One Belt One Road (OBOR) Initiative, also known as Belt and Road Initiative (BRI), is part of China’s development strategy to improve its trade relations with countries in Asia, Europe, the Middle East, and Africa. OBOR envisions to not just bring economic benefits to China but to also help other participating countries by integrating their development strategies along the way. It has the potential to be one of the most successful economic development initiatives globally. Opportunities are countless for investment along this route. Multinational companies are looking to make the most out of this project, however, capitalizing on this opportunity will not be easy. To benefit from this initiative, companies need to understand that assiduous research and effective long-term planning is crucial, as the nations involved, though offer economic growth, will also present a series of geopolitical risks and challenges.

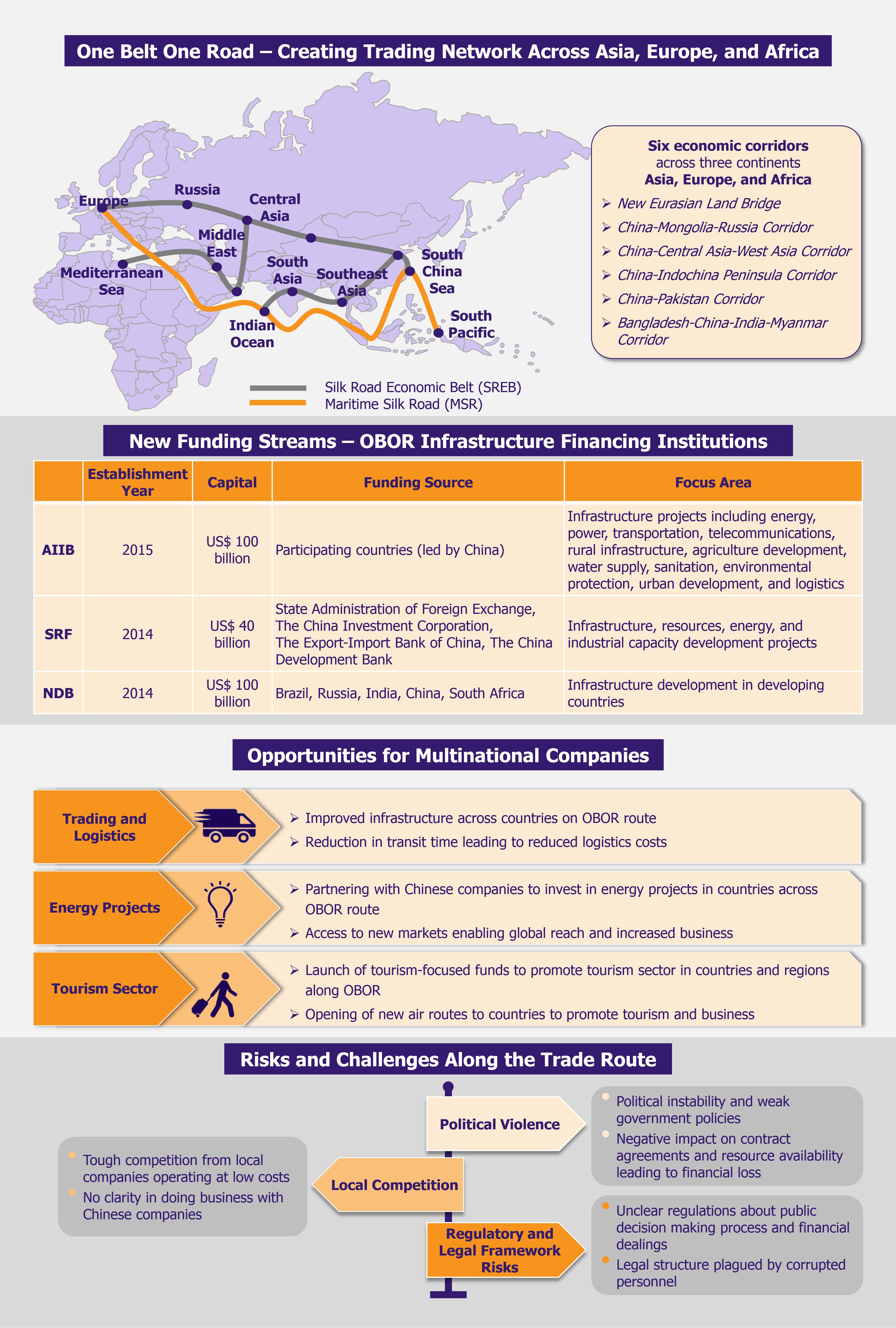

Chinese President Xi Jinping unveiled OBOR in 2013, aiming to improve relations and create new links and business opportunities between China and 64 other countries included in the OBOR. The initiative has two main segments: The Silk Road Economic Belt (SREB), a land route designed to connect China with Central Asia, Eastern and Western Europe, and the 21st-Century Maritime Silk Road (MSR), a sea route that runs west from China’s east coast to Europe through the South China Sea and the Indian Ocean, and east to the South Pacific. These two routes will form six economic corridors as the framework of the initiative outside China – New Eurasian Land Bridge, China-Mongolia-Russia Corridor, China-Central Asia-West Asia Corridor, China-Indochina Peninsula Corridor, China-Pakistan Corridor, and Bangladesh-China-India-Myanmar Corridor.

OBOR brings opportunities and challenges

Multinational companies will have a plethora of opportunities to explore along these economic corridors – for instance, trading companies can take advantage of these routes for logistics, while energy companies can use these corridors as gateways for exploring new sites of natural resources such as oil and natural gas. Along with dedicated routes, OBOR will require huge investment which is proposed to come from three infrastructure financing institutions set up as a part of this initiative – Asian Infrastructure Investment Bank (AIIB), The Silk Road Fund (SRF), and The New Development Bank (NDB).

The development of OBOR opens up a range of opportunities for overseas businesses. However, with the initiative being launched by the Chinese government and all the six corridors running across the country, it is clear that China will play a major role in most of the business collaborations. Thus, multinational companies investing in OBOR can prefer to partner with Chinese companies and leverage the partnership to access projects and assignments in other countries. Companies are also likely to be able to access new routes to sell products cheaply and efficiently, but looking for opportunities across OBOR would definitely involve initial partnerships between multinationals and Chinese state-owned enterprises.

Oil, gas, coal, and electricity

Oil, gas, coal, and electricity

OBOR has the potential to open up opportunities for collaboration in the areas of oil, gas, coal, and electricity. Several energy opportunities may emerge with the OBOR initiative, and these energy-related investment projects are likely to be an important part of OBOR. For instance, the Gwadar-Nawabshal LNG Terminal and Pipeline in Pakistan includes building an LNG terminal in the Balochistan province and a gas pipeline between Iran and central Pakistan. Estimated at a total value of US$46 billion, the project was announced in October 2015 along the China-Pakistan Economic Corridor.

Energy projects along OBOR include initiatives largely by Chinese companies due to funds coming in from China-led financial institutions. In another investment, General Electric, an American corporation, signed a pact with China National Machinery Industry Corporation (Sinomach), in 2015, to offer project contracting (for supply of machinery and hardware tools) for developing a 102-MW Kipeto wind project in Kenya. The project aims to set up 2,036 MW of installed capacity from wind power by 2030. Kipeto wind project was originally a part of US president Barack Obama’s ‘Power Africa’ initiative, but with Sinomach joining in hands, it is clear that more initiatives like this can be expected to come up in the near future as a part of OBOR.

Logistics

Players in the logistics industry can also benefit from the improved infrastructure along the OBOR. In 2015, DHL Global Forwarding, providing air and ocean freight forwarding services, started its first service on the southern rail corridor between China and Turkey, a critical segment of China’s OBOR initiative. This rail corridor is expected to strengthen Turkey’s trading businesses along with benefiting transport and freight industries of Kazakhstan, Azerbaijan, and Georgia. Logistics companies can also initially partner with local postal or freight agencies to set up new business in these regions. OBOR can provide fast, cost-effective, and high-frequency connections between countries along the route. Improved infrastructure, reduced logistics costs, and better transport infrastructure will also contribute to driving e-commerce businesses in the regions.

Tourism

Tourism is expected to also see a major boost as a result of OBOR initiative. As connectivity between countries improve and new locations become easily accessible, the tourism industry is expected to see positive growth in the coming years. To support tourism, Evergreen Offshore Inc., a Hong Kong-based private equity firm, in 2016, launched a US$1.28 billion tourism-focused private equity fund called Asia Pacific One Belt One Road Tourism Industry Fund to boost relations between China and Malaysia by investing in tourism sector. The company invested in Malaysia as the country is considered an ideal investment destination for a long-term gain. This is in sync with the long term vision of OBOR to promote tourism sector in countries and regions along the MSR.

As OBOR develops, new markets along the routes are likely to open to business. The already existing routes will experience business diversification as infrastructure and connectivity improves. Trade barriers will most likely reduce as developing countries become more open to international investment which brings new jobs, better infrastructure, economic growth, and improved quality of life. There is bound to be growth in consulting business, professional services, and industrial sectors apart from trade and logistics.

EOS Perspective

While OBOR initiative assures opportunities for multinational companies, the path may not be smooth for all. Investing in these new geographies, companies will come across various economies with different legal and regulatory frameworks. Political stability is also a matter of concern – some regions may have sound political structures while others may be dealing with ineffective government policies. In fact, political instability and violence are some of the key challenges in the development of OBOR. Weak government policies and lack of communal benefit lead to political instability including terrorism and riots. These factors influence the availability of resources, negatively impact the setting up of businesses locally, thus resulting in financial losses for multinationals. Local investments need policies and investment protection backed by the governments to facilitate growth which is far more difficult to achieve in case of political and economic instability. Taking advantage of the opportunities associated with OBOR may be of strategic importance, but the companies need to be cautious about the obstacles associated with it.

While OBOR initiative assures opportunities for multinational companies, the path may not be smooth for all. Political instability and violence are some of the key challenges in the development of OBOR.

Local competitors will also present obstacles to multinational firms. The competition is stiff for international players as local companies can operate better in riskier environment at low operating costs. Not only will regional companies pose a threat for survival of multinationals, in many scenarios, partnering with Chinese companies will also be a massive challenge. Many Chinese companies do not implement a clear structure while partnering with other international companies. Decision making and profit sharing is often not properly documented. Lack of clarity in business dealings give these state-owned enterprises an upper hand.

Complexity and lack of transparency in local regulatory framework for setting up a new business is also a hindrance for investments in many geographies along the OBOR. Absence of clear policies and delays in decision-making processes can prove too challenging for companies to adapt to which may even lead to financial losses or failed attempts to establish local operations. Issues such as corruption, challenges associated with supply chain security, and financial risks are some of the other obstacles that companies are likely to face while setting up businesses in new countries along the OBOR route.

Complexity and lack of transparency in local regulatory framework are a hindrance for investments in many geographies along the OBOR.

OBOR is still in the initial years of implementation. The initiative offers great potential for developing regions in need for improved infrastructure and economic growth but what this really means for multinational companies is still somewhat unclear. It encourages participation from international companies to turn the initiative a success, but there are no clear guidelines on how these investments would be integrated into the OBOR. With a major part of investment coming from China-based institutions, dominance of Chinese companies in major projects cannot be avoided. While the underlying aim of the initiative is to reduce China’s industrial overcapacity and to strengthen its economy, there are concerns about the part being played by multinational companies. To what extent would they participate, who would be the main investor (Chinese company or multinational companies), and how much share and what say would the multinational company have in a project, etc., are some of the questions that still remain unanswered.

With major part of investment coming from China-based institutions, dominance of Chinese companies in major projects cannot be avoided.

In view of these risks and challenges, we believe it is too early to estimate the scale of potential monetary benefits for companies wanting to invest along the OBOR route to expand their businesses. It will surely not be easy for multinational companies to compete for benefits from OBOR in an environment heavily dominated by Chinese companies. Developing business policies and financing schemes through related institutions can help the multinational firms to benefit from this initiative in the long run. There is no doubt that OBOR has the potential to open new markets for doing business by redrawing the global trade map, however, with no clarity and transparency on the role MNC’s as part of OBOR initiative, companies need to correctly identify the best opportunity by accessing the right market and find effective ways to mitigate a wide range of associated risks. For now, the future role of MNC’s in this environment is uncertain. They will have to wait and watch to work out a stable business arrangement. But in current times of global geopolitical turbulence, such a harmony is never guaranteed.

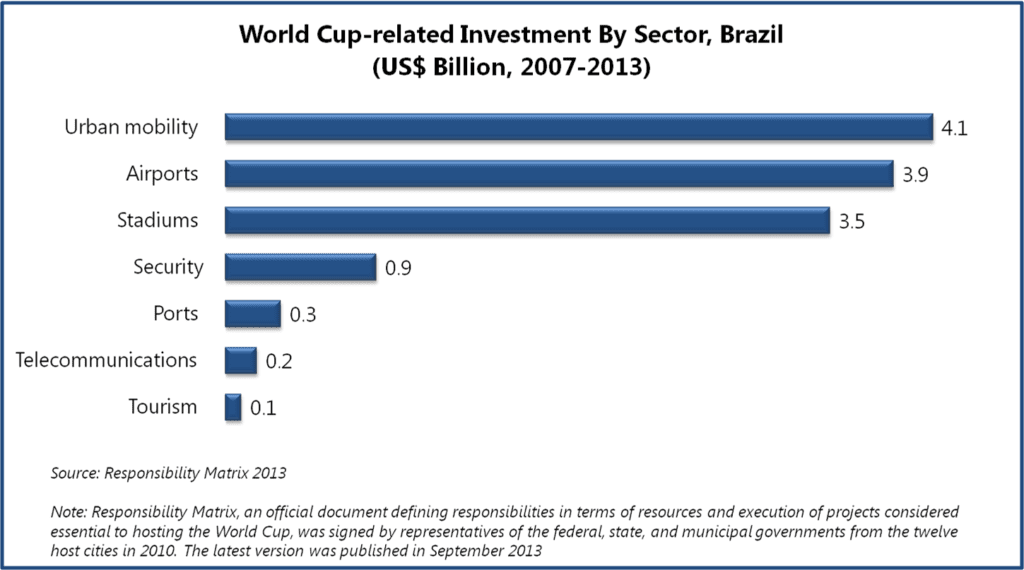

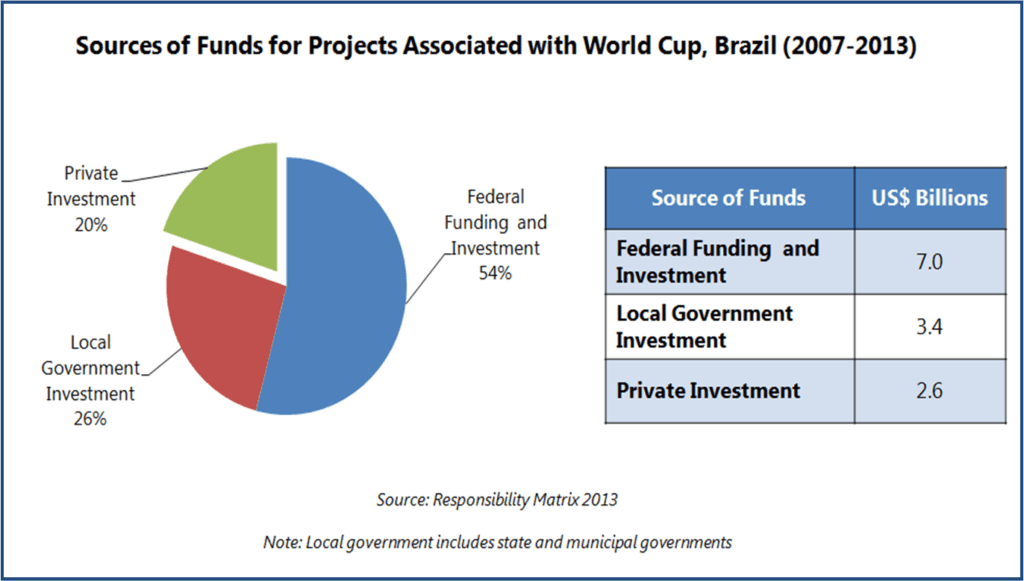

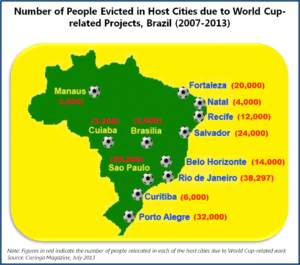

Between 2007 and 2013, about 248,297 people were forced to leave their homes due to infrastructure work for the tournament. Social activists claimed that most of the designated areas for relocation were at far distances from former dwellings and were less developed. There have been complaints that the compensations offered by the government to people for relocation were unfair and insufficient.

Between 2007 and 2013, about 248,297 people were forced to leave their homes due to infrastructure work for the tournament. Social activists claimed that most of the designated areas for relocation were at far distances from former dwellings and were less developed. There have been complaints that the compensations offered by the government to people for relocation were unfair and insufficient.