578views

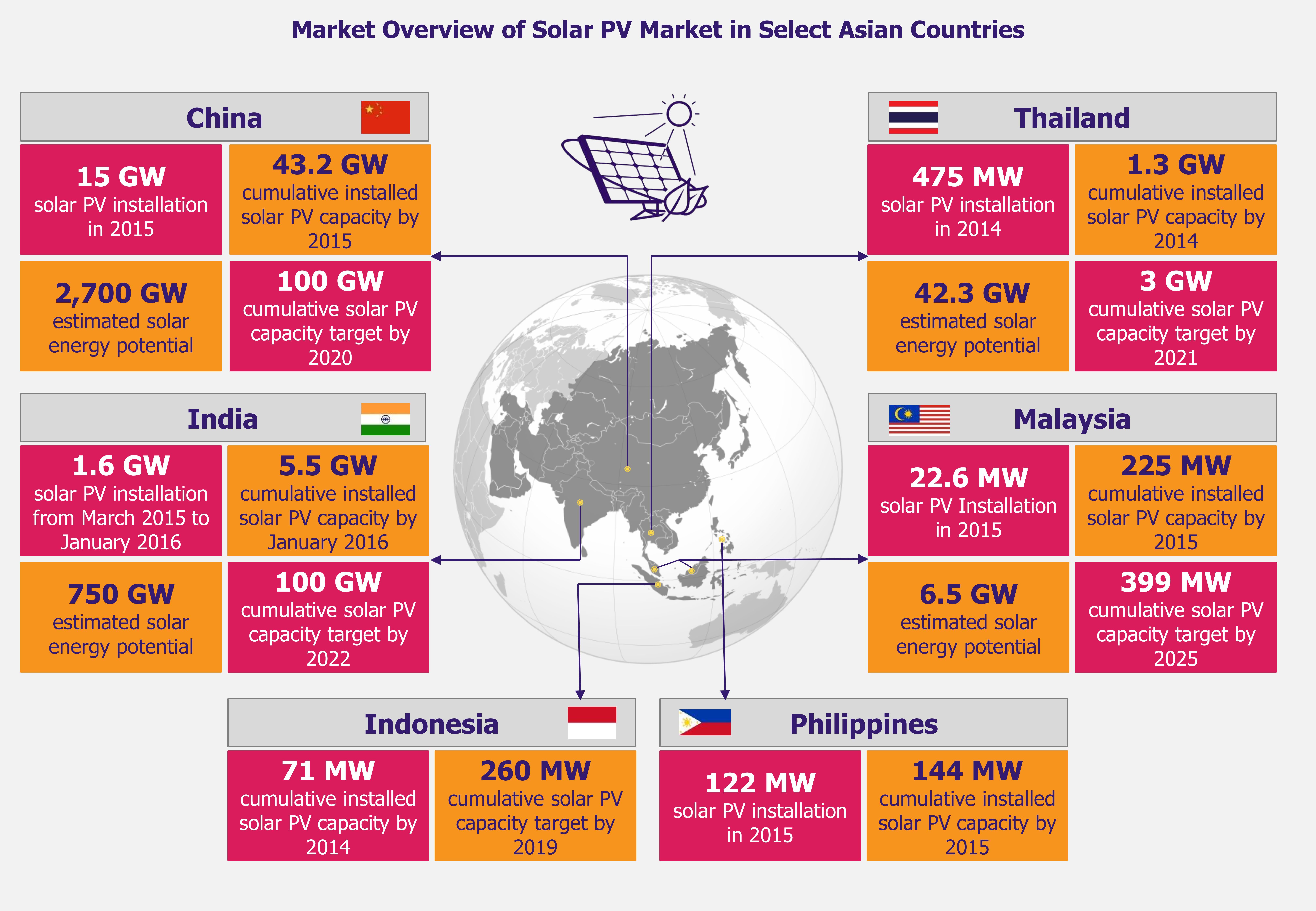

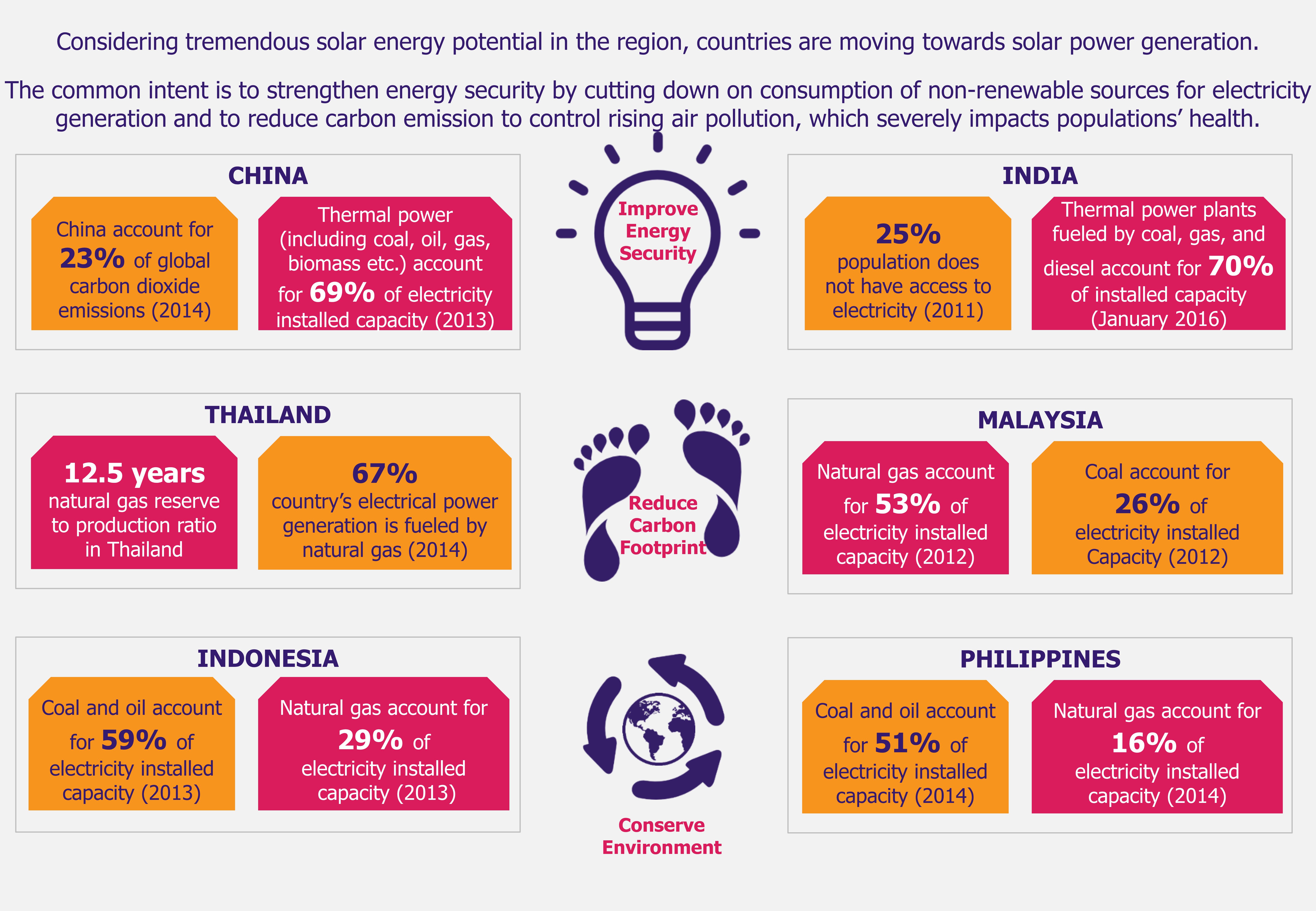

Solar power, once perceived as a luxury that only developed nations could afford, is becoming a viable energy source for a broader set of emerging nations, which are leaning towards solar power generation to meet their obligations under the Kyoto Protocol, conserve scarce traditional resources, reduce dependence on imports of oil and fuel, or address escalating power demand.

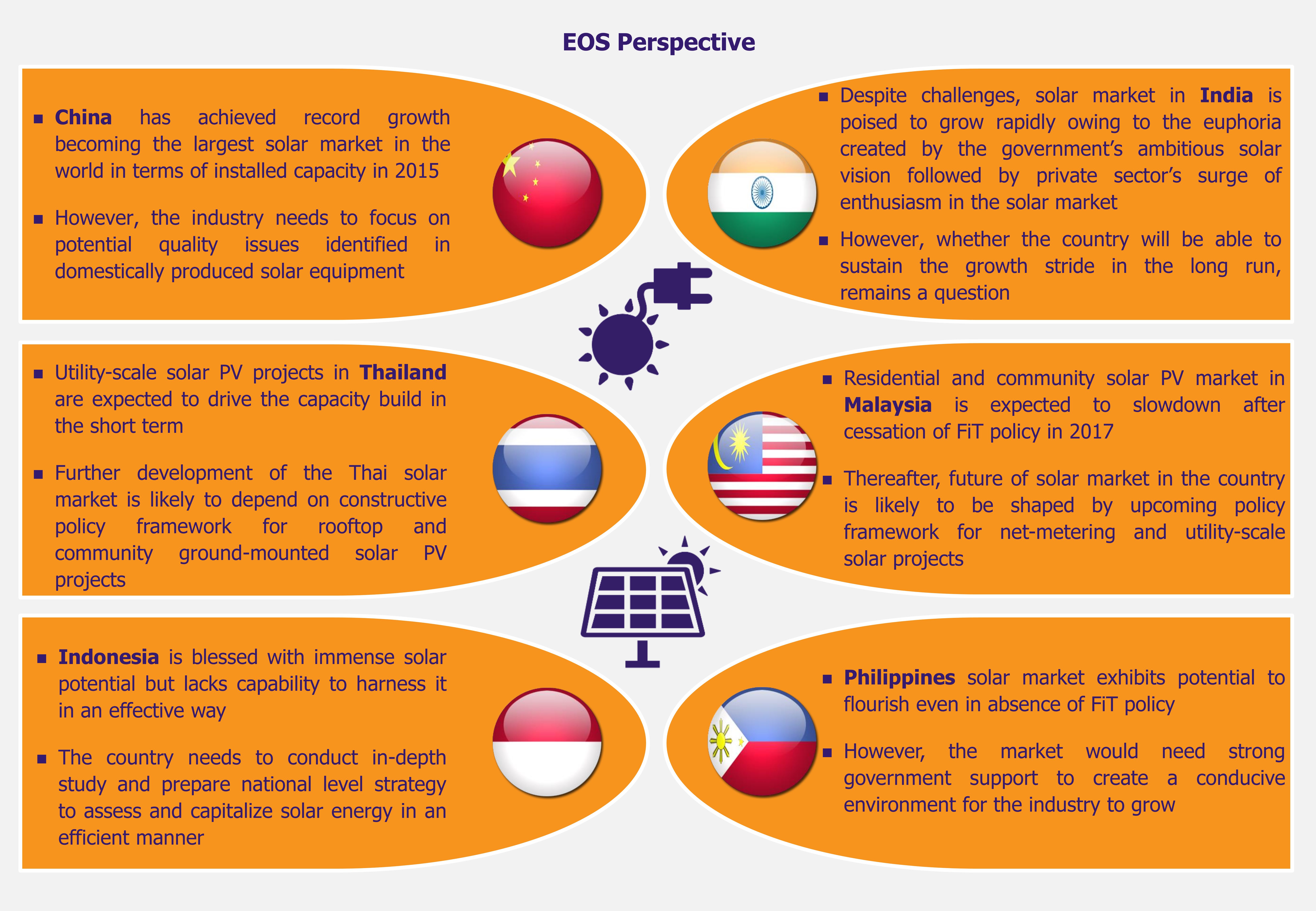

In particular, several emerging countries in Asia are showing signs of intensified solar photovoltaic (PV) development in the coming years. For instance, China and India, the two Asian giants, are aiming for solar revolution with the target of installing 100 GW of solar PV capacity by 2020 and 2022, respectively. Solar energy is gaining popularity in many other emerging countries in Asia as well, such as in Thailand, Malaysia, Indonesia, and the Philippines. This intensive growth of the region’s solar markets is offering a gamut of opportunities to domestic and global developers, investors, and financial institutions operating in the solar power industry.

This article is part of a series focusing on solar PV market across selected Asian countries: China, India, Thailand, and Malaysia.

The series closing article Solar Rises in the East examines challenges and opportunities in all four markets, with additional look into Indonesia and

The Philippines.

Currently, China represents the fastest growing solar market globally. While, in 2014, a total 38.7 gigawatt (GW) of new solar PV capacity was installed globally, China accounted for the largest share (roughly 27%) of this new capacity, adding some 10.6 GW, followed by Japan and the USA.

China’s strengthening position in the global solar power market is a matter of the past few years. At the end of 2010, China had an installed solar power capacity of less than 1 GW, and within three years it became a leading nation in terms of solar PV installations per year. Present outlook for China’s solar market is indicative of its bright future. Amidst burgeoning market growth, global solar companies are exploring diverse routes to benefit from China’s solar boom.

Market Overview

Total grid-connected solar power capacity in China reached 33.12 GW by the end of March 2015, with 27.79 GW from utility-scale solar PV projects and 5.33 GW from distributed solar PV projects. The country continues to add new capacity on an ongoing basis: it added 5.04 GW of new solar PV capacity in the first quarter of 2015 alone and aims to connect a total of 17.8 GW of new solar PV capacity to the grid in 2015.

Utility-scale solar refers to large-scale grid connected solar power generation, whereas distributed generation refers to electricity produced at or near the point where it is to be consumed. In China, solar power generated through rooftop solar PV systems on residential and commercial buildings as well as ground-mounted solar systems on abandoned lands, unused slopes, canopy for agricultural uses, and fish ponds are recognized as distributed solar PV projects.

All of this is just part of a larger plan to increase solar power output in this country, as according to the 13th Five-Year Plan (2016-2020), China aims to install a total 100 GW solar power capacity by 2020 (doubled from the target of 50GW set in 2013 under 12th Five-Year Plan, which we mentioned in our Perspectives in January 2015).

Growing solar market is expected to offer ample opportunities for new investments. A report released by Ernst & Young in 2014 indicated that China would require about RMB 737 billion (US$120 billion) of capital investment between 2014 and 2017 to meet its solar targets. About 71% of this capital investment value would be required for development of distributed solar PV projects.

“China’s continued demand for new energy capacity, its ongoing battle against air pollution and energy poverty, and its focus on economic development, meant the 100 GW solar target set in Beijing’s last Five-Year Plan could be treated as the bottom.” – Liansheng Miao, Chairman and CEO, Yingli (world’s second-largest solar panel producer), 2015

Such large-scale investments can be aptly utilized to capitalize on country’s abundant solar power generation potential. World Energy Council 2007 estimated China’s solar power potential at around 19,536,000 terawatt-hours (TWh) per year. 17% of mainland China receives annual solar radiation of more than 1,750 kilowatt-hours per square meter (KWh/m2) and more than 40% of China receives between 1,400-1,750 KWh/m2.

According to China National Renewable Energy Centre, several provinces in western and northern parts of the country (including Qinghai, Xinjiang, Tibet, Inner Mongolia, Sichuan and Gansu provinces) represent more than two thirds of the national solar energy resource potential. Most utility-scale solar PV power plants are concentrated in the northern and western parts of China, while distributed solar PV installation is gaining momentum in eastern parts of the country.

Solar Resource of China – Direct Normal Solar Radiation

Source: National Renewable Energy Laboratory

Key Growth Drivers

Attempts to counteract deteriorating air quality

China became the largest consumer of energy in the world in 2010, with majority of its electricity generated from domestic coal reserves. In 2014, coal accounted for 64% of the total energy consumed in the country. Consequently, air pollution, which impacts public health, is a major problem for China to combat. Chinese Ministry of Environmental Protection indicated that nearly 90% Chinese cities did not meet government-recommended standards related to air quality in 2014.

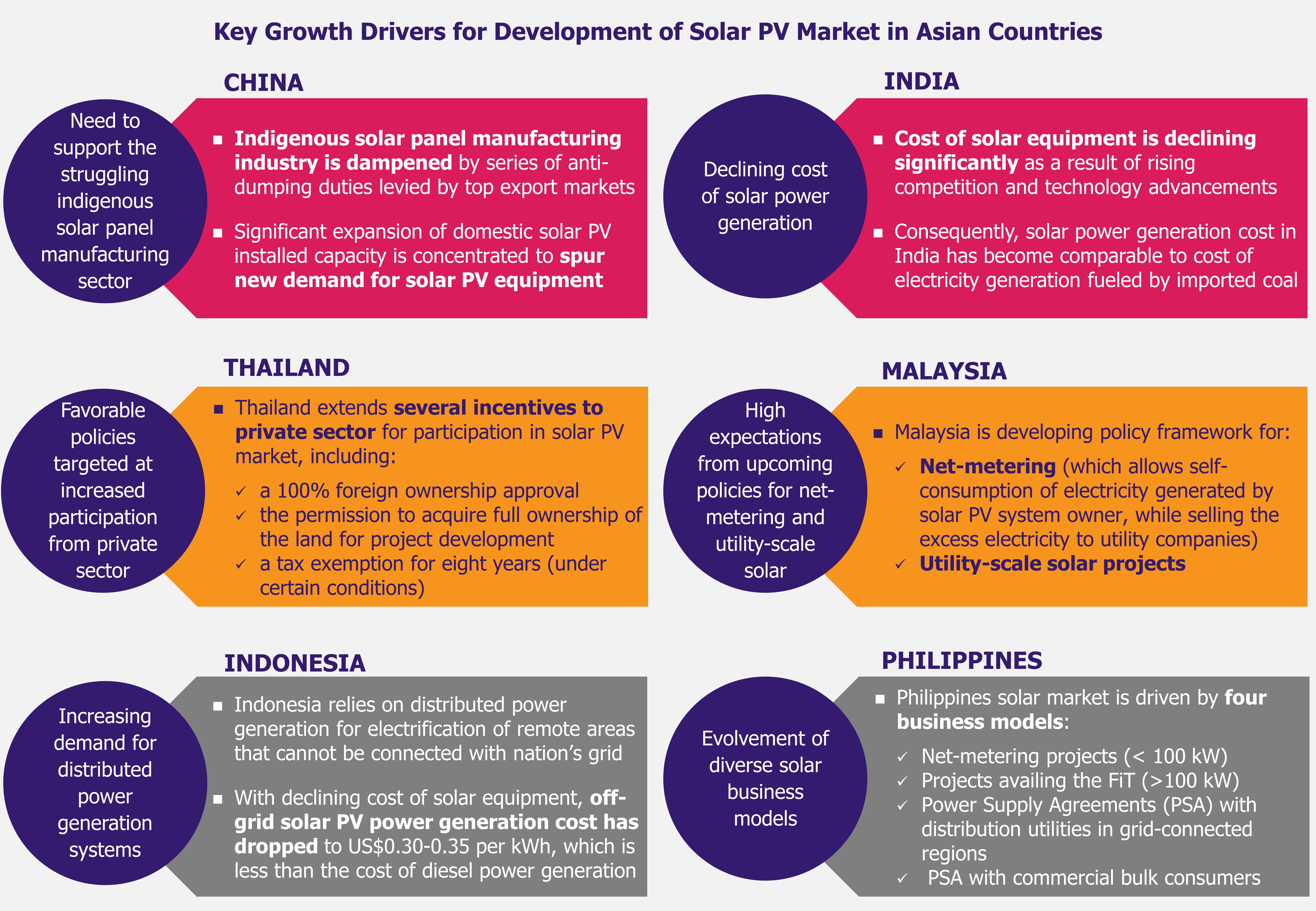

China’s solar boom is driven largely by a progressive policy framework intended to improve country’s energy mix by generating greater portion of energy from clean and abundantly available renewable sources. This push towards solar power generation is also partly aimed at creating additional demand for domestic solar equipment manufacturers.

China, being the largest emitter of carbon dioxide in the world (accounting for about 23% of global carbon dioxide emissions in 2014), is committed to move towards cleaner energy sources including solar power, and to cut down consumption of coal for electricity generation. In November 2014, Chinese President Xi Jinping pledged in an agreement with the US President Barack Obama to increase the share of non-fossil fuels in primary energy consumption in China from 9.8% in 2013 to around 20% by 2030. Country’s abundant solar power potential along with a strong commitment to move towards cleaner energy sources for electricity generation has been a contributing factor that boosted development of solar market in China.

The need to support the struggling indigenous solar panel manufacturing industry

China has been the largest manufacturer and exporter of solar PV panels since 2007, producing the cheapest solar PV panels in the world owing to massive subsidies granted by the government. China has been known to export about 90% of its solar panels. In the face of such a heavy reliance on exports, the trade tariffs recently applied by EU and the USA have affected the growth of this industry.

In 2013, EU and China came up with a trade settlement, under which in a given year, Chinese companies are allowed to export to EU solar equipment able to generate up to 7 GW power without paying duties, provided that the price is not lower than US$0.56 per watt. Any solar products sold above the permissible volume quota or below that minimum price would be subject to anti-dumping duties of an average of 47%. Consequently, EU’s share in overall Chinese solar PV module exports reduced from 65% in 2012 to 30% in 2013, and further down to 16% in 2014. At the same time, in December 2014, the USA, which accounted for 3% of the Chinese solar PV module exports in 2014, imposed anti-dumping duty rates of 52% and anti-subsidy rates of 39% on imports of solar panels made in China.

Chinese government’s aggressive efforts to drive significant expansion of domestic solar energy generation capacity is concentrated to spur new demand for solar PV equipment, and thus provide new market opportunity for indigenous solar panel manufacturing industry, dampened by series of anti-dumping duties levied by top export countries.

Favorable policies and generous government incentives for Chinese solar market

Impressive growth rate of Chinese solar market in the recent years has been largely driven by conducive investment and policy environment. The government has introduced several incentive schemes to encourage solar developers to ramp up solar PV installation in China.

Key Policies to Promote Solar PV Installations in China

While the introduction of subsidies and other solutions to fuel investment and installations of solar power facilities led to considerable positive results and increase in solar power generation capacity in China, the government intends to stop providing subsidies for solar projects by 2020 in line with falling costs of developing and operating solar projects in the country. With advancements in technology, leading Chinese solar companies’ solar PV modules cost decreased from US$1.31 per watt in 2011 to US$0.50 per watt in 2014, representing about 62% decrease in three years. In 2014, Deutsche Bank noted that the solar PV module cost could further decrease by 30-40% in next several years. Moreover, solar power generation cost in China is expected to reach a level comparable with the cost of conventional power generation by 2017. With the decrease of solar panel production costs and the decrease in cost of electricity generation using solar energy, the government will no longer consider subsidies a necessary tool to drive the solar market growth. While generous government incentives are likely to dry out over time, many renewable energy-friendly policies introduced since 2006 remain in place, and continue to ensure a favorable environment for solar power market.

Key Challenges

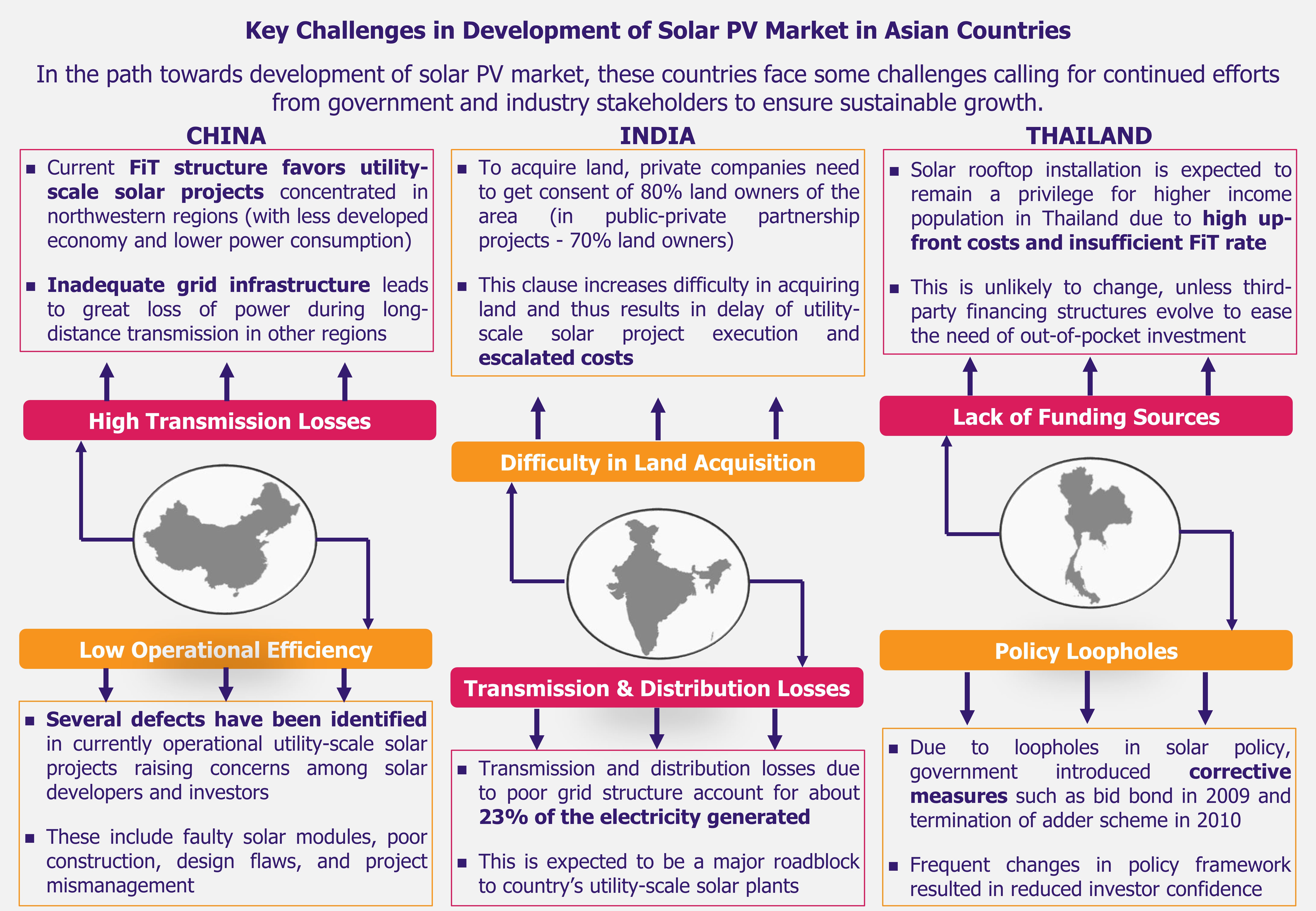

Lower development of China’s distributed solar PV sector in comparison with utility-scale solar PV generation

Most large-scale utility projects are concentrated in the highly irradiated northwestern regions of China, where the economy is relatively underdeveloped and electricity consumption is limited. Inefficient grid infrastructure in the country poses substantial challenge of power loss in long-distance transmission from northwest China to other regions that are rapidly developing and experiencing shortage of energy.

Considering transmission challenges and costs involved in utility-scale solar PV projects, most observers of China’s solar energy sector suggest that the country should ideally shift its solar PV market, which concentrates primarily on utility-scale solar PV in remote locations, to distributed solar PV in densely populated areas in the north, south, and east. However, as the current subsidy structure favors utility-scale solar PV projects over distributed solar PV projects, the development of distributed solar PV sector is relatively low. As of 2014, distributed solar PV installations connected to the grid accounted for only 16.65% of the total grid-connected solar installed capacity in China.

Current FiT Policy (Introduced in 2013)

Source: National Development Reform Commission

Furthermore, the market for distributed solar PV in China faces other challenges, such as the possible dearth of rooftops suitable for installations of solar systems. Therefore, solar energy developers continue to be more interested in utility-scale solar PV projects in northwestern regions over distributed solar PV projects in other parts of the country, which leads to great loss of power during long-distance transmission, a challenge that could be overcome only if the grid infrastructure is significantly improved.

Rising concerns about the quality of domestically produced solar PV modules

Solar developers, investors, and financial institutions are increasingly concerned about the quality, performance, and reliability of solar PV modules produced in China. General Administration of Quality Supervision, Inspection and Quarantine, a Chinese regulatory agency, indicated in 2014 that about 23% of solar PV modules produced by Chinese companies for the domestic solar market did not meet recommended quality requirements related to panel’s antireflective coating. Findings were based on inspection conducted in the third quarter of 2014 with samples from 30 companies, which represented about half of China’s suppliers of antireflective glass. Flawed antireflective coating may result in gradual deterioration of power output, thus increasing operational inefficiencies in the long-term. Experts suggest that such quality defects may not have immediate effect and can go undetected for two or more years of operation of the solar plant, raising uncertainty among investors and developers.

“A reduction in power generation caused by quality imperfections means declining investment returns or even losses from solar farms.” – Meng Xiangan, Vice Chairman, China Renewable Energy Society, 2015

Quality inspection of 3.3 GW of installed solar PV projects (about 10% of China’s installed solar capacity at the end of 2014) by China General Certification Center in 2014, indicated that a third of 425 utility-scale solar parks surveyed had several defects including faulty solar modules, poor construction, design flaws, and project mismanagement. These solar parks, built in China between 2012 and 2014, are likely to yield lower power output than originally estimated.

In light of recently identified quality issues in the domestically manufactured solar PV modules, investors and developers have increased caution in selection and implementation of solar projects in China. For instance, in a recent interview with Bloomberg, CEO of Sky Solar, a Hong Kong-based solar developer, said that the company plans to invest in China only at a “careful” pace because of quality concerns. This might be indicative of broader industry’s concerns that might hamper the rapid development of solar plants in the country.

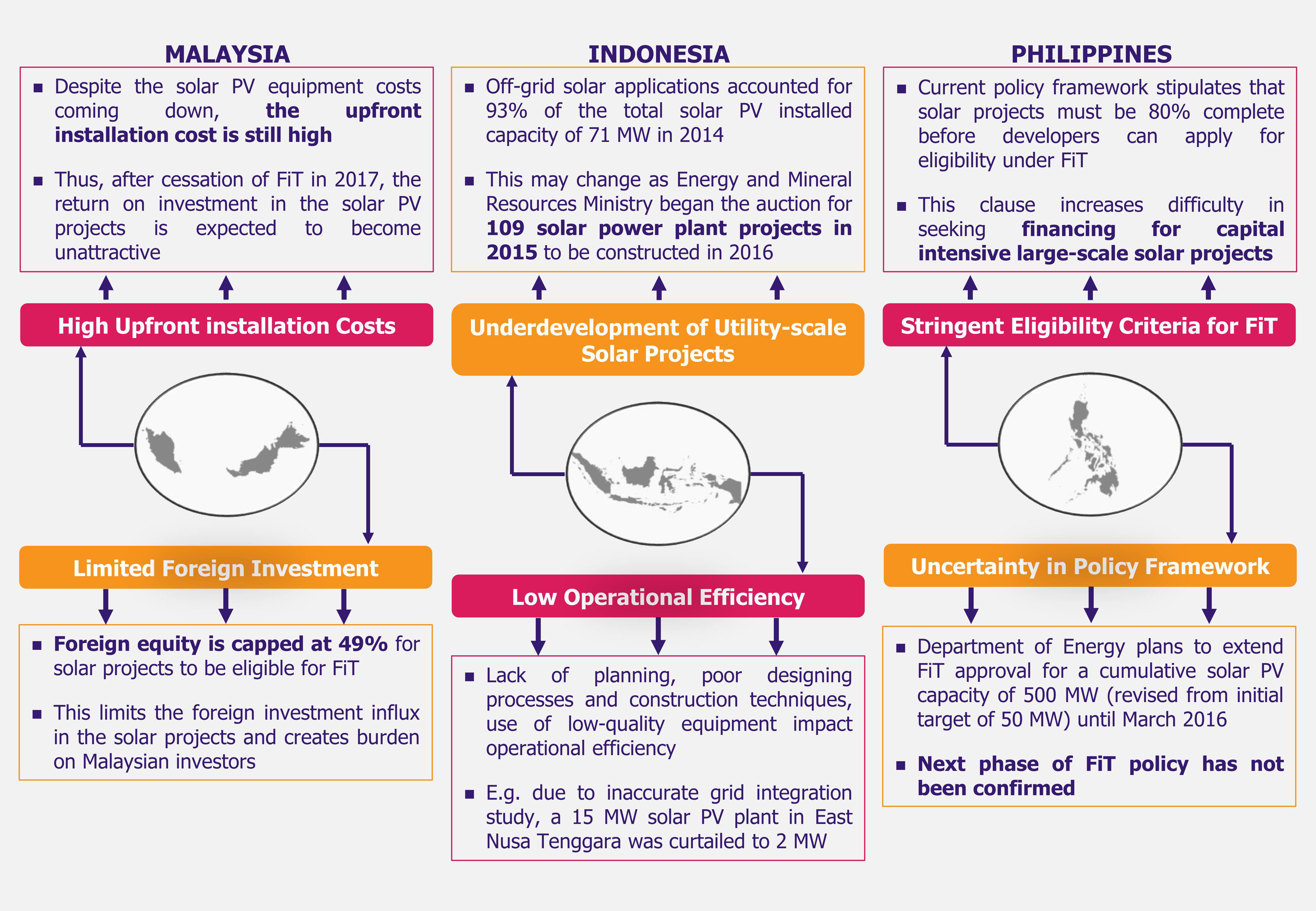

Opportunities for Global Solar Companies

Global solar developers seek manifold opportunities in China’s expanding solar market

Global solar companies are keen to grasp the opportunities offered by rapidly growing China’s solar market. With the market’s expansion, a surge is expected in demand for imports of certain materials and instruments utilized in solar equipment manufacturing in the country.

Participation from foreign solar firms in development of utility-scale solar PV projects in China is increasing in the form of joint development ventures. For instance, in 2014, SunPower, a California-based solar developer, announced plans to develop 3 GW of solar PV in Sichuan province in collaboration with four Chinese partners. SunEdison, another US-based solar energy company, is planning to partner with Chinese companies for development of 1 GW of utility-scale solar project in the country.

Foreign solar developers also see opportunity in China’s distributed solar PV sector. For instance, UGE International, a US-based firm offering renewable energy solutions, has partnered with Blue Sky Energy Efficiency, a Hong Kong-based energy investor, to offer the power purchase agreements (PPA) to customers in China.

“Blue Sky and UGE are bringing an innovative solar energy financing structure to China that will make it possible to rapidly expand use of on-site renewable energy with no money down.” – Rosie Pidcock, Senior Manager of Commercial Solar, UGE International, 2015

According to Solar Energy Industries Association, solar PPA is a financial agreement where a developer arranges for the design, permits, financing, and installation of a solar energy system on a customer’s property (rooftop) at little to no cost. The developer sells the power generated to the host customer at a fixed rate that is typically lower than the local utility’s retail rate. This lower electricity price allows the customer to purchase electricity at a rate lower than when purchased from the grid while the developer receives revenue from selling electricity as well as tax credits and other incentives generated from the system. PPAs are common in the USA, but they will be introduced in China for the first time in 2015. PPA financing structure will provide solar electricity to local and multinational corporations operating in China at a cost lower than conventional electricity without any capital investment. Hence, success of PPA is expected to boost the growth of distributed solar PV in China.

Inadequate domestic supply of some materials and instruments used in solar equipment manufacturing will encourage global exporters to strengthen their focus on Chinese market

Foreign companies may explore opportunities to export critical materials and components used in manufacturing of solar equipment to China. According to a report released by CCM in 2015, a Guangzhou-based research firm, China relies on imports for about 40-50% of its polysilicon (a key commodity for solar PV panel production) needs. In 2014, China imported around 93,000 tons of polysilicon worth US$2 billion. Other materials used in production of solar PV modules, including silver paste, TPT back sheets, EVA encapsulant film, and slurry material, are also short in supply in China. Furthermore, huge demand is anticipated for advanced equipment required to separate high-purity polysilicon, including hydrogenation furnaces, large-scale casting furnaces, plasma enhanced chemical vapor deposition (PECVD) coating equipment, and automatic screen printing presses. China is dependent on imports of these materials and technologies used in solar PV module production, and thus, the ongoing expansion of Chinese solar market will provide great opportunities to global suppliers of these commodities.

Despite a few challenges, China’s solar market is believed to be set for rapid expansion, at least for the foreseeable future

China is installing solar PV capacity at a breakneck pace. The country is already the largest producer of solar PV modules in the world and if it is able to achieve its solar targets, it might become the largest solar power consumer as well. Chinese government’s support for the development of solar market to achieve its ambitious solar targets by 2020 will serve as a key growth driver. However, China’s ability to establish strong and lasting position as the world’s largest solar power market will be dependent on its ability to efficiently deal with challenges it is facing, challenges significant enough to cause caution amongst private investments. The industry would need to focus on potential quality issues identified in domestically produced solar equipment in order to uphold investors’ confidence. The government’s role must also extend beyond the support for solar generation targets, to include development of distributed solar PV sector, that would need additional stimulus from government to pick up pace.