Japan is the world’s fourth largest automotive manufacturer, behind China, the USA, and India. The country has been long known for its innovation, technology, and efficiency in car manufacturing. Despite being one of the automotive superpowers, Japan has been slowly losing its dominance, struggling to maintain its competitive edge on the global stage. Rising consumer demand for electric vehicles (EVs) and Japan’s slower rate of adopting EV technology have largely contributed to this downfall. In 2022, Japanese brands accounted for less than 5% of global EV sales.

A 2022 report by the Climate Group, an international non-profit organization, warns that if Japan fails to adapt swiftly to global EV trends, the country could witness a 50% reduction in auto exports, impacting over 14% of its GDP by 2040.

Japan prioritizes hybrids and plug-in hybrids over electric vehicles

Japanese automakers are the pioneers of the EV development. Toyota launched Prius, the first mass-produced hybrid vehicle, in 1997, marking a significant development in the global automotive industry. Following Prius, Nissan launched Leaf in 2010, which gained significant attention worldwide as the first mass-produced battery electric vehicle.

Despite being the first to the EV revolution, Japan has failed to make a strong footprint in the global EV race so far. Japanese automakers have been largely skeptical about the EV’s future, profitability, and proposed environmental benefits. This has led them to tread cautiously. Instead, the Japanese government views hybrids (HEVs) and plug-in hybrids (PHEVs) as a strategic priority. It claims these vehicles meet both emissions targets and offer customers electrification features.

However, other major markets, such as the USA, China, the EU, and the UK, are trying to curtail HEVs and internal combustion engine vehicles (ICEVs) sales within the next 10-15 years. For instance, in 2021, the EU Commission announced a ban on ICEVs, including HEVs and PHEVs, starting in 2035. Similarly, the UK government proposed to ban all ICEVs beginning in 2035.

While Japan decided to ban gasoline vehicles by 2030, much of its focus is on promoting HEVs. Japan currently dominates the global gasoline-electric hybrids (HEVs) market and hopes to leverage its massive investment in the technology. Consequently, the country has delayed a significant push for EV adoption. Japan’s strong emphasis on hybrid technology has made other countries, especially China, gain a massive lead in developing and commercializing battery electric vehicles (BEVs).

With the looming bans on ICEVs and the increased consumer preference for BEVs over gasoline-powered engines, the limited number of Japanese BEVs on the market has led to a subsequent loss of market share for Japanese automakers.

Traditional auto manufacturing environment makes the EV switch difficult

Japan’s economy is intertwined with its auto industry. Automotive manufacturing accounts for about 2.9% of the country’s GDP and 14% of the manufacturing GDP. The country spent years working on perfecting the ICEV automotive technologies and manufacturing. Japan wishes to retain its advantage from ICEVs for as long as possible. The current prevalence of traditional manufacturing capabilities and well-established supply chains make the country hesitant to switch to EVs.

ICEVs and EVs cannot be manufactured on the same platform. Remodeling existing ICEV facilities into EV facilities is a daunting and cost-intensive task. Moreover, as EVs require fewer parts, Japanese automakers are concerned about the impact on their extensive networks of components and parts suppliers, which could disrupt the entire industry.

Further, the significant costs associated with developing EV production technologies and platforms have led these automakers to question the potential profitability of EVs. Japan’s complacency with ICEVs has resulted in its lagging position in the global EV race.

Japan’s focus on fuel cell vehicles hampers EV development

Japan is a country with the least self-sufficient energy system. The country imports over 90% of its energy, heavily relying on foreign sources. Energy independence has been Japan’s major strategic goal for many years now. The government views hydrogen as a crucial clean energy source since the country can produce it domestically. On the contrary, EVs use electricity and could further increase the country’s energy dependence.

The government invested about US$3 billion between 2012 and 2021 in hydrogen technology. Some 70% of that was dedicated to fuel cell vehicles (FCEVs) and related infrastructure. The country aims to sell 800,000 FCEVs by the end of 2030 and provides massive subsidies and funds to Japanese automakers to research, develop, and commercialize FCEVs.

Thanks to substantial government support, in 2014, Toyota launched Mirai, the first mass-produced fuel cell vehicle. However, high fuel costs and insufficient hydrogen infrastructure have slowed its adoption in the country. As of January 2023, Japan had only built 164 hydrogen stations nationwide, far behind the target of 1,000 stations by 2030.

FCEVs demand and sales have not picked up the pace owing to the limited number of fueling stations and FCEVs’ high running costs. Automakers sold only 8,283 fuel cell vehicles by the end of July 2023. This was far below the sales that could lead to the 800,000-vehicle target set for 2030. Japan’s heavy focus on hydrogen technologies contributes to the slow EV transition, impacting its competitiveness in the global automotive space.

Increased EV competition puts Japan in a tight spot

Due to the surging interest in EVs, automakers from China, South Korea, Germany, and the USA have disrupted Japan’s dominance in the automotive sector over the past few years. This shift is especially evident in emerging markets such as Southeast Asia, with a surging demand for EVs. International automakers, especially the Chinese, have slowly expanded their presence in this region.

For instance, several Chinese automakers have entered Indonesia over recent years, challenging Japan’s long-standing dominance of the Indonesian automotive market. Wuling, a prominent Chinese EV automaker, has gained significant popularity in Indonesia, making it the seventh preferred car brand. In May 2024, BYD, another Chinese automaker, announced its plans to build a US$1 billion EV production facility in West Java, Indonesia. To be completed in 2026, this facility would significantly improve the Chinese market presence in Indonesia, which might further weaken the Japanese market share. Meanwhile, South Korean automakers Hyundai and Kia are also making significant strides in the Indonesian market.

Japanese automakers have also been losing their grip in Thailand as EVs are gaining traction. In 2023, new vehicle sales of Mazda, Mitsubishi, Nissan, Suzuki, and Isuzu fell by 25% in the country, while the market share of Chinese brands increased to 11% from 5% the previous year. As a response to these shifting dynamics, Japanese automakers either choose to close or merge factory operations in Thailand. In June 2024, Suzuki Motor decided to stop making cars in Thailand altogether. China’s BYD and Great Wall Motor are spending US$1.4 billion on new EV production and assembly facilities in Thailand to facilitate domestic production and overseas sales.

Sales of Japanese brands have also plunged in China in recent years. Amid low sales and intense EV competition, in October 2023, Japanese automaker Mitsubishi Motors announced its exit from a joint venture with the Guangzhou Automobile Group, a China-based automotive manufacturer. They shut down all the local manufacturing operations.

With the rising preference for EVs, Japanese automakers will likely face more fierce competition, which could profoundly transform their position in the global automotive landscape.

Toyota and Honda look to strengthen overseas EV manufacturing capabilities

Amidst increasing competition, Japanese automakers have recently started investing in EV technologies and production to catch up with rivals such as China, Europe, and the USA. Large carmakers, such as Honda and Toyota, are looking to develop and commercialize solid-state batteries to enhance the competitiveness of their EV line-up in the global EV market. These batteries are relatively safer than lithium-ion batteries, offering greater energy density and quick charging times. For instance, Toyota claims its first-generation solid-state batteries would cover a range of about 520 miles (about 830 km), with a 10-minute charging capability.

Toyota and Honda want to strengthen their EV supply chain, especially in North America. Toyota plans to launch a three-row electric SUV in the USA in 2025, now postponed to 2026. This SUV will be the company’s first electric car assembled locally. Toyota invested US$8 billion in its Princeton, Indiana facility to support production and added a new battery pack assembly line. The company has also invested considerably in preparing its facility in Kentucky for another three-seater electric SUV manufacturing.

In the European market, Toyota is looking to release six electric models by 2026 amidst the increasing demand. As its sales are shrinking in China, Toyota plans to launch an EV with autonomous driving technology in 2025. In Thailand, Toyota is set to launch an electric pickup truck in 2024.

In January 2024, Honda announced an investment of US$14 billion to build an electric car and battery plant in Ontario, Canada. The carmaker also announced an investment of US$700 million to start EV production in Ohio, USA. Honda said it would invest nearly US$65 billion in EVs till 2030. It plans to sell two million BEVs by 2030 and aims to make 40% of the vehicle sales either EV or FCEV by the same year.

Nissan, another giant Japanese carmaker, plans to achieve 40% of global offerings as EVs by 2026. However, Nissan’s EV strategy is largely unclear compared to Toyota and Honda. As Nissan struggles to counter the EV dominance, the company has increasingly leveraged partnerships with carmakers such as Mitsubishi and Renault to bolster its EV supply chain and production. In March 2024, Nissan and Honda did a joint feasibility study on vehicle electrification. Together, the companies look to develop automotive software platforms, core components related to EVs, and other electrification components.

Suzuki Motor has also announced its plans to invest approximately US$35 billion by 2030 in BEVs. The company plans to introduce BEVs in Europe, Japan, and India over the next few years.

Some smaller automakers, such as Subaru, Mazda, and Mitsubishi Motors, are still unclear about their EV transition and face daunting challenges in rolling out EVs.

EOS Perspective

Japanese automakers are realizing their difficult position and plan to bolster their EV manufacturing and technological capabilities. However, it requires significant efforts, and the road to EV transition will not be easy.

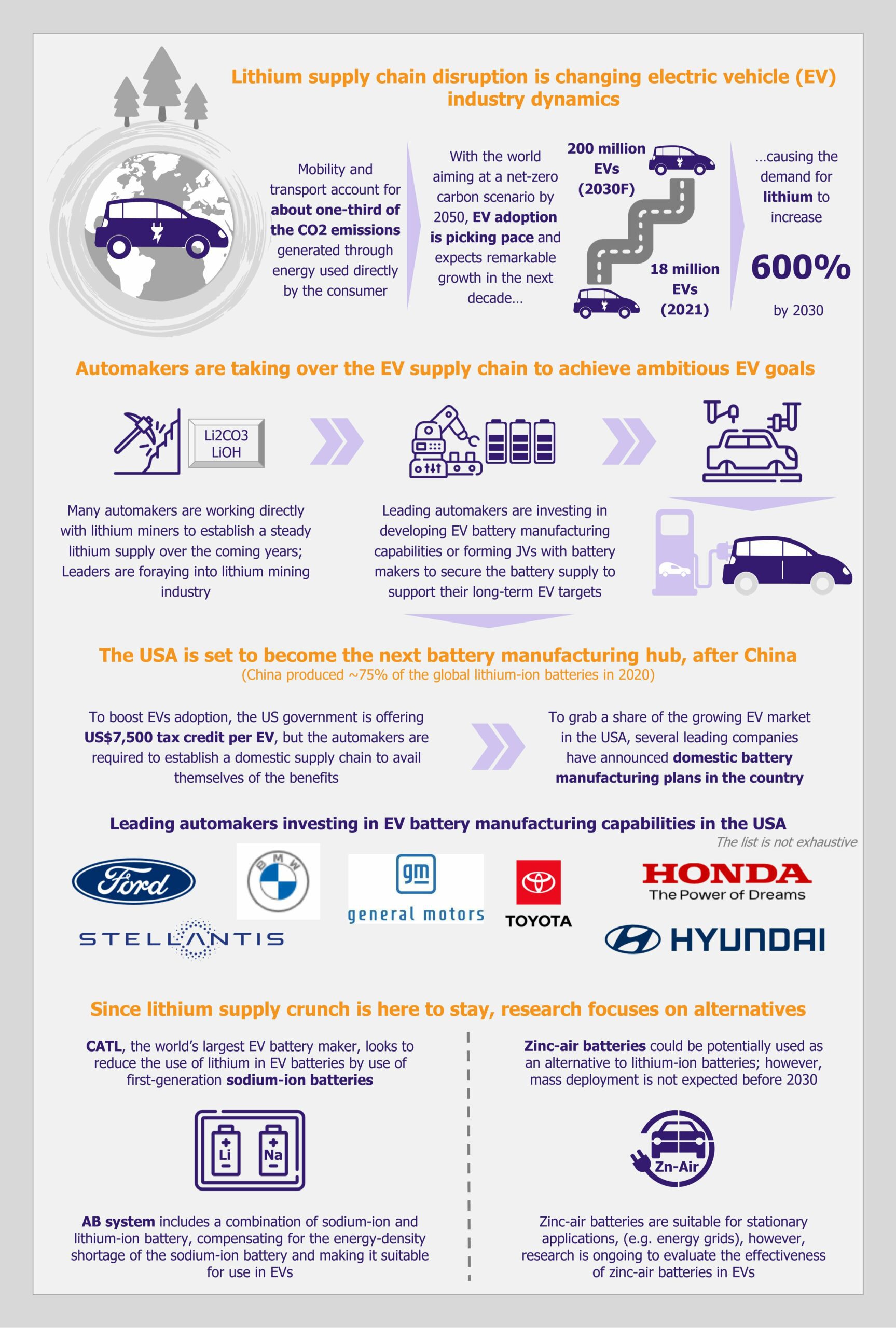

One of the critical factors affecting Japan’s EV adoption is the supply chain constraints. Japan does not possess the minerals necessary to make batteries for EVs. The country primarily depends on its rival, China, for approximately 60% of its rare earth requirements. Globally, China refines 90% of critical minerals, including 60% to 70% of lithium and cobalt, needed to make EV batteries. The Japanese government is looking to diversify its EV manufacturing supplies to reduce its reliance on China. The country has taken significant strides to develop critical mineral resources with other countries such as the USA, Indonesia, and Australia. Inevitably, all these efforts would take a lot of time and money.

Japanese automakers are also less proficient in vehicle software development, an aspect that EVs require to a great extent. To address this challenge, leading Japanese automakers have partnered with other automotive companies to develop software for EVs. In August 2024, Honda, Mitsubishi Motors, and Nissan announced a collaboration to develop software-defined vehicles (SDV), to standardize battery technology, and to reduce EV production costs.

Mass-producing EVs at a competitive price is one of the other significant challenges for Japanese automakers. Currently, China-based BYD and CATL supply 50% of the batteries for EVs globally. These companies spent years perfecting the cost-effective battery technology using lithium iron phosphate (LFP) cathodes. They have strong expertise in efficiently transferring innovations from R&D into large-scale production.

However, unlike China, Japan still depends on lithium-ion batteries using NMC cathodes, which involve lithium, nickel, manganese, and cobalt. These batteries are cost-intensive in comparison to China’s LFP batteries. BYD and CATL produce batteries at lower capital costs (below US$60 million per gigawatt hour). In comparison, Japan’s Panasonic produces batteries at US$103 million per gigawatt hour. It would take years for Japan to perfect the battery technology and mass-produce EVs at affordable prices.

Japan has also not yet established comprehensive policies and strategies to push EV adoption. Stringent regulations have hampered the expansion of EV charging infrastructure in the country. On the other hand, since the 2010s, countries such as the USA, China, and Norway have started implementing measures such as EV purchase subsidies, tax rebates, and procurement contracts to promote EV sales. China invested over US$29 billion between 2009 and 2022 in promoting EVs. If Japan does not take similar measures soon, its ability to foster an EV-friendly environment will be significantly compromised.