market is the third largest globally, after the USA and Japan, and is expected to surpass Japan to become the second largest by 2020. In 2017, the industry was valued at US$58.6 billion, maintaining a double-digit growth over the previous three years.

Similar to the Indian market, the Chinese medical device sector continues to be dominated by foreign players through imports or their locally manufactured products. However, the market is also characterized by the presence of several local players (though smaller in size), especially in the drug-eluting stents, IVDs, and orthopedics segments.

While the foreign players hold the major chunk of innovative medical devices, the government has been taking several and significant steps to promote local companies. The government requires international players to have local legal entities in China for registration and licensing, thus China cannot serve only as an export market.

Another such major step is the regulatory proceedings under Order 650, which mandate clinical trials in China for all class II and III medical devices, with few exceptions. This prolongs the period for obtaining a license to 3-5 years and adds close to US$1-1.5 million (CNY 7-10 million) in costs. However, it has introduced a shorter channel, called the Green Channel, which provides a fast track review option. While the government introduced this to foster domestic innovation, foreign players can use it too. To be eligible for the Green Channel, the device must have a Chinese patent and it must be an innovative product with design progress and records. Products qualifying for the Green Channel are given priority in the registration review and are exempt from the US$90,000 registration fee.

In 2016, the government introduced a second priority review system for certain breakthrough products. Under this fast track channel, the need for a lengthy pre-qualification application process was further eliminated.

The government’s guidelines in its new healthcare reform called The Healthcare Reform 2020 also aim at reducing the share of imported medical devices and promoting locally produced counterparts. Several state-based medical tenders differentiate between local and imported products, giving preference to the former. Moreover, in some tenders a further distinction is made between domestic and foreign-owned local manufacturers. Thereby foreign companies that buy-out local companies to get an easier access into China are also considered as foreign players.

Under its Made in China 2025 plan, the government has also focused on domestic development and manufacturing of high-end and innovative medical devices. These devices include imaging equipment, medical robots, fully degradable vascular stents, and other high-caliber medical devices. The government aims to boost local production of such innovative and high-value devices by supporting the R&D infrastructure and manufacturing capabilities of local players. The government also provides extension of tax benefits for a period of three years if the investment made is used towards the development of medical devices.

Moreover, under the initiative, the government has aimed at increasing the use of locally produced devices by hospitals to 50% by 2020 and 70% by 2025. To pursue this goal, in September 2017, the Sichuan province mandated the use of locally-made devices in hospitals across 15 categories including respirators, PET, and CT scanners.

Just like India, China is also focusing on combating high distribution costs of medical devices, which in turn will make their prices more affordable for the general population. However, instead of capping prices, the government has introduced a Two Invoice System. The system limits the number of invoices between a supplier and the hospital to only two – the first invoice would be from the manufacturer/trading company to a government-appointed supplier/distributor (GAS) and the second invoice will be from the supplier to the hospital. This will eliminate most links in the non-transparent and fragmented distribution network in the Chinese medical device sector, which encompassed several distributors, sub-distributors, agents, etc. (the sub-distributors were engaged due to their personal and long-standing relationships with a set of hospitals). This new system is expected to reduce the corruption level by reducing the number of intermediaries and in turn improving efficiency and reducing prices for the patients.

Chinese players dominate several narrow industry segments

China’s medical device industry is dominated primarily by international players, especially with regards to high-end and innovative devices. Having said that, there are a lot of upcoming local players, although, most of them are still limited to the high-volume low-technology segments.

However, local Chinese players have managed to dominate several narrow industry segments, such as drug eluting stents, which is dominated by three domestic companies, namely Biosensors International, Lepu Medical, and MicroPort. Similarly, local players have managed to capture a significant share of the digital x-ray market, which was dominated by foreign players a few years back.

The orthopedic sector is also characterized by the presence of several large and small local players while a few dominating local players (Trauson, Kanghui, and Montage) have also been acquired by leading international players (Stryker, Medtronic, and Zimmer, respectively). Mindray and Microport, two of the largest Chinese medtech players (who have also successfully internationalized), have strong hold on the country’s patient monitoring equipment and orthopedic segment, respectively.

Moreover, while foreign companies enter the Chinese market to cater to the grade-3 hospitals and the high-end segment, the local players focus primarily on the grade-2 hospitals’ value segment (i.e. products that may not have as many functionalities but serve the basic need). The products in the value segment are more localized in terms of both need and pricing. Several international companies, such as Siemens, Philips, and GE, have also modified their product offerings and have come up with a lower-end range of devices to capture this market (as per experts, the value segment has the potential of becoming much larger in comparison with the high-end segment over the coming years).

Leading Chinese medical device companies are investing heavily in their R&D to move up the value chain with more innovative and high-segment products. Therefore, in the coming years, one can expect intense competition in the Chinese medical device sector.

Similarly, leading Chinese medical device companies are investing heavily in their R&D to move up the value chain with more innovative and high-segment products. Therefore, in the coming years, one can expect intense competition in the Chinese medical device sector, which may also lead to some consolidation. With growing government support to local companies as well as their ease to localize, it is expected that the domestic players will provide a stiff competition to international players unless the latter take action soon.

EOS Perspective

While the governments in both countries are taking significant and constructive steps to increase the reach of the medtech industry as well as boost domestic manufacturing, it is too far-fetched to believe that this will uproot the leading global players from the market. However, that being said, in case global companies such as GE, Siemens, and Philips do not continue to customize and localize their offerings as per the changing needs of these markets, they will definitely lose market share to domestic players.

If global companies do not continue to customize and localize their offerings, they will definitely lose market share to domestic players.

Moreover, with the upcoming regulatory changes, support to local production, and overall surge in demand (especially from tier-2 and tier-3 cities in India and grade-2 hospitals in China), the sector is likely to undergo a phase of consolidation in both countries.