To contain the spread of coronavirus, many governments globally implemented country-wide closures resulting in discontinuation of large part of business activities. As a result, business-related travels also came to an abrupt halt as flights got cancelled and hotels temporarily shut down. Even after partial reopening, the continuing travel restrictions and the fear of contracting virus while travelling have restrained people from taking work-related trips. The shift towards working from home and conducting meetings virtually furthers the need to not travel. Thus, to revive the business travel sector, various stakeholders are devising new short and long-term strategies to minimize the impact of COVID-19 on corporate travel.

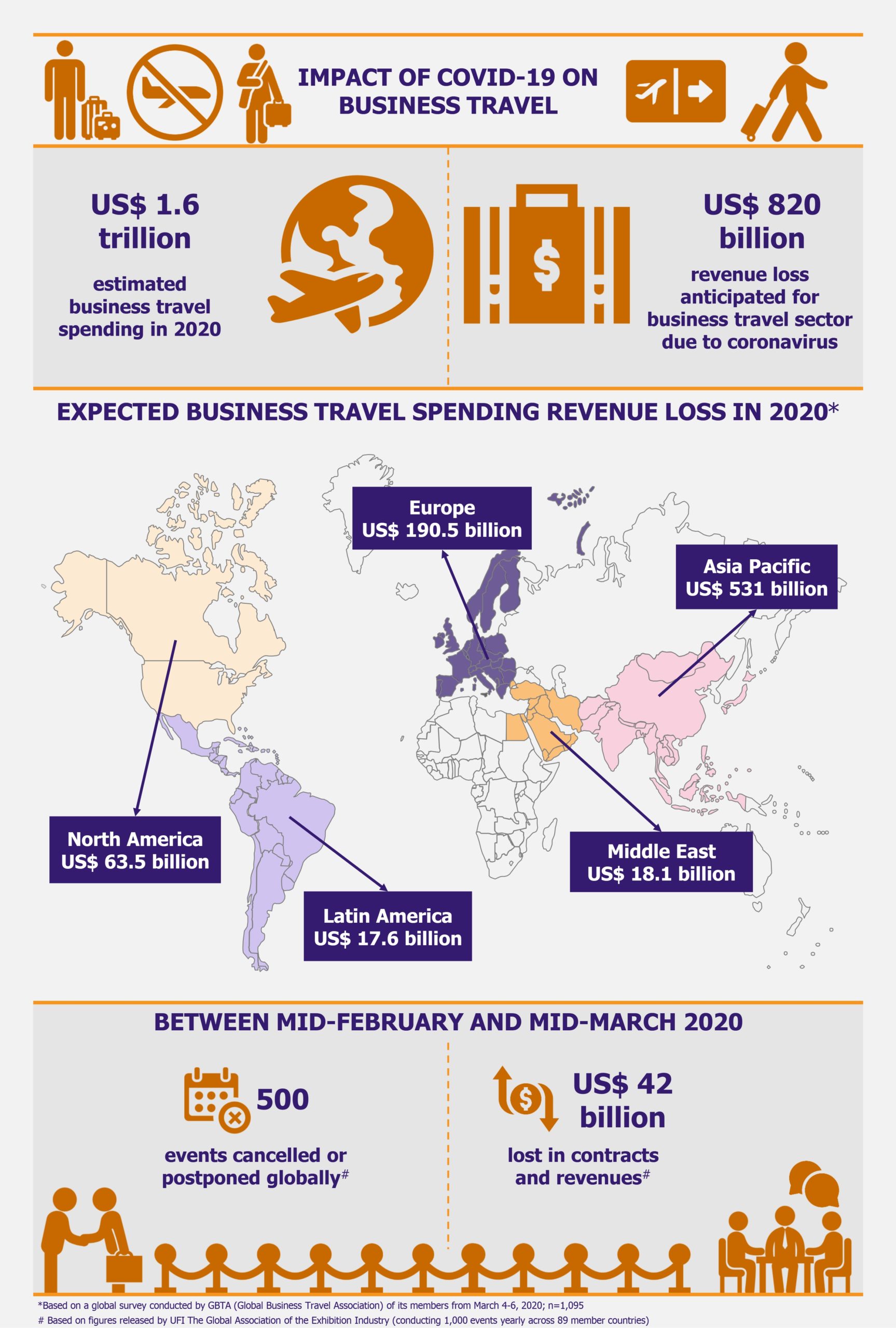

Business travel spending was expected to reach US$ 1.6 trillion in 2020. However, as per Global Business Travel Association’s estimates, due to coronavirus, the global business travel market is expected to lose US$ 820.7 billion in revenue in 2020. China, the epicenter of the pandemic, is expected to lose US$ 404.1 billion followed by Europe (US$190.5 billion) in revenue from corporate travel.

Read more on the pandemic impact on leisure travel in our next Perspective: Crippled by COVID-19, Tourism Gears Up to Rebound

Innovative travel protocols to the rescue

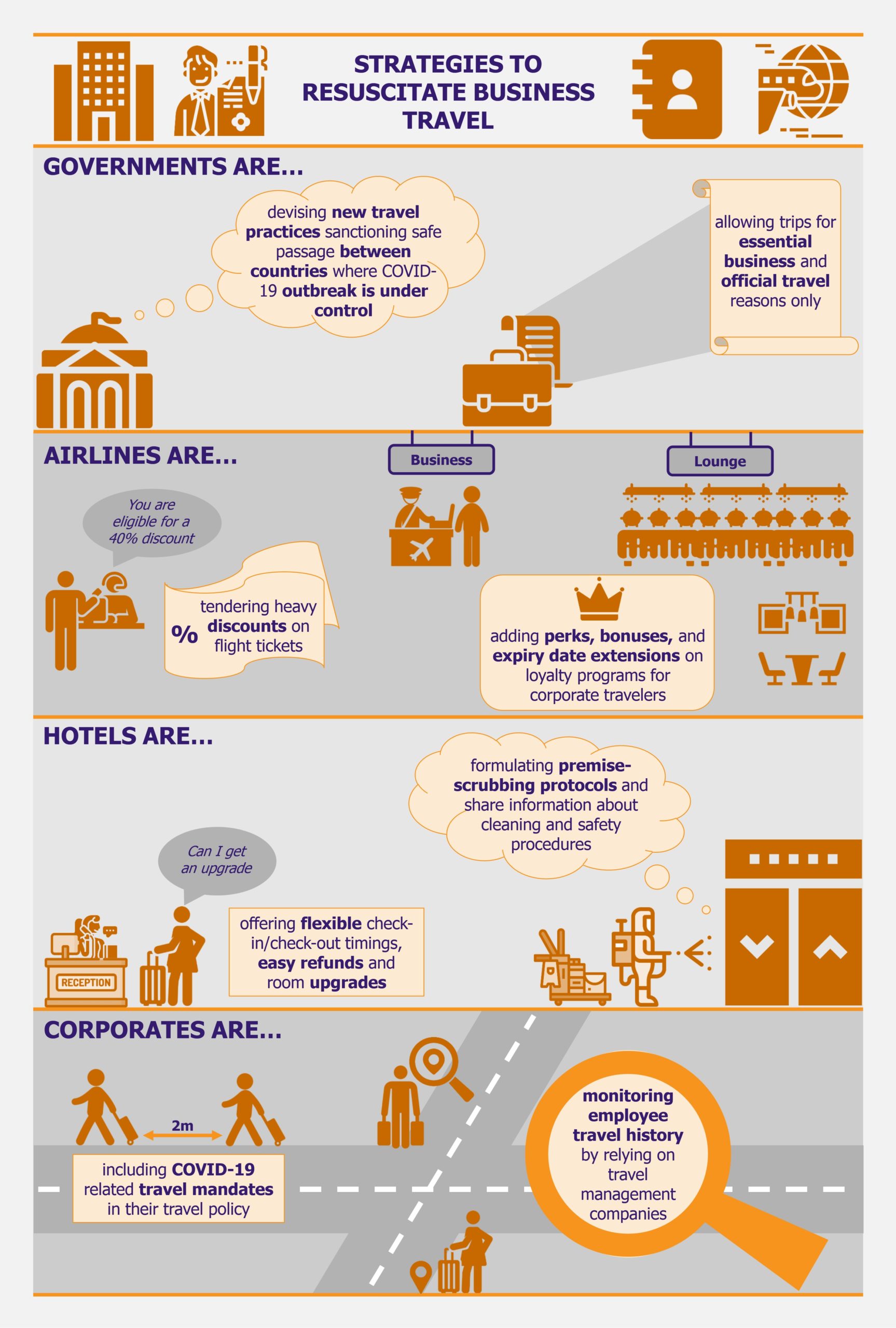

For the most part of 2020, tourism sector took a beating due to the multifaceted crisis presented by coronavirus. Governments globally are devising new travel practices to facilitate economic recovery for the business travel industry. This new form of international travel consists of green lanes, travel bubbles, and air bridges which essentially facilitates the reopening of international air travel between countries where the COVID-19 outbreak is under control. Furthermore, each business traveler must go through strict health screening at entry and exit points to ensure safe travel.

Governments’ globally are devising new travel practices to facilitate economic recovery for the business travel industry. This new form of international travel consists of green lanes, travel bubbles, and air bridges which essentially facilitates the reopening of international air travel between countries where the COVID-19 outbreak is under control.

The key idea behind these new travel corridors is primarily to bestow normalcy to the tourism sector with travels currently being reserved for business travelers for whom travel is a necessity rather than an option. Such planned travel movements are an effective means to give the necessary push to tourism sector, thus economically aiding the countries, even if to a small extent.

Singapore is one such country which carefully weighed its reopening options and as of late September had the following agreements in place:

- Fast Lane Agreement with China and South Korea – enabling essential business and official travel between both countries for travelers carrying a Safe Travel Pass issued by a company or government agency of the respective country

- Reciprocal Green Lane (RGL) with Malaysia, Brunei, and Japan – facilitating short-term essential business and official travel between both countries for up to 14 days carrying a Safe Travel Pass issued by a company or government agency of the respective country; RGL with Japan is also referred to as Business Track

- Periodic Commuting Arrangement (PCA) Agreement with Malaysia – permitting residents of both countries holding work passes in the other country to enter that country for work

- Air Travel Pass with Brunei and New Zealand – allowing short-term visitors (including foreigners who have remained in either of the two countries in the last consecutive 14 days prior to entry in Singapore) entry into Singapore and the travel reason may extend beyond official business

Under all agreements, all travelers entering Singapore have to abide by strict health measures such as pre-departure and post-arrival testing (to be paid by the traveler), serving stay-home notice, using the TraceTogether app (that allows for digital contact tracing by notifying the user if they have been exposed to COVID-19 through close contact with other app users), and adhering to a controlled itinerary for the first 14 days of stay (being prohibited from using public transportation).

Other than Singapore, Thailand had also planned to allow foreign business travelers from Hong Kong, Singapore, South Korea, Japan, and some provinces of China into the country from July as part of its business bubble travel approach. However, the discussions were delayed amid rising cases of coronavirus in East Asian countries where previously the outbreak was under control.

Hospitality players bending rules to appeal to corporate travelers

Business travel is of great importance for both airlines and hotels. Corporate travelers purchase high-value airline tickets, airport lounge access memberships, and reside in business hotels forming a major chunk of their clientele. However, hotel and airline industries have taken a major hit due to the ongoing pandemic.

Also, travelers currently show an unprecedented concern about their health and safety, and demand assurance that they can get on a plane or check into a hotel without worrying about the risk of infection. For hotels and airlines, safety has gone up their priority list, as they are developing premise-scrubbing protocols and ensure clear information about cleaning and safety procedures to their guests.

For years, hotel industry had been rigid in regard to guest’s arrival and departure timings, cancellation policies, etc. However, in the current scenario, corporate travelers’ expectations for hotels to offer flexibility have greatly increased. Thus, hotels are focusing on extending flexible services such as round the clock check-in/check-out option, accommodating refunds in case of room cancellations, and being more pliable to room upgrades (for free or at a minimum charge) so that guests can still work in case of event cancellations (or if they have to be in quarantine when traveling internationally for longer durations).

Other than offering generous discounts on flight tickets and hotel stays, airlines and hotels are highly likely to offer extra perks and bonuses such as fee waivers, extension on rewards redemption dates, bonus reward points, and upgrades, among others, as part of loyalty programs for corporate clients. Extension on expiration date of loyalty programs also make business travelers feel welcomed.

For hotels and airlines, safety has gone up their priority list, as they are developing premise-scrubbing protocols and ensure clear information about cleaning and safety procedures to their guests.

Corporates shake up travel maneuvers

Traveling priorities changed overnight during the coronavirus pandemic driving companies to reconsider their travel protocols and develop contingency plans. It is expected that 5-10% of business-related travel will be permanently eliminated as companies reduce their travel budgets and embrace virtual interactions, wherever possible, avoiding the need to travel. Moreover, companies are working on developing robust travel policies to account for safety before sanctioning any trip.

As a result of these changes, reliance on travel management companies for corporate travel is likely to increase, however, working with a trusted partner will be key to ensure travel safety. Companies will look for partners that can help them strategize travel plans, prioritize safety, and monitor spending. Round-the-clock travel support staff, flexibility to authorize last-minute itinerary changes, ability to track employee location online via an app, and expansive portfolio of hotels and travel partners to choose from in case of replacements, sudden cancellations, etc., are some of the key requirements corporates would expect their travel partners to offer. Availability of a single digital platform for travelers, agents, and company travel managers comprehending all travel-related information will make it easy to plan and track employee’s movement.

Availability of a single digital platform for travelers, agents, and company travel managers comprehending all travel-related information will make it easy to plan and track employee’s movement.

Many companies plan to resume their travel plans on a need-only basis with sales and marketing related trips being the first ones to recommence. Companies are keen to adopt a remote work location approach, wherever applicable, to limit the number of trips their employees take and to keep them safe. Additionally, including specific COVID-19-related do’s and don’ts around booking trips (via air, rail, or road), lodging, and rentals in the travel policy will prevent companies from being at litigation risk.

Corporate events take a backseat

Restrain on public gatherings and travel bans hit the corporate event industry the hardest. Many events were cancelled or postponed indefinitely while many events gradually shifted to virtual platform. It is anticipated that between mid-February and mid-March 2020, the corporate event and conferences industry globally lost US$ 26.3 billion and US$ 16.5 billion in potential contracts and revenues, respectively. With the rising number of virtual events, some of which might never return to the real world, the corporate events industry is in troubled waters, at least in the foreseeable future.

As of now, the fear of contracting the virus at an event and the comfort of participating in an event remotely will continue to stifle the recovery rate for the event industry. However, in the medium term, a blended approach (in-person attendance and digital medium) may offer some respite. Organizing multi-location small gatherings, wherein small groups of people (located in a particular area or smaller region) connect online with other such groups to form a larger event could be a successful model for conducting corporate events.

EOS Perspective

Demand for business travel is most likely to elevate gradually. Domestic travel entailing client meetings and site visits are likely to resume first. Even when travelling within the country, travelers will prefer to undertake self-driven trips and same day return tours to avoid using public transport or rental vehicles and staying at hotels. International trips are likely to take much longer to rebound owing to diverse government regulations and quarantine procedures in each country. Moreover, it is highly probable that travel related to global events and conferences may never return to pre-pandemic levels.

It can also be expected that for some time, the business travel industry will revolve around the degree of flexibility and sanitation standards offered to customers. Business travel industry stakeholders will have to continuously readjust their business policies, product offerings, and day-to-day functions as situation improves (or worsens) to accommodate changing customer needs. For instance, while some hotel chains may decide to temporarily shut their properties, others may offer them for quarantine purposes for travelers visiting for longer work durations.

Similarly, it is up to the airlines to decide which routes to fly, how frequently to fly, and how much to charge (they can offer to sell premium and business-class tickets at much discounted rates to attract travelers, to at least recover some costs, if not to make profits). Modifying their offerings to appeal to business travelers (when travel is neither necessity nor priority) during these uncertain and volatile times would be of great merit for players operating in this space.

Nevertheless, the road to recovery for business travel sector is bumpy. Business travel will certainly pick momentum but the recovery is likely to be slow. However, whether the sector will reach pre-COVID revenue levels (and how many years it will take) is still debatable. This being said, stakeholders in the business travel industry who are adaptable and operate around customer expectations are the ones who have a higher chance to sail through this less damaged.