E-commerce in Mexico is witnessing a steady growth and is slowly becoming one of the most dynamic sectors of the country’s economy. In the last five years, e-commerce market in Mexico has grown significantly, as retailers strengthened their digital strategies to grow sales. The online channel is becoming an indispensable part of retail and despite all operational challenges that exist in the market, opportunities are too attractive to be missed.

The article is part of series focusing on e-commerce in LATAM, which also includes a look into e-commerce market in Brazil

In recent years, Mexico has attracted interest from global brands to expand in the country, where online retailing is expected to grow substantially – revenue generated by e-commerce is expected to reach US$ 17.6 billion by 2020, growing at a rate of 16.6% annually. Mexico’s distinctive geographic and demographic characteristics make it one of the most promising e-commerce markets in Latin America, where global companies are looking to expand. Its proximity to the USA is advantageous, making it an attractive target for USA-based retailers looking to grow internationally (Amazon, Walmart, Best Buy, among others). Additionally, the growing population of young, working-age, tech-savvy Mexicans with sufficient disposable income is the key target for global retail chains, particularly for companies eyeing growth through e-commerce channel.

Mexico’s distinctive geographic and demographic characteristics make it one of the most promising e-commerce markets in Latin America, where global companies are looking to expand.

Lack of consumer trust

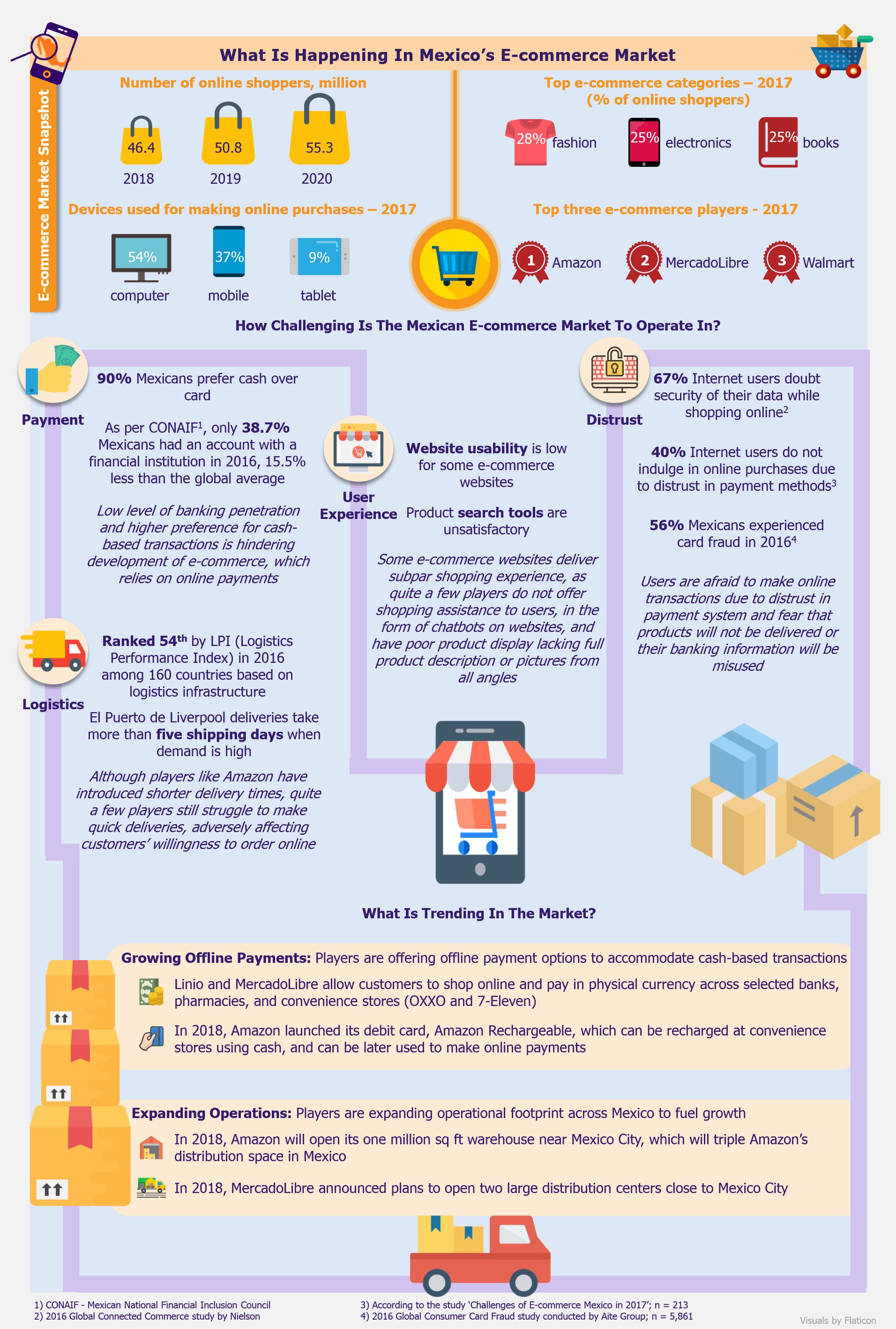

In the last five years, e-commerce has witnessed double-digit growth and the trend is likely to continue in the long term. However, the market faces few challenges, which are impeding growth. To begin with, low consumer confidence in online transactions is a major barrier. Mexican users are skeptical when it comes to internet-based transactions due to distrust in payment methods and fear that the banking information provided will be misused, amidst high level of banking-related frauds prevalent in the country. According to a study conducted by Aite Group1, in Q2 2016, 83% of the interviewed respondents witnessed identify theft, while 70% were victims to online banking frauds. Consumer willingness to make online purchases is further shattered by the unsatisfactory online shopping experience delivered by some retailers due their relatively poor website designs and product display. According to a joint study by The Cocktail.com and ISDI, Challenges of E-commerce Mexico in 2017, consumers typically lost confidence in the online purchase process when trying to look for information on the products sold, making payments, understanding shipment and delivery policies, and dealing with returns.

Dependence on cash

Mexico is a cash-based economy, with 90% Mexicans preferring to make payments in physical currency. High dependence on cash is largely caused by limited access to modern financial infrastructure – as of 2016, there were only 37.7 ATMs and 10.3 bank branches per 100,000 people. Moreover, large proportion of the population remains unbanked along with low credit card penetration in the country. The dominance of physical currency in Mexico limits e-commerce growth, which is dependent on online payments. To overcome this challenge, players are adapting to align with customer preferences, as the significance of cash is impossible to overlook in Mexico. E-commerce players are introducing hybrid payment systems. For example, Linio and MercadoLibre allow customers to pay in cash, through banks, pharmacies, and convenience stores (OXXO and 7-Eleven), for items bought online. Walmart has introduced more than 2,000 kiosks in its physical stores, where customers can pay in cash for products bought online.

EOS Perspective

Although several large players, such as Amazon, Walmart, and MercadoLibre operate in the market, e-commerce sector still faces several obstacles and has yet not developed to the levels of other e-commerce markets that exist globally. For the Mexican e-commerce market to grow, it is imperative for the retailers to boost consumer confidence by ensuring that the buyer is safe; one way to achieve that is to make sure that the purchase process does not end with payment confirmation. Instead, the complete purchase process should be made transparent by enabling consumers to track all orders, receive notifications on shipping process, as well as making the return policy/process agile and convenient for shoppers.

For the Mexican e-commerce market to grow, it is imperative for the retailers to boost consumer confidence by ensuring that

the buyer is safe.

In spite of all quirks and challenges of the market, undoubtedly, Mexico offers a promising future for e-commerce with its sizable upsides – high internet and mobile penetration, growing purchasing power among consumers, declining smartphone prices, presence of e-commerce giants, such as MercadoLibre and Amazon looking to expand operations, among others. According to the Mexican Association of Online Sales (AMVO), five years ago in Mexico, online sales of large retailers including Walmart, Sanborns, Sears, Liverpool, and Palacio de Hierro comprised merely 1% of their total sales. This share rose to nearly 20% by 2017.

The e-commerce market is developing, demonstrated through sustainable and constant improvements – for instance, the country is making efforts to steadily develop infrastructure, customers are offered wider payment options through offline channels, and Amazon’s entry in the market has acted as a catalyst to e-commerce development, boosting customers’ trust in online shopping websites. With the launch of Amazon Prime in 2017, Amazon reduced shipment time to 1-2 days and expanded free shipping option across Mexico – a significant step that would revolutionize online retailing with other players trying to follow Amazon’s lead.

Mexico is ripe for e-commerce to boom. Even though the market is at nascent stage of development and faces challenges, it is also laden with myriad of opportunities. Online shopping accounts for a small share of the total annual retail sales in Mexico – e-commerce comprised 1.6% of total retail sales in 2016 and is likely to grow to 2.6% by 2019 – which represents a huge opportunity for players, as Mexicans have just begun adopting shopping through e-commerce. Players operating in the market understand the tremendous future growth prospects that the market offers, hence, are focusing to expand operations. With the right growth strategy, understanding of the market, and knowledge of consumer buying behavior, it is possible to survive and grow in the market, even though it is packed with challenges.

———-

Notes:

- 2016 Global Consumer Card Fraud study conducted by Aite Group; n (number of respondents interviewed in Mexico) = 303

- American e-commerce companies: Amazon and Best Buy

- American retail companies: Walmart and Sears

- Latin America-based e-commerce companies: Linio and MercadoLibre

- Mexico-based department store chains: El Palacio de Hierro, Sanborns, and Liverpool