Currently, gaming industry is believed to be bigger than any other popular entertainment mediums such as films and music. IDC estimated that global gaming revenue reached US$180 billion in 2020. Another research firm, Newzoo, indicated that global gaming industry generated US$159.3 billion in revenue in 2020. On the other hand, the global film industry surpassed US$100 billion in revenue for the first time in 2019 according to the Motion Picture Association. And, as per MIDiA Research (a firm specializing in digital content research), global recorded music industry generated US$23 billion in 2020.

Gaming industry has been on a continuous growth trajectory

Gaming industry has enjoyed a steady growth in the past few years with increasing its reach by each year. As per Newzoo’s analysis, the number of gamers increased from 2 billion in 2015 to 2.7 billion in 2020, indicating annual growth rate of over 6%.

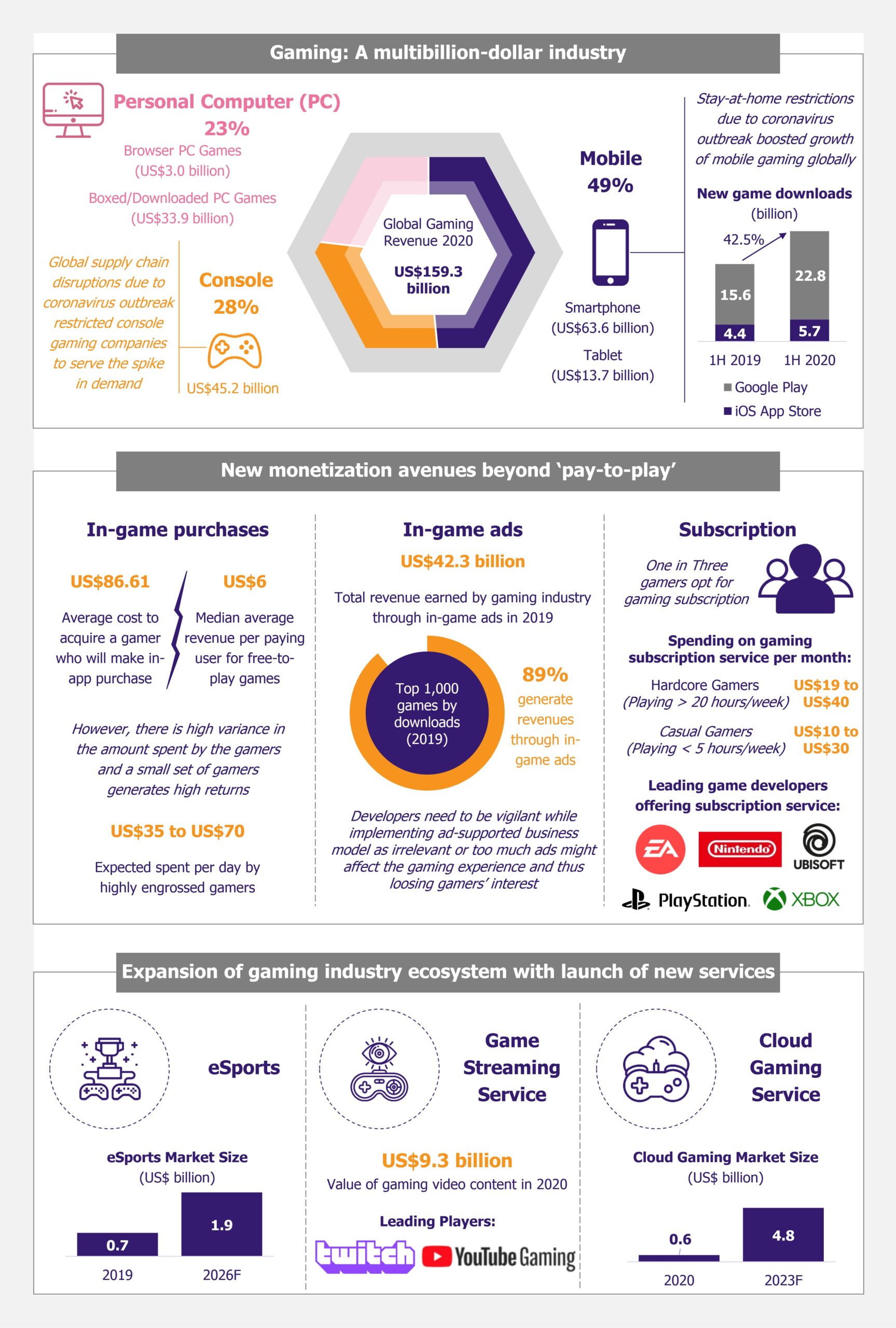

Games are generally played through mobile devices, personal computers, or gaming consoles. In 2020, 2.5 billion were playing games on mobile devices (including games played via smartphones and tablets), 1.3 billion on personal computers, and 0.8 billion using consoles. Mobile gaming was the largest revenue segment in 2020, accounting for nearly half of the total gaming industry revenue, followed by gaming on consoles and PC which represented 28% and 23% of the market share, respectively. These estimates are from Newzoo Global Games Market Report 2020 which was based on a survey of 62,500 people from 30 countries (representing more than 90% of the global games industry revenue) conducted between February and March 2020.

Gaming on smartphones generated US$63.6 billion in annual revenue in 2020, recording 13.3% growth over previous year. Increasing number of smartphone users and improving internet connectivity are driving growth in this category. Gaming on tablets generated US$13.7 billion, indicating a moderate growth of 2.7% over previous year.

Mobile gaming has seen unprecedented growth due to coronavirus outbreak. According to Sensor Tower, a research firm providing insights on mobile app ecosystem, global downloads of mobile games from Google Play and iOS App Store totaled 28.5 billion in the first half of 2020, an increase by 42.5% as compared with the same period in 2019.

Newzoo’s analysis concluded that console gaming generated US$45.2 billion in 2020, representing 6.8% growth compared with 2019. While there was an increased demand for gaming consoles amidst coronavirus outbreak as more people turned to games due to stay-at-home restrictions, the manufacturing and distribution of gaming console providers were affected because of global supply chain disruptions, and as a result, the increase in demand for gaming consoles could not be met. For instance, Sony sold 118,085 PlayStation 5 consoles within four days of its launch in November 2020, but this figure was approximately one-third of the volume of PlayStation 4 sold over its launch weekend in November 2013. PlayStation 5 consoles were in high demand and were sold out within minutes after being made available in retail outlets. In October 2020, Sony’s Chief Financial Officer indicated that the company was not in capacity to fulfil pre-orders for PlayStation 5 consoles because of supply chain bottlenecks created by coronavirus outbreak.

PC games, including browser-based as well as downloaded versions, clocked US$36.9 billion in annual revenues in 2020, representing 4.8% year-on-year growth. Though PC games market is not declining, it shows the smallest growth compared with other categories, mainly because there is more deflection towards mobile gaming which is comparatively more convenient and less expensive.

Further, the number of gamers worldwide is expected to cross over 3 billion mark in 2023 contributing nearly US$200 billion in annual revenue for the global gaming industry.

| Gaming Market Breakdown by Region | ||

| Asia Pacific | North America | Other Regions |

|

Asia Pacific represents the largest gaming market with a total of US$84.3 billion in annual revenues in 2020. China, Japan, and Korea are among the top five revenue generating countries worldwide. In 2020, China’s gaming industry raked in about US$41 million in annual revenues, while gaming industry in Japan and Korea recorded annual revenue of US$18.7 million and US$6.6 million, respectively. |

North America represents the second largest gaming market which generated about US$45 million in annual revenue in 2020. The USA, the second largest gaming market worldwide by revenue, accounted for majority of the share of the North America gaming market, with about US$37 million in annual revenues in 2020. |

Europe was the third largest gaming market with revenue of US$32.9 billion for 2020, followed by Latin America in the fourth place, with revenue of US$6.8 billion. MENA represented the smallest region in terms of revenue with US$6.2 billion. |

With rising popularity and wider reach, gaming industry looks to unravel multiple monetization strategies

Historically, gaming used to be an entertainment medium for a niche segment, mainly gaming enthusiasts and children or teenagers. At the time, ‘game-as-a-product’ was a go-to monetization strategy for most game developers, where gamers paid one time to purchase the physical or digital copy of the game.

Today, however, gaming attracts a much wider audience, enticing people from every age group. Business strategy has also evolved from upfront-based revenue model to ongoing-based revenue model where game developers seek monetization avenues from various transactions during the lifetime of a game. For instance, retail sales of Ubisoft (a French gaming company) were 98% of total sales revenues in 2010, and in 2019, this was less than one-third of the total revenue. Gaming companies today are increasingly looking to diversify their monetization avenues beyond upfront retail sales.

The most widely used monetization strategies nowadays include:

In-game purchases

In-game purchases refer to virtual items such as new features, functionality, upgrades, aesthetic elements, or content that gamers can buy to enhance their gaming experience. Newzoo estimated that in-game purchases accounted for nearly three-fourth of the global gaming revenue in 2020.

While in-game purchase seems to be a good monetization strategy, it also involves high cost to acquire paying users. Based on analysis of 992 apps between September 2018 and August 2019, Liftoff (a mobile app marketing firm) found that game developers spend an average of US$86.61 to acquire a user who will make in-app purchase. Moreover, the median average revenue per paying user for free-to-play games was estimated at US$6. However, there was high variance in the amount spent by the gamers and a small set of gamers, who were grossly engaged in games, expectedly spent US$35 to US$70 per day, thus creating high returns for the game developers.

In-game ads

In-game ads is a widely used monetization strategy, especially for free-to-play games. According to a report released in June 2020 by Omdia (a UK-based technology research firm), worldwide game developers earned revenue of US$42.3 billion in 2019 through in-game ads. Based on analysis of top 1,000 games by downloads by App Annie (app analytics company), 89% of them used in-game ads as one of the revenue streams.

As per a 2019 survey of 284 game developers conducted by deltaDNA (a consultancy firm for gaming industry), 94% of the free-to-play mobile games carried in-game ads. Rewarded ads are most popular: 82% of game developers in the deltaDNA survey indicated that they deployed rewarded video ads, compared to interstitial video ads (57%) and banners (34%).

As per the same survey, 30% of game developers showed more than five ads per gaming session. While in-game ads seem like a lucrative monetization opportunity, there is also a risk of affecting gaming experience and thus loosing gamers’ interest. deltaDNA survey suggested that display of too many ads might result in gamer churn (30%), affect gamers’ playing experience (27%), and scare off potential gamers that might be willing to spend on in-game purchases (16%). Hence, game developers need to strike a balance and control the frequency of ads.

Subscription

Witnessing the success of subscription streaming service such as Netflix and Hulu, many game developers have started exploring subscription-based model generating regular revenue stream.

Console gaming companies have been diving into the subscription model for a few years now, for instance, Sony’s PlayStation Now offers on-demand streaming of PlayStation games for a monthly subscription of US$9.99 in the USA. Some of the leading mobile and PC game developers also offer subscription service, for example, Uplay Plus by Ubisoft and EA Play by Electronic Art (creators of world-renowned FIFA game). Subscription-based model is more suitable for large gaming companies who have multiple games under their umbrella, thus offering a wide selection range to the gamers.

Based on a survey of 13,000 people in 17 countries between May 2020 and June 2020, Simon-Kucher (a global consultancy firm) suggested that over one in three gamers opted for at least one gaming subscription. Moreover, hardcore gamers who typically dedicated more than 20 hours per week on gaming would spend US$19 to US$40 per month on gaming subscription service, and casual gamers who played fewer than five hours per week were willing to shell out US$10 to US$30 for monthly subscription.

Gaming industry ecosystem is expanding with advent of new services

As gaming is more and more perceived as mainstream entertainment, there is an increased effort to capitalize on the industry’s wider reach, thus giving birth to eSports and games streaming services. Moreover, with increased demand from gamers to reduce reliance on hardware and access their favorite games anytime anywhere, advancement of cloud gaming service is encouraged.

eSports

eSports includes games played in highly organized competitive environment. As per estimates of Valuates Reports, an India-based research firm, the global eSports market was valued at US$692 million in 2019 and it is expected to reach US$1.9 billion by 2026.

eSports demand cross-industry collaboration including key players such as eSports organizations, tournament operators, digital broadcasters, etc. eSports offer monetization opportunities through advertising and sponsorships, media rights, ticket sales, merchandise sales, as well as in-game purchases.

Game streaming services

Game streaming services allow live broadcasting of gaming sessions by players. Game streaming services have been welcomed by the community of gamers as a medium to learn, connect, and get entertained.

Gaming video content was valued at US$9.3 billion with a viewership of 1.2 billion in 2020. The content may include pre-recorded or live gaming sessions by individuals as well as live broadcasting of eSports events. Game streaming service segment has particularly seen high involvement from Tech giants. Amazon’s Twitch and Google’s YouTube Gaming are the top two players in this space with annual revenue of US$1.54 billion and US$1.46 billion, respectively, in 2019.

Cloud gaming services

Newzoo projects cloud gaming to grow from US$585 million in 2020 to US$4.8 billion in 2023. Cloud gaming ecosystem typically includes game developers, cloud gaming platforms, as well as content service providers. Google launched its cloud gaming platform ‘Stadia’ in November 2019. For a monthly subscription fee of US$10, Stadia offers access to 152 games. Microsoft launched cloud gaming platform xCloud for its Xbox user base in September 2020. China-based gaming giants Tencent and Netease started beta testing of their cloud gaming platforms in 2019.

A Deloitte survey of over 2,000 US customers conducted between December 2019 and May 2020 indicated that 23% of gaming respondents were multiplatform players, playing games via all three mediums, i.e. mobile, console, and PC. Cloud gaming services could offer good value proposition for these gamers which look for seamless play between platforms.

EOS Perspective

As mobile gaming started to gain more traction, there is an increasing demand for casual games which target mass audience. As per analysis of top 1,000 games by downloads in 2019, casual games accounted for 82% of all game downloads, and remainder were hardcore games. Casual games are for on-the-go fun, which requires less time and low skillset, while hardcore games demand high commitment from the gamers who willfully spend comparatively more time and money on gaming.

Usually, casual game developers prefer ad-supported business model. Since these games require low skills, attracting masses, they are likely to generate more revenue through in-game ads than in-game purchases. As the level of skill set required goes up, a hybrid monetization model is preferred. Beyond that, the main monetization method is in-game purchases, especially for role-playing and strategy games which demand gamer’s higher engagement.

The role of gaming is evolving from a medium of entertainment to a social engagement platform. Games such as PUBG enables social interaction and networking as it allows to connect with different players and chat with people in the game. As per Sensor Tower, PUBG was the highest-grossing mobile game globally in 2020, earning US$2.6 billion in annual revenues. Rising popularity of such games shows how the gaming culture is transforming and pushing game developers to design games allowing players to socialize within the virtual environment.

‘Cross-play’ is another interesting trend which is likely to be the way forward for gaming industry. In September 2018, Fortnite became the first game to allow cross-play between mobile, PC, and all major consoles (Microsoft XBOX, Nintendo Switch, and Sony PlayStation). Between March 2020 and June 2020 more than 60% of Fortnite players paired up with a player from another platform to cross-play. The average monthly revenue-per-user who cross-played Fortnite was 365% higher than non-cross-players.

Multiplayer gaming is becoming a cultural phenomenon, and thus, the industry needs to focus on offering easy on-demand access and development of platform agnostic games.