The utilization of retail health clinics (RHCs), also known as convenience care clinics, peaked during the coronavirus outbreak, with people rushing to get COVID-19 vaccinations or treatment for minor ailments when access to other care settings was restricted. FAIR Health (a non-profit organization managing a repository of 40 billion claim records) indicated that the utilization of RHCs increased by 51% from 2020 to 2021. Accordingly, the US retail health clinic market grew from US$1.78 billion in 2020 to US$3.49 billion in 2021 (as per estimates by Fortune Business Insights). With increasing familiarity and utilization, are RHCs set out to play a bigger role in the nation’s healthcare system?

RHCs move beyond low-acuity care

RHCs began with the concept of providing low-acuity care, spanning from minor illnesses and injuries to occasional visits for vaccinations or wellness screening. Increasingly, retailers are eyeing a larger share of the primary care market by making inroads into chronic disease management. Several are even expanding into mental and behavioral health.

- Vaccinations

In 2022, nearly 40% of the patients at the RHCs came in for vaccinations. Much of this footfall can be attributed to the public health advisory recommending booster shots for COVID-19 vaccination. Even though the need for COVID-19 vaccinations is gradually expected to decline, the pandemic has established RHCs as a convenient venue for vaccinations. Before the coronavirus outbreak, about 50,000 adults died every year from ailments that could be prevented by vaccines, highlighting the value offered by RHCs in immunization delivery.

- Diagnostics

During the pandemic, RHCs became a key provider of COVID-19 testing. Almost all the RHCs today have point-of-care testing capabilities. Flu and strep tests, lipid tests, pregnancy tests, glucose tests, etc., are among the diagnostics tests commonly offered at the RHCs. As RHCs aim to expand their services to penetrate deeper into the primary care market, the scope of diagnostic services is likely to widen. For instance, Walmart, which opened its first RHC in 2019, provides EKG tests and X-ray imagining services on-site as well.

- Chronic disease management

In 2022, the Centers for Disease Control and Prevention (CDC) estimated that six in ten adults live with a chronic disease. This data indicates the vast opportunity this segment has to offer, and RHCs are vying for a piece of it. Analysis by Definitive Healthcare suggests that, in 2022, about one in ten diagnoses at the RHCs was related to a chronic condition. Nearly 6% of the claims were with the diagnosis of diabetes (Type 2 diabetes mellitus without complications and Type 2 diabetes mellitus with hyperglycemia).

As the opportunity for RHCs to contribute more to chronic disease management is vast, retailers are focusing on evolving the clinic offerings to provide treatment for chronic conditions such as diabetes, hypertension, chronic obstructive pulmonary disease, kidney disease, etc. For instance, in 2020, CVS launched HealthHubs, an enhanced RHC format, offering a larger suite of services including chronic disease management.

RHCs are able to provide chronic disease management at a lower cost. For instance, in 2022, the average charge per claim for Type 2 diabetes mellitus without complications was US$160 at an RHC compared with US$367 at a physician’s office, whereas for Type 2 diabetes mellitus with hyperglycemia, the average charge per claim was US$255 at RHC vs. US$639 at a physician’s office. Given that a chronic disease requires continuous long-term care, patients see RHC as a cost-effective and viable option for chronic disease management.

- Mental and behavioral health

In early 2022, the Harris Poll data (based on a monthly survey among 3,400 people over the age of 18, physicians, and pharmacists) indicated that 41% of Gen Z and younger millennials were suffering from anxiety or depression conditions. However, the same study found that only 16% of those struggling with these mental conditions were comfortable seeking treatment from a therapist or mental health professional. A mystery shopper study (conducted in 2022) investigating 864 psychiatrists across five US states indicated that only 18.5% of psychiatrists were taking appointments for new patients with a significant wait time (median = 67 days). A person going through a breakdown or depression needs immediate attention. Thus, the low availability of psychiatry outpatient new appointments is concerning and one of the main reasons why mental health issues remain under-treated. With walk-in appointments and easy accessibility, RHCs are well-positioned to fill this gap.

Leading RHC chains have forayed into mental and behavioral health services. In 2020, MinuteClinic (an RHC chain owned by CVS) started offering mental and behavioral health counseling services. The company also added Licensed Mental Health Providers to its staff at select locations. In the same year, Walmart announced counseling services for US$1 a minute in partnership with Beacon Care Services, a subsidiary of Carelon Behavioral Health (formerly Beacon Health Options).

Patient-centric approach differentiates RHCs from traditional providers

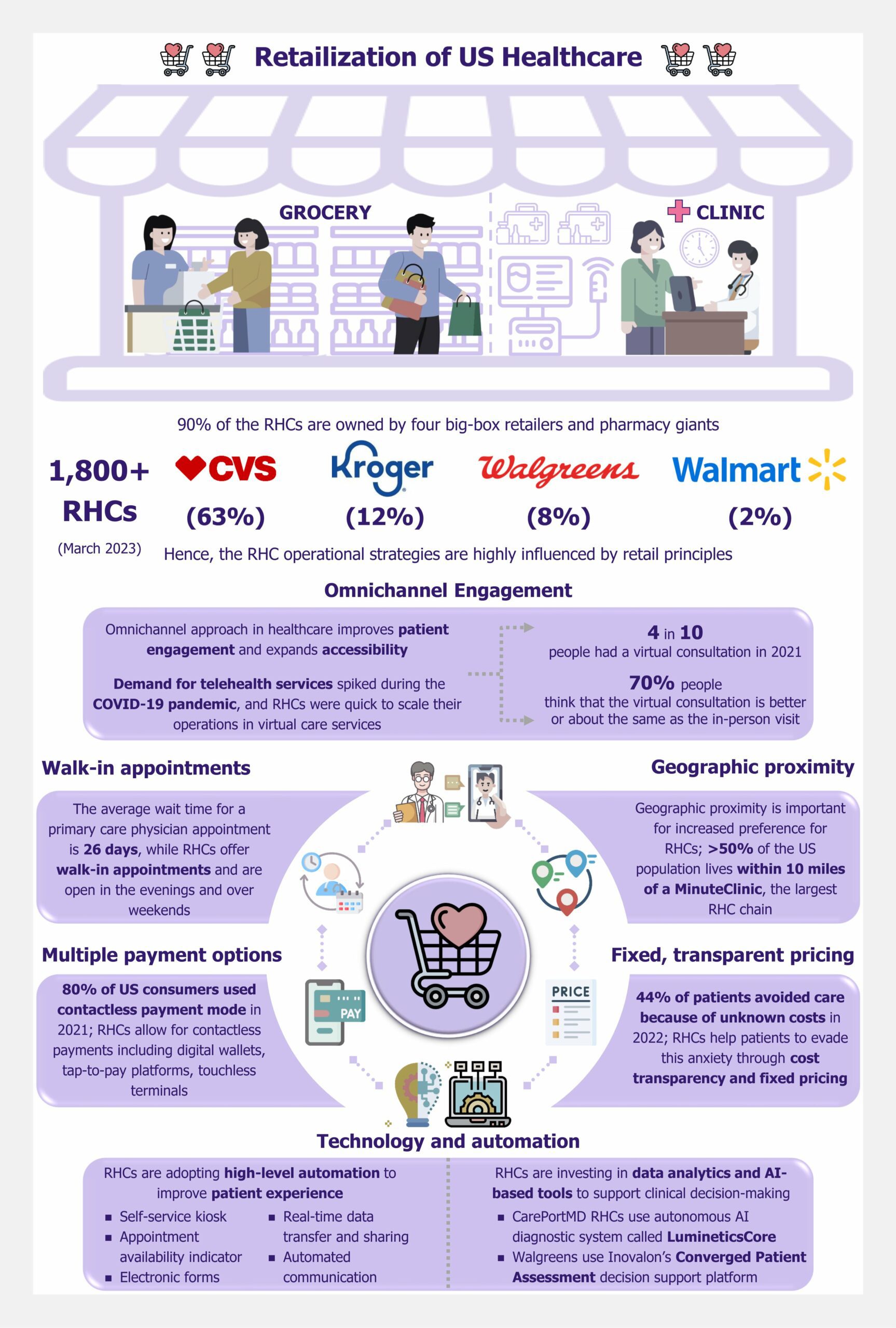

Definitive Healthcare estimates that as of March 2023, there were 1,800+ RHCs, of which 90% were owned by retail and pharmacy giants CVS (63%), Kroger (12%), Walgreens (8%), and Walmart (2%). Noticeably, the consumer-centric concepts and learnings from the retail segment have helped RHCs improve patient experience and satisfaction. Implementation of proven retail strategies is, in turn, defining and shaping the convenient care model and setting apart the RHCs from traditional healthcare providers.

- Omnichannel engagement

Omnichannel engagement is a key retail concept enabling companies to offer a seamless consumer experience across various touchpoints. Health Care Insights Study 2022, based on a survey of 1,000 US-based respondents, indicated that four in ten people had a virtual consultation in the past year. The same study suggested that ~70% of the respondents think that the virtual consultation is better or about the same as the in-person visit. RHCs, owned by big-box retailers and pharmacy giants, are seizing the omnichannel opportunity by complementing their in-person visits with virtual care services.

MinuteClinic (owned by CVS) started piloting telehealth services in 2015. In 2021, the company provided 19 million virtual consultations, of which ~10 million were for mental and behavioral health. The Little Clinic (owned by Kroger) stepped into telehealth services following the country-wide shutdown due to the coronavirus outbreak in March 2020. In 2021, with the aim to extend virtual care, Walmart Health acquired MeMD, a 24/7 telehealth company providing on-demand care for common illnesses, minor injuries, and mental health issues.

- Walk-in appointments

The average wait time for a primary care physician appointment in the 15 largest cities of the US was 26 days, as per Merritt Hawkins survey data (2022). RHCs typically accept walk-in patients. Moreover, RHCs are open for extended evening hours and over weekends when primary care physicians are not available. This allows the patients to visit an RHC at their convenience.

- Geographic proximity

RHCs benefit from the wide footprint across the country established by their owners, the big-box retailers. For instance, CVS, operating 1,100 retail clinics across 33 states, indicated that more than half of the US population lives within 10 miles of a MinuteClinic as of March 2022.

However, currently, there is a geographic disparity as the majority of the RHCs are located in urban areas, with only 2% serving the rural population. From the business perspective, it makes sense to concentrate on the metropolitan areas targeting high-income populations. Moreover, just like traditional healthcare providers, RHCs also find it challenging to hire qualified staff to work at remote locations. However, as the popularity and utilization of RHCs increase, expansion to rural areas may come as a natural progression. For instance, Walmart is uniquely positioned to capture the rural market opportunity by leveraging the presence of its 4,000 stores located in medically underserved areas as designated by the Health Resources and Service Administration.

Dollar General is the first retailer to step up and penetrate this unserved market. In January 2023, Dollar General, in partnership with DocGo (a telehealth and medical transportation company), piloted mobile clinics set up at the parking lots at three of its stores in Tennessee. This initiative is Dollar General’s first step into retail healthcare, and there is no clarity yet on whether the company is looking at the in-store clinics model.

- Fixed and transparent pricing

RHCs have fixed pricing for different types of treatments offered, and the treatment costs are communicated up-front to the patient. The Annual Consumer Sentiment Benchmark report based on a survey conducted in January 2022 indicated that 44% of the 1,006 respondents avoided care because of unknown costs. It is evident that besides the concern over affordability, the anxiety and fear around uncertain costs are making patients avoid healthcare services. RHCs help patients to evade this anxiety through cost transparency.

- Multiple payment options

At RHCs, patients receive a more retail-like experience at the time of the payment. Besides the common mode of payment such as cash and cards, the RHCs also allow for contactless payments, including digital wallets, tap-to-pay platforms, touchless terminals and, thus making the payment process faster, simpler, and more convenient. This aligns with the growing popularity of contactless transactions. 80% of US consumers used some form of contactless payment mode in 2021, as per a survey of 1,000 US consumers conducted by Raydiant (an in-location experience management platform).

- Technology and automation

Technology and automation have been an integral part of modern retail. A reflection of this is seen in an RHC setup. For instance, at CVS MinuteClinic, the reception is a form of self-service kiosk. The patient is notified of the wait time (if any) and directed to fill out the electronic forms to share important personal and health-related data. The information submitted by the patient is directly shared with the healthcare professional on-site, who then confirms the details and proceeds with the diagnosis and course of treatment. Details of the diagnosis and treatment, along with the bill payment receipt, are automatically shared with the patient at the end of the visit. The communication for follow-up consultations or other reminders is automated. The process is highly streamlined and backed by automation.

Moreover, in the RHC model, the application of technology can be seen not only to improve patient experience but also to support clinical decision-making. For instance, in 2019, CarePortMD RHCs (owned by Albertsons grocery stores) started using the autonomous AI diagnostic system called LumineticsCore to detect a leading cause of blindness in diabetic patients. Such technological additions reduce the chances of human error, thus eliminating potential liability issues as well as increasing patient confidence. Walgreens, leveraging Inovalon’s Converged Patient Assessment decision support platform that provides insights into possible diagnoses using predictive analytics, is another case in point.

EOS Perspective

With all the growth and progress, RHCs are penetrating the underserved population and strengthening the current primary care delivery model. A report released by the National Association of Community Health Centers in February 2023 indicated that about a third of the US population does not have access to primary care. RHCs are well-positioned to fill this gap. Moreover, according to the data published by the Association of American Medical Colleges in 2021, the USA could struggle with a shortage of up to 124,000 physicians (across all specialties) by 2034. In the face of physician shortage, RHCs providing non-emergency care can help to alleviate the burden on the primary care providers.

To what extent the RHCs would be able to carve out a space for themselves in the primary care segment is still an ongoing debate. However, the owners of RHCs are determined to compete head-on with the traditional providers for the primary care market share and are rapidly foraying into alternative primary care models.

In May 2023, CVS completed the acquisition of Oak Street Health providing primary care to Medicare patients through its network of 169 medical centers across 21 states.

Walgreens holds a majority stake in VillageMD, offering value-based primary care to patients at 680 practice locations (including independent practices, Summit Health, CityMD, and Village Medical clinics at Walgreens, as well as at-home and virtual visits) across 26 states. In October 2021, Walgreens acquired a 55% stake in CareCentrix, an at-home care provider serving post-acute patients. The company has plans to acquire the remaining stake by the end of this year.

Amazon is another prominent retailer that made inroads in the primary care space this year with its acquisition of One Medical, a primary care provider with a network of 200+ medical offices in 27 markets across the USA.

It is foreseeable that at some point in time, the retailers will try to bring in the synergies between the RHC business and other alternative primary care service offerings with the aim to become a one-stop shop for all healthcare needs. As retailers take on a larger role in primary care delivery, the retailization of healthcare is certainly on the way.